That is an opinion editorial through Archie Chaudhury, a blockchain fanatic and former winner of best prize on the 2021 MIT Bitcoin Expo.

When Satoshi Nakamoto first revealed the Bitcoin white paper in October of 2008, the sector used to be reeling from a monetary disaster brought about through the irresponsibility and negligence of the establishments that managed our monetary device. Hedge finances, central banks and different robust brokers have been all too glad to position over-leveraged bets at the economic system, and to benefit from the industrial losses incurred through the running magnificence when those bets collapsed.

Governments, in a determined try to stay those establishments alive, spent loads of billions of bucks in bailouts and different financial injections as an alternative of making sure the well-being of the common citizen. Bitcoin used to be Satoshi Nakamoto’s resolution to state-backed cash; it used to be a imaginative and prescient for a decentralized virtual forex that would give you the potency of on-line banking, the relative pseudonymity of bodily money, and the shortage of gold.

In contrast to earlier makes an attempt at growing virtual money, Bitcoin used to be no longer subsidized through or managed through a novel entity or birthday party, however fairly through an nameless developer (builders?), a suite of faceless discussion board guests and a small on-line group that believed in the use of cryptographic device for privateness and independence from authoritarian powers. Nakamoto’s final purpose used to be to create an asset that used to be self sufficient, decentralized and used to be no longer vulnerable to the greed or will of anybody person. October 31, the day Satoshi Nakamoto officially introduced their white paper to the Cypherpunks Mailing Checklist, has come to be referred to as “Bitcoin White Paper Day” and is well known as an off-the-cuff declaration of independence from corrupt state-backed cash, heard internationally. The aim of this newsletter is to replicate on how a ways now we have come since then, and what kind of paintings continues to be carried out as a way to accomplish Nakamoto’s targets.

The Bitcoin that we use nowadays is hugely other from the Bitcoin that Satoshi Nakamoto and his fellow individuals created within the past due 2000s and early 2010s. Past the a lot of technical upgrades and difficult forks, the community itself has grown considerably, with increasingly more other people taking the proverbial “orange tablet” and deciding to make use of bitcoin in some capability.

There’s otherwise through which Bitcoin has modified: the core community, and asset (BTC), is considered extra as a shop of worth fairly than a platform for micropayments. Certainly, there used to be an important cultural schism throughout the Bitcoin group that ended in this alteration: the well-known, and aptly titled, “Blocksize Wars” roughly 5 years in the past ended in this alteration, with forks comparable to Bitcoin Money and later Bitcoin SV being created through group contributors who believed in scalability over all else, and the core Bitcoin chain being upheld through contributors who sought to keep decentralization and to have a look at selection strategies comparable to Layer 2 fee channels to strengthen scalability. The Lightning Community, which is the most well liked fee channel, has slowly won reputation, not too long ago attaining a capacity of 5000 bitcoin.

Regardless of those adjustments, the core technological tenets espoused through Nakamoto in 2008 (Nakamoto Consensus with proof-of-work mining and a static most provide of 21 million) stay consistent. This isn’t only on account of a technological or financial reason why; if truth be told, it’s been argued that converting Bitcoin’s underlying consensus mechanism or provide cap may just result in larger efficiency and adoption respectively. Fairly, Bitcoin’s consistency in those spaces may also be attributed to the philosophy of its underlying community, who imagine strongly in shortage, safety and decentralization over all else.

In the meantime, bitcoin is being utilized by other people around the world to stave off unruly financial stipulations. Bitcoin’s herbal shortage makes it horny for electorate the place corruption has ended in unrestricted inflation. This adoption has even led some governments, comparable to El Salvador, to claim bitcoin a countrywide forex, a transfer that may were unfathomable to Nakamoto and Bitcoin’s unique individuals.

Possibly probably the most fascinating factor to take from Bitcoin’s growth during the last couple of years is that it has came about with no central chief: not like selection property which are extra corresponding to decentralized device platforms, bitcoin purposes purely as cash, with key “coverage” choices being made through a group. There is not any Bitcoin group or consultant only liable for selling adoption, neither is there a central “leader scientist” that has an important have an effect on on key protocol-level choices. Whilst there are indisputably main influences throughout the group, the protocol as a complete does no longer have an organizational construction to steer both adoption or building. If truth be told, Bitcoin’s loss of hierarchy will have to be a purpose for different disbursed ledger tasks who, whilst in all probability decentralized to a undeniable level, are nonetheless in large part influenced through a novel entity or person.

Whilst Bitcoin has indisputably grown from its humble beginnings as a white paper and a pair hundred strains of scrappy code, it nonetheless has a protracted method to pass whether it is to succeed in the formidable targets mentioned through Nakamoto and different early adopters of their e mail chains and discussion board posts. From a technical perspective, the Bitcoin group must proceed development generation that no longer simplest allows additional scalability and safety, however in all probability extra importantly, additionally is helping make the community extra decentralized. Probably the most staunch mottos that Bitcoin group contributors have followed is the time period “Don’t accept as true with, test.” That is, in fact, in connection with operating a complete Bitcoin node and no longer depending on information from exterior 3rd events, comparable to node suppliers. Community optimization, rollups, and other scalability research has been proposed through more than a few members within the Bitcoin group as some way for the community to concurrently scale whilst lowering the price it takes to run a complete node. A contemporary record, revealed through John Mild thru analysis funded through the Human Rights Basis, Starkware and CMS Holdings, supplies extra detail about rollups-related scalability analysis.

Regardless of its roots in generation, Bitcoin has advanced over time to grow to be one thing extra: it’s now a group, a community, if you’ll, of like minded-individuals who all have some various levels of trust in a novel thought. Bitcoin is now not a device, privy to simply builders, coders or the ones with a extremely technical background, and this marked shift will have to additionally sign further non-technical priorities for the Bitcoin group to deal with over the following decade.

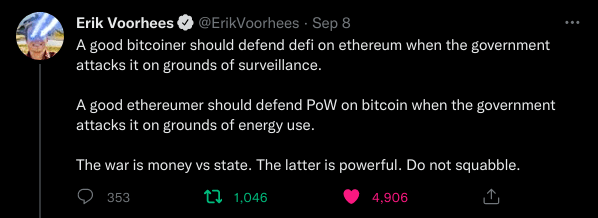

Extra effort must be spent on teaching most people and making them conscious about no longer simplest Bitcoin’s generation, but additionally the screw ups of the legacy monetary methods that they use nowadays. Extra effort must be spent no longer simplest on touting bitcoin’s economics and generation, but additionally drawing on distinctions between bitcoin and different cryptocurrency platforms. In the end, extra effort must be made some of the cryptocurrency group as a complete to return in combination when the basic rules that Satoshi Nakamoto and his fellow cypherpunks believed in are threatened through authoritarian governments, irrespective of the platform this is being attacked.

Whilst discussions round various blockchain networks have at all times been tribalistic to some extent, the new pattern has been to advertise the luck of your platform over all else, or even chide or insult platforms who face possible regulatory scrutiny. Whilst believing that bitcoin is probably the most sound virtual asset relating to economics/building, and coming into arguments about mentioned trust is fine, and will have to also be inspired, celebrating when another platform is threatened with regulatory motion or censorship is going towards what Bitcoin is essentially all about.

The cypherpunks, Satoshi Nakamoto and a majority of Bitcoin’s group all imagine in the concept that sooner or later, there is usually a virtual peer-to-peer forex utterly impartial of any executive, middleman or biased birthday party. Whilst we indisputably have more than a few disagreements concerning the execs and cons of our respective generation, belong to other “maximalist” teams, and basically have various ideals, all of us in the end belong to an area that used to be motivated through the speculation of a censorship-resistant and non-partisan virtual asset/community. We’d do nicely to understand that basic theory as we proceed to paintings on Bitcoin over the following 14 years.

Tweet from Erik Vorhees at the sanctioning of Twister Money and possible BTC law through ESG proponents.

This can be a visitor publish through Archie Chaudhury. Evaluations expressed are completely their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)