XRP loses 13% depsite optimistic court docket feedback. BTC sees weekly outflows of $111m. PayPal launches a stablecoin. XDC rallies 13%.

XRP

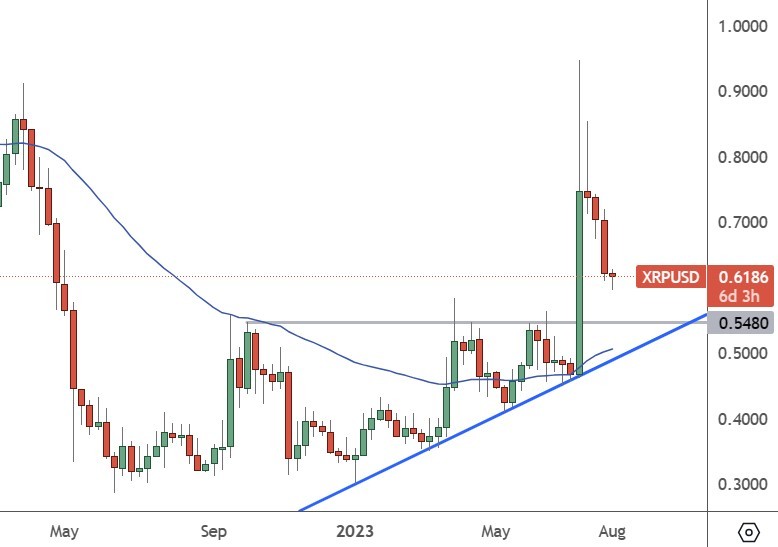

Ripple XRP misplaced 13% regardless of favorable feedback about its standing as a safety.

U.S. Choose Analisa Torres stated that the sale of XRP tokens on exchanges and thru algorithms doesn’t represent funding contracts, which was celebrated by XRP supporters. The information led to a pointy improve in lots of tokens.

The ruling was an enormous improvement within the authorized battle between Ripple and the Securities and Alternate Fee (SEC). The SEC alleged that Ripple engaged in unregistered gross sales of XRP, which it considers to be a safety. The choice might additionally set a precedent for different cryptocurrency firms dealing with comparable authorized challenges.

XRP fanatic John Deaton was hopeful however instructed traders to be cautious. He stated that he didn’t base his expectations on the assumption that XRP would attain a brand new all-time excessive after the ruling however he did anticipate the worth of XRP to surpass the resistance degree of $1.

He stated, “It’s all about expectations. Until we have been in a full bull market – led by Bitcoin – I by no means believed XRP would hit an ATH, even after a great ruling, and I stated that when requested about my expectations on value (though I did anticipate it to interrupt $1 tbh). However till Bitcoin breaks its ATH, I don’t anticipate anything to.”

The value of XRP dropped on the week to commerce across the $0.60 degree.

PYPL

Funds big PayPal introduced the discharge of a brand new USD-backed stablecoin.

The platform, which has over 400 million customers, stated on Tuesday that it was launching PayPal USD. Earlier makes an attempt by mainstream companies to launch stablecoins have met opposition from monetary regulators and policymakers. Meta tried to launch a Libra stablecoin however was blocked by regulators who feared it might upset the worldwide monetary system.

PayPal USD shall be backed by U.S. greenback deposits and short-term U.S Treasuries and shall be issued by Paxos. It can regularly be out there to PayPal prospects in the US.

The token might be redeemed for U.S. {dollars} at any time and can be used to purchase and promote different cryptocurrencies PayPal presents on its platform, together with bitcoin.

“PYUSD is the primary of its form, representing the subsequent part of U.S. {dollars} on the blockchain,” Paxos posted on messaging platform X, previously often known as Twitter. ” This isn’t only a milestone second for Paxos & PayPal, however for the complete monetary business.”

The most important stablecoin at current is Tether, which has a market cap of $83 billion. The value of tether was decrease by 0.11% over the past week.

BTC

Bitcoin was additionally decrease this week by 0.19% because the market awaits a call by the SEC on Arc’s software for a Bitcoin Alternate Traded Fund (ETF).

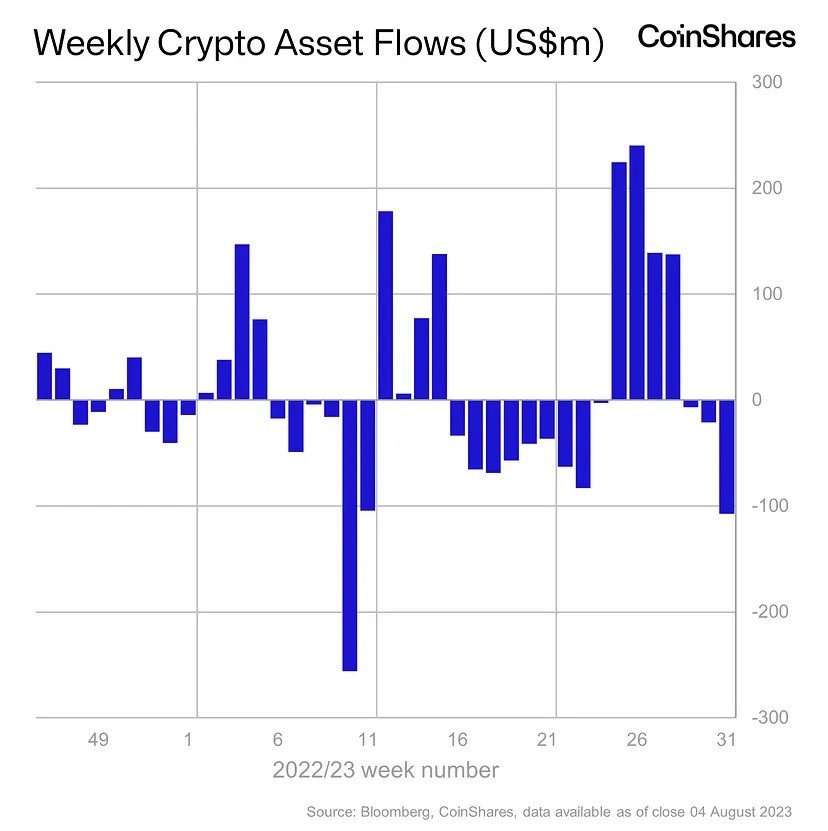

Weekly cryptocurrency asset flows for the week ending Aug. 4 reconciled at $107 million in outflows, persevering with a three-week detrimental development totaling $134.8 million.

As soon as once more, the lion’s share of motion was attributed to Bitcoin with $111 million in outflows, Bitcoin funds negated the vast majority of inflows for the week.

In keeping with CoinShares’ “Digital Asset Fund Flows” weekly report, it was one other signal of “revenue taking” following a pointy rally this yr. For the month main as much as the current spate of outflows, inflows of $742 million into crypto funds have been seen, with 99% of that coming into Bitcoin.

Weekly buying and selling volumes in funding merchandise noticed a dip under the year-to-date common, in keeping with the report, with broader on-exchange market volumes down 62% in opposition to the relative common.

Weekly buying and selling volumes in funding merchandise noticed a dip under the year-to-date common, in keeping with the report, with broader on-exchange market volumes down 62% in opposition to the relative common.

Regionally, solely Australia and the US confirmed inflows, with $0.3 million and $0.2 million incoming, respectively. The most important regional outflows got here from Canada, with $70.8 million, and Germany, with $28.5 million.

The value of Bitcoin has been hovering close to the $29k degree for nearly a month.

XDC

XDC Community was the best-performing token, with a return of 13% for the week.

The token’s value surge follows the blockchain undertaking’s partnership with Japan-based crypto buying and selling firm SBI VC Commerce to sponsor the WebX 2023 occasion.

XDC Community, a crypto agency, revealed its Gold Sponsorship of a significant Japanese occasion organized by Coin Put up, a distinguished crypto information outlet in East Asia.

The upcoming occasion presents XDC community customers with an opportunity to discover thrilling alternatives, uncover cutting-edge improvements, and interact with business leaders.

XDC Community, a hybrid blockchain constructed for international commerce and finance, has built-in with the Infocomm Media Improvement Authority’s (IMDA) TradeTrust, and launched an initiative to allow the creation and financing of Mannequin Regulation on Digital Commerce Information (MLETR)-compliant digital commerce paperwork.

The value of XDC was buying and selling at nearly $0.07 on Monday after the week’s good points.

Disclaimer: data contained herein is supplied with out contemplating your private circumstances, due to this fact shouldn’t be construed as monetary recommendation, funding suggestion or a suggestion of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)