XRP added 5% however surrendered beneficial properties. Bitcoin suffered with a Binance lawsuit. LUNC rises forward of an improve. LDO rose as TVL rises.

XRP

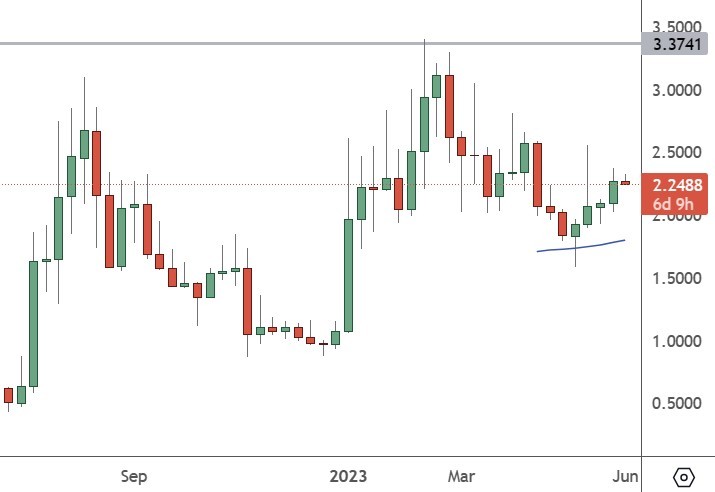

The worth of Ripple XRP returned 5% this week, outperforming the remainder of the highest fifty cryptocurrencies, however the coin gave up a few of its 10% rally.

Legal professional John Deaton has stated there’s a 25% probability Ripple will declare an outright victory in opposition to the Securities and Trade Fee (SEC). Deaton stated on the Good Morning crypto podcast there was additionally a 50% probability that U.S. District Choose Torres delivers a “splitting the newborn” ruling.

That will imply Choose Torres “drawing a line within the sand,” the place she might probably rule that XRP was provided as an unregistered safety earlier than 2018.

“I believe that XRP itself goes to be deemed not a safety and that I believe that secondary market gross sales present that. Even when Choose Torres does rule discovering that Ripple violated the legislation, that does not apply to secondary market gross sales,” Deaton defined.

XRP has a key resistance stage at $0.5480 which it hit this week. A transfer above that stage can see continued beneficial properties for XRP. Deaton stated that if a constructive ruling for Ripple occurs, the coin can hit $10.

I actually consider that someplace consider $2 and $10 is cheap.

BTC

The worth of Bitcoin was decrease by 7% for the final week after the passing of the U.S. ceiling deal.

One other controversial deal divided political events however retains the federal government functioning previous the 2024 election. A bout of weak spot within the inventory market added to the losses in Bitcoin. There was bigger bearish information for crypto this week with the announcement that the U.S. Securities and Trade Fee (SEC) was suing the Binance trade.

The lawsuit claims that Binance, Binance.US, and Changpeng Zhao provided unregistered securities to the general public within the type of the BNB token and the Binance-linked BUSD stablecoin, violating securities legal guidelines

The U.S. Securities and Trade Fee sued crypto trade Binance, the working firm for Binance.US, and Binance founder and CEO Changpeng “CZ” Zhao on allegations of violating federal securities legal guidelines on Monday.

Binance, Binance.US, and CZ provided unregistered securities to most people within the type of the BNB token and Binance-linked BUSD stablecoin stated the swimsuit, which additionally alleges that Binance’s staking service violated securities legislation. There are related prices in opposition to BAM Buying and selling – the working firm for Binance.US – and Binance itself, together with failure to register as a clearing company, failure to register as a dealer, and failure to register as an trade. The SEC additionally alleged that Binance allowed for the commingling of buyer funds, that CZ was “secretly” controlling Binance.US, and {that a} CZ-owned and operated entity was inflating Binance.US’s buying and selling quantity.

“As a second a part of Zhao’s and Binance’s plan to protect themselves from U.S. regulation, they persistently claimed to the general public that the Binance.com Platform didn’t serve U.S. individuals, whereas concurrently concealing their efforts to make sure that essentially the most useful U.S. prospects continued buying and selling on the platform,” the swimsuit stated.

In a press launch, SEC Chair Gary Gensler stated, “By way of 13 prices, we allege that Zhao and Binance entities engaged in an in depth net of deception, conflicts of curiosity, lack of disclosure, and calculated evasion of the legislation.”

Binance Coin (BNB) was buying and selling over 8.8% decrease on the information of the lawsuit. The Binance USD stablecoin continues to see an exodus of buyers with a market cap of $5.1 billion, which peaked at $23 billion in late-2022.

Bitcoin has an essential assist stage at $25,212 which can decide the trail forward for the world’s largest cryptocurrency.

LUNC

The Terra Basic (LUNC) coin was a gainer with a 5% enchancment on the week, however the coin gave up a lot of its earlier beneficial properties.

Terra’s Luna Basic challenge is about for a June 7 vote on a brand new model 2.1.0 improve. The slated improve would go dwell on June 14 and features a 5% validator fee to draw additional validators to the protocol. There may even be further safety updates.

The upgrades embody the implementation of Cosmwasm, a Cosmos-based platform that simplifies the event of sensible contracts. The Cosmwasm GitHub says that examples of these sensible contracts, together with these geared towards DeFi or token utilization.

The Luna Basic challenge rose from the Might 2022 collapse of the Terra ecosystem. The challenge’s founder Do Kwon continues to face a authorized battle after being bailed from a courtroom in Montenegro. Kwon will have the ability to go away detention whereas he awaits a courtroom look on June 16. Kwon, and his former chief monetary officer Chang-joon Han, are dealing with as much as 5 years in jail for utilizing false id paperwork.

The worth of LUNC is probably buying and selling in a value channel and might want to maintain the week’s beneficial properties in a bearish marketplace for an extra advance.

LDO

Lido (LDO) rose 10% this week because the challenge continues to see progress in its Complete Worth Locked (TVL) metrics.

The challenge is presently the most important challenge by TVL with $13.62 billion locked on the staking community. Lido noticed its deposits drop beneath $5 billion after the collapse of the Terra UST stablecoin.

The marketplace for high-yield staking was additionally hit by the Federal Reserve’s technique change to lift rates of interest considerably on its authorities bonds. Lido has emerged from the turmoil of the final yr to change into the most well-liked staking challenge for Ethereum holders.

The worth of LDO was flat on the week after giving up preliminary beneficial properties of round 10%. The coin will search for assist on the transferring common across the $1.75 mark.

Disclaimer: data contained herein is offered with out contemplating your private circumstances, subsequently shouldn’t be construed as monetary recommendation, funding advice or a suggestion of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)