A lot dialogue has focused across the implications of lowering price earnings for bitcoin miners — why is it taking place and what does it imply?

A lot dialogue has focused across the implications of lowering price earnings for bitcoin miners — why is it taking place and what does it imply?

Creation

Earnings for bitcoin miners from transaction charges is losing to file lows, and fierce debates over the significance and long-term results of this information are raging on-line. Present price earnings represents barely 1% of general income for miners, a vital drop from the peak of the most recent bullish marketplace cycle when, in February 2021 as an example, charges have been over 13% of per month earnings. This information has been the topic of intense war of words on Twitter as everybody from decentralized finance researchers to Bloomberg journalists to professional cryptocurrency traders weigh in at the doom (or lack thereof) signaled for bitcoin through low price earnings.

This newsletter supplies an summary of the most recent knowledge on bitcoin price earnings and solutions the query of whether or not it issues within the brief or longer term that price earnings as a proportion of general income is low and losing.

Present Charge Earnings Knowledge

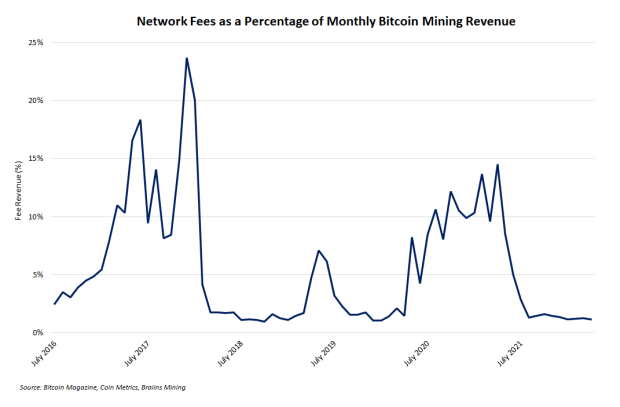

Even if the most recent batch of heated debates concerning the importance of price earnings have simplest seemed previously few weeks, transaction price earnings for miners has been moderately low for a number of consecutive months. The road chart under visualizes community charges as a proportion of per month mining earnings. From early summer season 2020 to spring 2021, price earnings sustained a robust upward expansion trajectory. Issues temporarily modified closing summer season despite the fact that across the time China banned bitcoin mining. Charge earnings has but to get well.

Present price earnings ranges don’t seem to be unheard of despite the fact that. The above chart displays an identical ranges on a proportion foundation right through the undergo marketplace of 2018 and 2019.

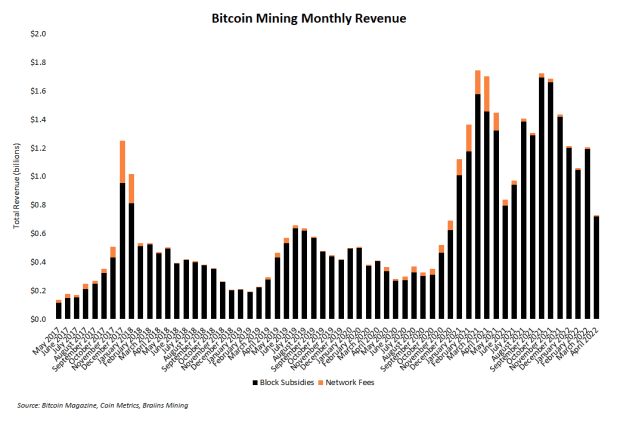

And miners aren’t essentially complaining. Each and every month since August 2021, their general per month earnings has surpassed $1 billion, and April 2022 displays no indicators of bucking that development. The bar chart under displays general per month earnings (subsidies and costs) paid to miners every month for the previous 5 years. Charge earnings is represented in orange on best of every bar, and sizable fluctuations within the greenback quantity of charges paid to miners are obtrusive.

However miners are nonetheless being profitable for securing the community and processing transactions. Positive, mining is getting extra aggressive as huge and small miners alike proceed adding more hash rate to the network. On the other hand, combination mining earnings remains to be really extensive, because of the Bitcoin protocol’s mining subsidy, contributing to the already huge stashes of cash a lot of miners have stockpiled.

Why Are Charges Down?

The primary and most blatant query to invite about bitcoin price earnings is: Why is it low?

For context, charges constitute one in all a two-part praise device for miners servicing the Bitcoin community. Charge earnings varies in keeping with community utilization, so when fewer folks use Bitcoin, miners earn much less price earnings. The opposite a part of mining payouts is the block subsidy, a set quantity of bitcoin paid each and every block which is famously halved more or less each and every 4 years. In the end (that means, a pair centuries from now), the subsidy will drop to actually 0, which leaves transaction fees as the one income for miners who safe Bitcoin.

Having a look a pair hundred years into the long run, the most obvious attainable downside is that if the subsidy is long gone and price earnings remains to be low, miners don’t receives a commission and a key a part of Bitcoin’s safety incentives evaporates. This particular incentive is usually known as Bitcoin’s security budget, which represents the whole sum of money the community will pay miners. Put in a different way, the safety price range is how a lot each and every Bitcoin person, in combination, will pay for mining as a fundamental provider to stay the community operating and safe from assaults.

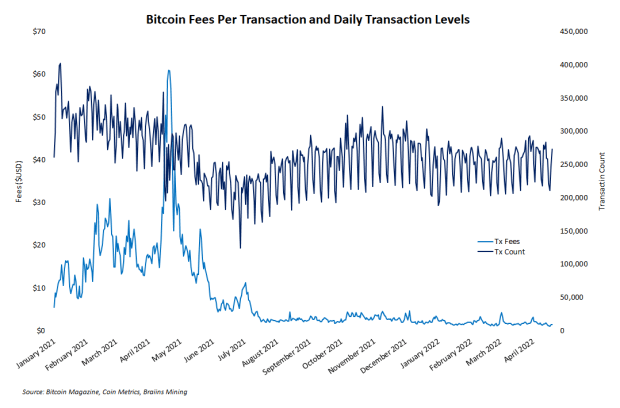

The road chart under visualizes one of the price earnings knowledge contextualized with day-to-day transaction ranges on Bitcoin. The precipitous drop in price earnings is plain, and on the identical time, transaction ranges are flat, at absolute best, following a noticeable dip right through maximum of 2021.

The most straightforward solution, due to this fact, to the query about why charges are low is as a result of Bitcoin is getting used not up to it used to be earlier than. So, why is Bitcoin used much less? This query is more difficult to respond to. Causes for decrease provide use of Bitcoin vary from increased Layer 2 use (e.g., Lightning Community or Liquid) to basic boredom as price volatility continues dropping.

Is Low Charge Earnings A Downside?

Within the brief time period, results of low price earnings most commonly include sporadic Twitter drama as critics attempt to extrapolate these days’s price ranges into predictions about Bitcoin’s sustainability a long time and centuries from now.

Bitcoin is lately in the course of simplest its fourth halving duration with a subsidy payout of 6.25 BTC in step with block. The subsidy will nonetheless be above 1 BTC for 2 extra halving sessions and above 0.1 BTC for a minimum of 20 extra years. Even if incessantly tracking community well being is essential, alarmism over the present state of price earnings is untimely.

The entire to be had price knowledge represents an unhelpfully small quantity, when bearing in mind the long run lifespan of the Bitcoin community. Charge earnings may be extremely risky, which makes price earnings predictions even more difficult to as it should be calculate. On the top of the most recent bull marketplace, price earnings represented more or less 15% of general per month mining earnings. Lately, that stage has dropped to slightly 1%. Will the ones huge fluctuations proceed? No person is aware of needless to say.

Briefly, present price earnings provides no explanation why for panic, however ignoring this essential knowledge may be unjustified.

Will Charges Rebound?

The most straightforward and traditionally maximum dependable explanation why for price earnings to rebound is every other red-hot bullish marketplace. However at a deeper stage, the one method charges build up is that if call for for Bitcoin block areas additionally will increase. Charges move up when folks need to use Bitcoin. Choices for cultivating this call for vary from merely increasing adoption and day-to-day use of bitcoin for bills to extra debatable and sophisticated efforts like development a decentralized finance ecosystem at the Bitcoin blockchain.

And it’s k for long run price earnings to be an open query — for now. Just about all the doom and gloom broadcasted on social media about low Bitcoin charges is poorly substantiated given the small knowledge set of ancient price earnings to be had to analysts and the sheer period of time till the mining subsidy drops so low as to grow to be beside the point, making charges the one supply of mining earnings.

If not anything else, Bitcoin has confirmed itself to be a reliant piece of generation. For the previous decade, price earnings has long gone up and down. What charges will probably be 100 years from now could be, relatively merely, a wide-open query.

It is a visitor submit through Zack Voell. Evaluations expressed are completely their very own and don’t essentially replicate the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)