2022 has been the 12 months of mass go out from stablecoins as greater than $14.three billion has been redeemed from those tokens since March.

General Stablecoin Provide Is Down 8% From March 2022 Top

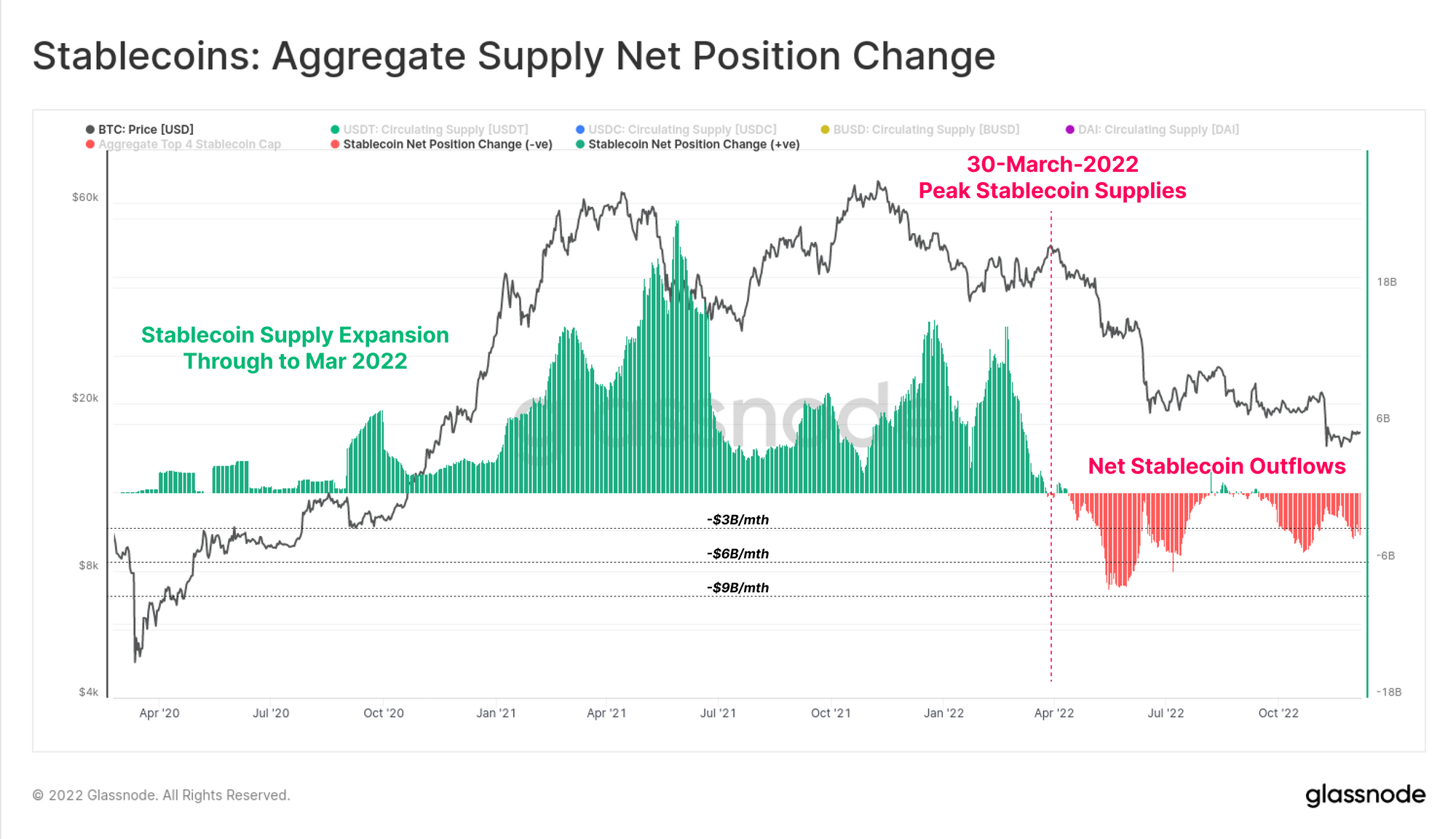

Consistent with the most recent weekly document from Glassnode, the stables seen enlargement all the way through 2020 and 2021. The related indicator this is the “stablecoin provide net position change,” which measures the web quantity of capital flowing into or out of those fiat-tied tokens.

When the worth of this metric is certain, it way the whole provide of those belongings is expanding in dimension presently as extra tokens are being minted. Then again, unfavorable values suggest a internet quantity of capital is leaving this sector as buyers are redeeming their stables for fiat lately.

Now, here’s a chart that displays the fad within the stablecoin provide internet place exchange over the previous few years:

Looks as if the worth of this metric has been crimson in fresh days | Supply: Glassnode's The Week Onchain - Week 50, 2022

Because the above graph displays, the provision of stablecoins noticed a internet building up all the way through 2020 and 2021, with the latter 12 months staring at an extremely speedy enlargement. This pattern of inexperienced internet place exchange in those tokens’ provide persevered into the primary quarter of 2022, and by means of the top of March, the metric hit a top of $161.five billion.

Following that, alternatively, the fad began to turn and capital started to go with the flow out of the stablecoin sector. This lower within the belongings’ general provide has persevered via the remainder of the 12 months, and in general, holders have redeemed greater than $14.three billion price of those tokens. This drawdown corresponds to round 8% of the height provide observed again in March, because of this that even supposing the redemptions had been important, the vast majority of the capital remains to be within those stablecoins.

Probably the most primary causes that buyers had been chickening out from those virtual greenback tokens is the cave in of Terra USD (UST) again in Might of this 12 months. A stablecoin, which is meant to stay “strong” in price, shedding the whole lot put an actual scare available in the market. From the chart, it’s obvious that the height redemptions came about simply after the loss of life of UST.

USDD, any other stablecoin that purposes on a type very similar to the now defunct UST, went beneath its $1 peg following the FTX crash and is but to get better again to it. Not too long ago, it slipped even further away from this stage, making buyers wonder if the stablecoin is headed at the similar trail as Terra USD. Then again, prior to now day, the token turns out to have observed some restoration above those fresh lows.

USDD value stays beneath peg | Supply: USDD/USDT on TradingView.com

On the time of writing, USDD was once exchanging fingers at a below-peg price of $0.9822, down 0.27% within the final 24 hours.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)