Whilst rival stablecoins positive factors an increasing number of marketplace worth, Tether remains to be the king of stablecoin. However the query is – for the way lengthy?

Buyers are fleeing from Tether (USDT), says on-chain knowledge. The stablecoin large, in consequence, has misplaced important marketplace percentage amid a slew of marketplace corrections.

Tether’s Dropping Marketplace Proportion

Tether these days sits on a $68 billion marketplace cap, the bottom since October final yr, down from the not too long ago established all-time top of $83 billion. Since then, the stablecoin underwent a cascade of repeated declines. In line with the data from CoinGecko, it freshly shed round $four billion since June 14 by myself.

TerraUST’s cave in driven marketplace avid gamers to hunt sanctuary in different virtual belongings that take care of a one-to-one peg with the USD. In consequence, the following marketplace contagion drove crypto and stablecoins to wobble, throughout which USDT in short misplaced its greenback parity because it plunged to 95 cents.

Whilst it controlled to re-peg temporarily, the deathly spiral ended in many buyers ditching the stablecoin large for its rival – USDC, a most sensible contender. Upon gauging additional, it used to be discovered that, not like the falling marketplace cap of USDT, Circle’s flagship stablecoin has endured to follow an upward trajectory.

After topping out within the first week of March, USDC’s marketplace cap temporarily bounced again in mid-Might. As reported previous, it even went directly to grow to be the stablecoin of selection at the Ethereum blockchain.

All over the similar time, Binance USD (BUSD) additionally famous a minor however related leap again up. With TerraUSD long past, the 3 greatest stablecoins – Tether, USD Coin, and Binance USD – have controlled to retain their positions within the most sensible ten leaderboard.

Tether’s shrinking marketplace cap comes days after it refuted rumors that the stablecoin is in large part subsidized through Chinese language and Asian industrial paper. In regards to the contemporary occasions impacting the crypto lending platform, Celsius, the stablecoin issuer said,

“Celsius place has been liquidated with out a losses to Tether. Tether’s lending task with Celsius (as with every different borrower) has all the time been overcollateralized. Tether has these days 0 publicity to Celsius with the exception of a small funding created from Tether fairness within the corporate. Tether is acutely aware of different rumors being unfold, suggesting that it has a lending publicity to 3 Arrows Capital – once more that is categorically false.”

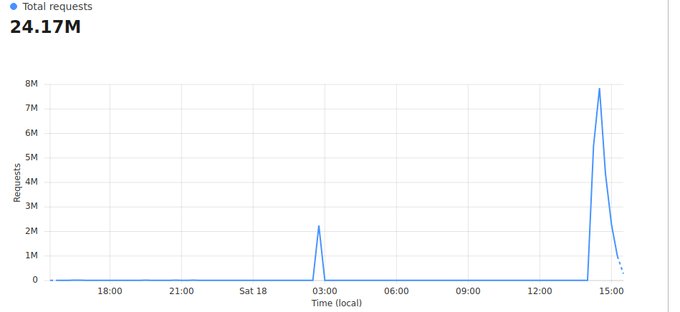

One after the other, Tether’s CTO – Paolo Ardoino – defined an assault towards the corporate’s servers, however reassured that it used to be no longer a success.

Stablecoin Economic system

Whilst different dollar-pegged tokens could also be consuming up Tether’s percentage, for the primary time in historical past, the full stablecoin provide as an entire has dropped sharply in the second one quarter of 2022 (with the exception of UST). CoinMetrics head of study and building Lucas Nuzzi revealed that stablecoin redemptions rose hugely because of non permanent liquidity and issues about insolvency.

Of all centralized issuers, Tether witnessed probably the most redemptions, wiping roughly 7 billion of its provide up to now month, as buyers tried to tug out from the marketplace and keep away from to any extent further injury.

However, the abruptly declining costs of all non-stablecoin crypto belongings imply that stablecoins have risen relating to marketplace cap and location. Fresh data presentations that there’re 4 such virtual belongings within the most sensible 10 greatest cryptocurrencies, and the 5th one is with reference to breaking in as neatly.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)