Be a part of Our Telegram channel to remain updated on breaking information protection

A latest survey by the USA Monetary Trade Regulatory Authority (FINRA) Investor Training Basis has make clear the the reason why new buyers have began shopping for cryptocurrency in 2022.

Buddy Suggestion and FOMO High Causes for First-Time Crypto Buyers

The survey discovered that 31% of recent cryptocurrency buyers cited “buddy suggestion” as the first purpose for his or her foray into crypto. As compared, solely 8% of first-time equities or bond buyers talked about this as their motivation, indicating that there’s “a social aspect to cryptocurrency investing not evident in equities or bond investing.”

Along with buddy strategies, the power to start out with small quantities of cash was the second-biggest purpose for getting into the crypto market, at 24%, which is analogous to the the reason why equities and bond buyers begin investing.

It’s fascinating to notice that about 10% of individuals surveyed stated they purchased cryptocurrency for the primary time as a result of they had been afraid of lacking out on an opportunity to make some cash. That is popularly known as FOMO within the crypto group.

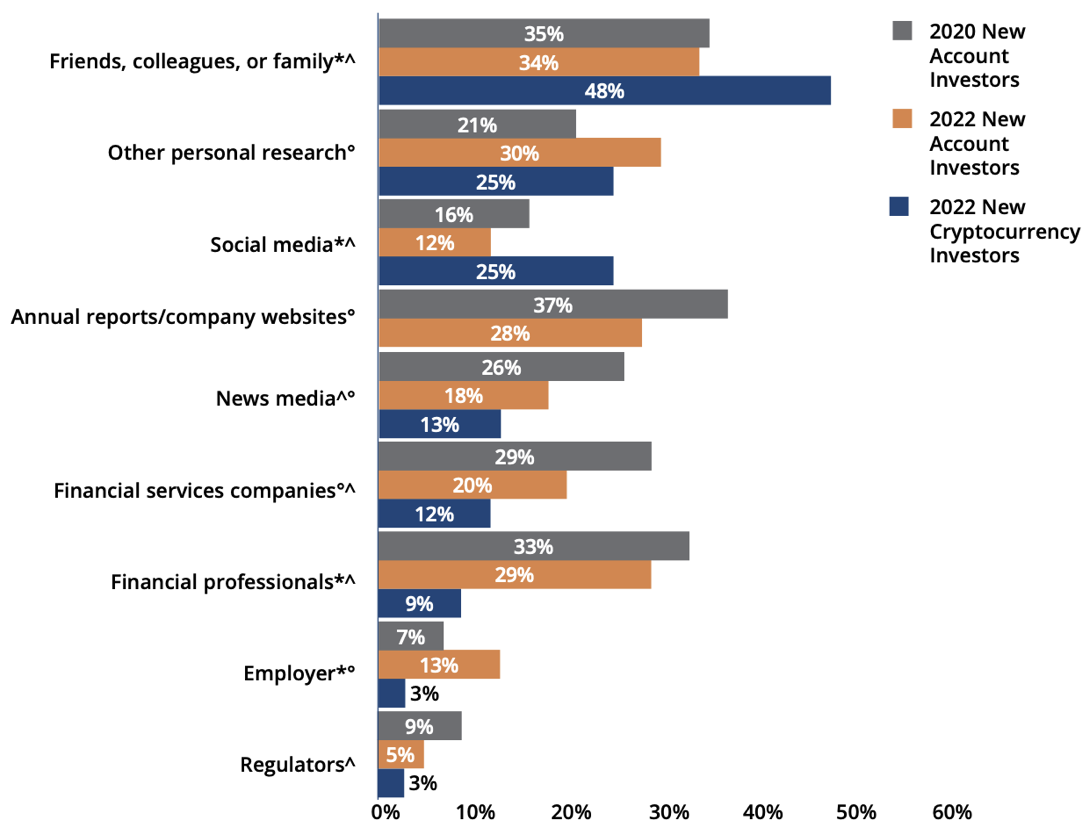

In response to the survey, virtually half of the crypto buyers stated that they get details about cryptocurrencies from buddies, household, or colleagues at work.

Social media was the subsequent commonest supply of data, with 25% of respondents saying they be taught concerning the crypto market from these platforms. This means that many people who find themselves new to crypto are counting on these sources to grasp extra about it.

The research found that youthful folks, with a mean age of 37, had been extra more likely to spend money on cryptocurrency, they usually had been much less more likely to have a four-year school diploma, with solely 28.5% having accomplished one. However, inventory buyers had been older, with a mean age of 43, and higher educated, with 46.3% having a university diploma.

Surprisingly, the research discovered that digital asset homeowners didn’t know as a lot about cryptocurrencies as they initially thought. Digital asset buyers scored solely 26.6% on a five-item quiz that requested questions on how a cryptocurrency is issued, transferred into US {dollars}, taxed, and the way transactions could also be inclined to fraud.

Total, the survey exhibits that the social aspect and affect of family and friends are sturdy drivers of recent buyers getting into the crypto market, with many counting on these sources for data. It additionally means that many new buyers might not absolutely perceive the complexities of cryptocurrency and the dangers concerned.

Crypto Adoption In Europe Will increase Amidst Struggling Market

The usage of cryptocurrency in Europe has been steadily growing, however there are important gender gaps in its possession.

Within the UK, solely a small variety of respondents in a survey performed in March 2022 claimed to personal cryptocurrency, with Bitcoin being the popular cryptocurrency. Equally, in Germany, the share of people that owned cryptocurrency was only some factors greater than those that deliberate to spend money on it sooner or later.

Nonetheless, amongst those that had already invested in cryptocurrency, almost half of them deliberate to extend their investments within the subsequent six months. In France, Bitcoin remained the most well-liked foreign money amongst those that had invested in cryptocurrency or deliberate to take action, together with NFTs.

Switzerland had over 50% of its crypto buyers inclined in the direction of shopping for and holding crypto, with Bitcoin as their prime desire. However, Europe has skilled a surge within the implementation of stringent laws on cryptocurrency, regardless of its growing adoption.

Throughout the first half of 2022, over 50% of surveyed people who owned cryptocurrency expressed their want to extend their holdings throughout the subsequent 12 months. This sentiment was extra distinguished amongst youthful age teams than older generations. Bitcoin and Ethereum had been the popular cryptocurrencies throughout this era.

Nonetheless, the cryptocurrency market suffered a decline in worth beginning within the spring of 2022, leading to investor enthusiasm loss and unfavorable asset worth actions throughout Europe.

FTX’s fall and BlockFi’s chapter led lawmakers in Europe to agree on implementing licensing and supervision guidelines by 2024 to make sure shopper safety, market integrity, and monetary stability.

The crypto crash had various impacts throughout Europe, with nations similar to Cyprus being hit more durable than others as a result of a scarcity of nationwide laws. Nonetheless, Germany, the Netherlands, and France noticed restricted impacts because of their nationwide laws that shielded them from extreme losses.

Will Central Financial institution Digital Currencies Catalyze Cryptocurrency Adoption?

We at the moment are in a interval of stagflation, with central banks – particularly the Fed – making selections that might do extra hurt than good.

The Fed has already spent a substantial amount of cash on quantitative easing in the course of the pandemic, nevertheless it now appears that they’re specializing in combating inflation by elevating rates of interest and doubtlessly utilizing quantitative tightening (QT).

These selections have created a possibility for these with money to buy belongings from those that are much less well-off and should promote. This has resulted in an unbalanced financial system the place an excessive amount of is given to those that don’t want it, whereas those that do should spend get little or no. This may be improved if central banks goal nominal GDP as an alternative of inflation and institute delicate QE whereas decreasing rates of interest.

However, the results of continuous with the present path may lead to a recession. As an example, within the subsequent two years, over $3 trillion of property loans within the US are anticipated to be refinanced, leading to a -40% drop in business property values.

Buyers are piling into cryptocurrencies as a hedge in opposition to what they understand as an issue within the fiat world. It stays to be seen if this pattern will proceed. Nonetheless, it’s possible that central banks worldwide might be implementing Central Financial institution Digital Currencies (CBDCs) to airdrop tokens like Bitcoin straight into folks’s wallets. This transfer will simplify the method and make sure that the needful can spend whereas these well-off can’t save or earn curiosity on it.

This might very possible make cryptocurrencies extra accessible to a wider part of the demographic. Plus, an institutional foreign money will assist instill confidence within the CBDC and subsequently promote additional adoption. As for now, buyers can maintain their eye on additional surveys to maintain themselves up to date on elements influencing cryptocurrency adoption.

Associated Articles

Ecoterra – New Eco Pleasant Crypto

- CertiK Audited

- Doxxed Skilled Crew

- Earn Free Crypto for Recycling

- Gamified Environmental Motion

- Presale Reside Now – $2M+ Raised

- Yahoo Finance, Cointelegraph Featured Undertaking

Be a part of Our Telegram channel to remain updated on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)