Tether (USDT) is the most important stablecoin available in the market, with a market capitalization of over $86 billion as of Might 2023. Regardless of the considerations in regards to the present state of the cryptocurrency market, Tether has continued to dominate the stablecoin area, with its provide rising considerably for the reason that starting of 2023. Nevertheless, there are indicators that new rivals might problem its dominance sooner or later.

USDT’s Reign Over?

In accordance to the researcher and founding father of DeFiance Capital, ArthurOx, one issue that will restrict Tether’s progress is the emergence of latest stablecoins. As traders grow to be extra involved in regards to the dangers related to Tether, they’re more likely to search options that supply better transparency and accountability.

For instance, USDC (USD Coin) is a stablecoin absolutely backed by US {dollars} held in reserve by regulated monetary establishments, and its provide has been rising quickly lately.

One other issue that will restrict Tether’s progress is the emergence of decentralized stablecoins. These stablecoins are constructed on blockchain platforms, providing a decentralized different to centralized stablecoins like Tether.

Decentralized stablecoins get rid of the necessity for a government to handle the reserves, because the reserves are held in good contracts on the blockchain. This provides excessive transparency and safety and eliminates the danger of a government mismanaging the reserves or partaking in fraudulent actions.

One instance of a decentralized stablecoin is DAI, constructed on the Ethereum blockchain. DAI is backed by a basket of cryptocurrencies held in good contracts on the blockchain. This ensures that the worth of DAI stays secure whereas providing excessive transparency and safety.

Along with these elements, there are additionally regulatory dangers related to Tether. The stablecoin has come underneath scrutiny from regulators within the US and different nations, with some calling for better transparency and oversight. If regulators impose stricter rules on Tether, this might restrict its progress and open up alternatives for different stablecoins to realize market share.

Tether And USDC Present Resilience Amid US Debt Ceiling Drama

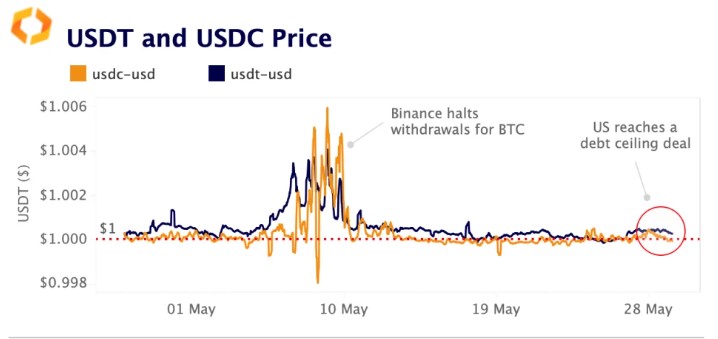

In accordance with a current report by Kaiko, USDT and USDC have proven little volatility amid the continuing drama surrounding the US debt ceiling. Regardless of considerations over a possible US default, USDT and USDC noticed little to no value motion over the previous two weeks. This means that the markets didn’t view default as the bottom case state of affairs and that traders remained assured within the stability of those stablecoins.

Apparently, USDT and USDC have more and more been buying and selling in tandem in periods of market stress. For instance, when Binance briefly halted withdrawals for Bitcoin (BTC) earlier this month as a result of community congestion points, each stablecoins rose above $1, as seen within the chart above. This means that USDC might have gained some safe-haven enchantment as U.S. banking troubles eased.

The resilience of USDT and USDC through the debt ceiling drama displays a wider pattern within the cryptocurrency market, the place stablecoins have grow to be an more and more well-liked approach for traders to hedge towards volatility.

These developments underscore the rising significance of stablecoins within the cryptocurrency ecosystem. As extra traders search to hedge towards market volatility and regulatory uncertainty, the demand for stablecoins will possible develop. Furthermore, the emergence of latest decentralized finance (DeFi) functions that require stablecoins as a way of change and collateral can also be fueling demand.

Featured picture from Unsplash, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)