That is an opinion editorial through Zack Voell, a bitcoin mining and markets researcher.

One of the most extra fascinating and debatable trends within the Bitcoin ecosystem is off-chain use circumstances. Many of those packages aren’t technologically similar, however all of them however amplify the checklist of doable use circumstances excluding the Bitcoin base layer for a given bitcoin holder. And a few of these merchandise are totally outdoor the Bitcoin financial system altogether.

This newsletter takes no place at the distinctive deserves of any specific off-chain use for Bitcoin, but it surely summarizes some enlargement developments and provide information appearing enlargement and adoption throughout Layer 2 protocols, bitcoin-backed tokens and extra. The usage of bitcoin in those techniques isn’t fitted to each investor, however any person who cares concerning the extensive scope of Bitcoin adopters will have to keep in mind of those developments to raised perceive the place and the way bitcoin are shifting.

Defining ‘Off-Chain Bitcoin’

Ahead of inspecting some information, this segment will with a bit of luck mitigate one of the doable psychological blocks or preconceived opinions readers can have about those packages that might colour their goal interpretation of information within the following sections.

The catch-all class of “off-chain” bitcoin isn’t supposed to equate or conflate the entire later discussed protocols as similar and even most commonly identical. However this is a sufficiently workable label for those equipment that provide makes use of for bitcoin that aren’t immediately at the base later. A few of these makes use of proportion traits of merely protecting property on a custodial change, however a key distinction is that the majority of those protocols aren’t permissioned, closed supply or as centralized as exchanges. The next information specializes in those open monetary equipment for selection bitcoin makes use of.

Evaluate Of Layer 2 Bitcoin Capability

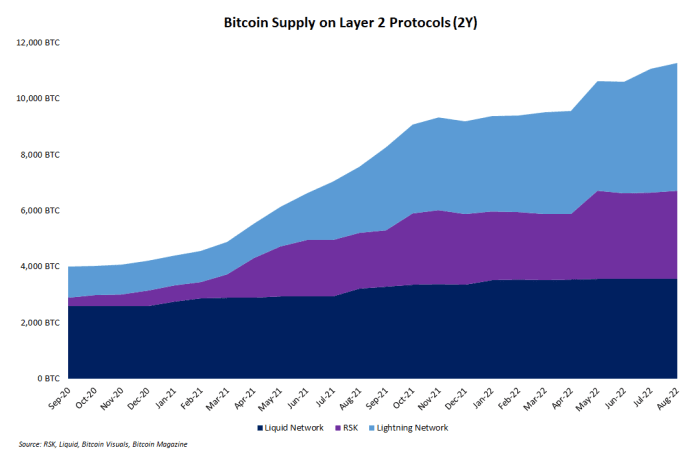

Protocols inbuilt layers of the Bitcoin generation stack above the bottom layer blockchain are frequently criticized for his or her meager adoption. Generally, those criticisms come from proponents of different blockchains. However the information presentations enlargement is however stable although relatively slower.

The coloured house chart under presentations bitcoin provides at the Lightning Network, Liquid Network and RSK over the last two years. It’s obvious that of those 3, some are seeing provide develop quicker than others. However the total enlargement trajectory is markedly reverse of bitcoin’s present price action. Regardless of the undergo marketplace, adoption continues.

Those 3 “built-on-bitcoin” protocols aren’t by myself, then again. Different Bitcoin-adjacent networks like Stacks additionally strengthen a kind of artificial bitcoin asset. Constructed with the motto of “unleashing Bitcoin’s full potential,” Stacks introduced its providing of a type of wrapped bitcoin in January 2021. The asset makes use of the ticker image xBTC.

Information Evaluate Of Tokenized Bitcoins

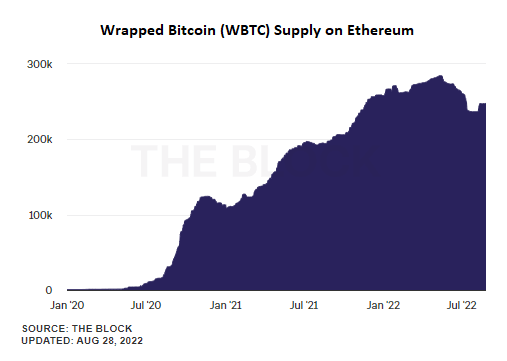

It’s no secret that artificial bitcoin merchandise on different blockchains are frequently derided on Twitter and no longer universally used or welcomed through the wider Bitcoin neighborhood. However information presentations {that a} non-trivial quantity of bitcoin traders are more and more the use of bitcoin-backed tokens.

The most productive instance is the expansion of Wrapped Bitcoin (WBTC), an ERC-20 token introduced through BitGo. The chart under taken from The Block presentations the unusual enlargement in WBTC provide over the last two years regardless of any downward bitcoin value motion:

BitGo’s bitcoin-backed token isn’t the one asset of its type on Ethereum. Six different groups have introduced an identical property, together with tBTC, pBTC, renBTC and extra. Every one provides quite other options and protocol architectures to serve other demographics of customers.

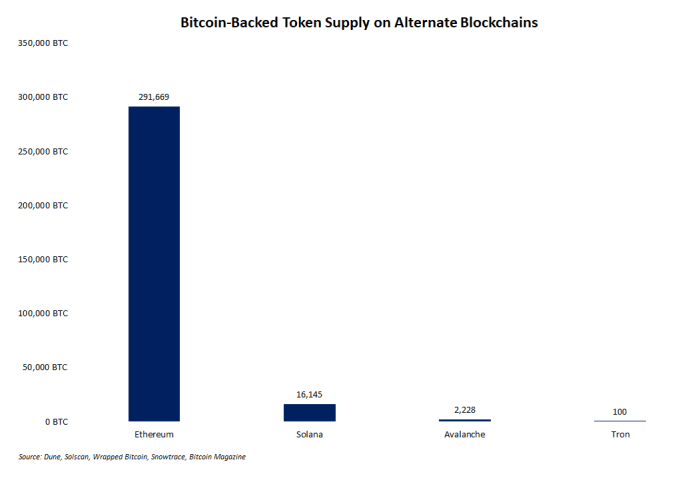

Ethereum may be no longer by myself in supporting artificial bitcoin merchandise excluding the Bitcoin blockchain. Different chains introduced those merchandise later as gimmicks (e.g., Tron) or to check out and imitate the good fortune of Ethereum’s bitcoin-backed tokens (e.g., Solana and Avalanche). However Ethereum is through some distance the community with the biggest quantity of artificial bitcoin property, largely because of the trend of “DeFi Summer season” in 2020.

The bar chart under presentations present provides of artificial bitcoin on selection blockchains:

Are Those Bitcoin Merchandise ‘Just right’?

Point out tokenized bitcoin merchandise in a crowd, and the reactions are certain to be polarized. In orthodox Bitcoin communities, Layer 2 protocols (e.g., Lightning and Liquid) are simple favorites, and their adoption is stable, although relatively gradual.

So, are those merchandise “excellent”? All of those off-chain makes use of for bitcoin provide more than a few tradeoffs, however the idiosyncratic software of each and every can’t be overlooked. Whether or not or no longer everybody will have to select a method to make use of their cash is irrelevant. As a result of turning into a reserve asset — of the worldwide fiat financial system or the internet-based “crypto” financial system — is bitcoin’s maximum frequently authorized objective, typically talking, merchandise that accomplish that purpose will have to be inspired. Lightning pushes software within the Bitcoin-native financial system in the similar means that tokenized bitcoin has a transparent and direct impact on bitcoin serving as a type of reserve asset for non-Bitcoin-native sectors of the wider cryptocurrency marketplace.

Rehypothecation is some other well-liked worry with maximum bitcoin monetary merchandise. Importantly, this worry does no longer observe to those off-chain merchandise. The loss of rehypothecation for Lightning merchandise is apparent. And, in truth, the majority of those merchandise constructed on and excluding the Bitcoin protocol itself are designed to provider a one-for-one bitcoin-backed or -swapped asset, whether or not it’s a easy transference of bitcoin from the bottom layer to the Lightning Community or a switch of “actual” bitcoin for a bitcoin token used on different blockchains. One of the most main tokenized bitcoin merchandise maintained through BitGo, for instance, publishes proof of the reserves backing the bitcoin tokens it problems.

The Long run Of Off-Chain Bitcoin

Readers who ideologically reject the set of tradeoffs inherent to tokenized bitcoin merchandise will certainly no longer be satisfied through anything else on this article to modify their considering, nor are they criticized according to se on this article. The purpose of this information and research is solely to turn that some other people (in truth, a persistently rising quantity) see worth in opting for to make use of their bitcoin someplace but even so the Bitcoin blockchain — or even puts outdoor of the Bitcoin-native financial system. In the end, HODLing in chilly garage is solely as legitimate of a use case as tokenization.

This can be a visitor publish through Zack Voell. Critiques expressed are fully their very own and don’t essentially replicate the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)