The much-awaited Ethereum 2.Zero is nearing its release and a core Ethereum developer, Tim Beiko, has identified some important adjustments that customers can be expecting from the replace, The Merge.

Ethereum is all set to transport from its provide PoW (Evidence-of-Paintings) consensus to PoS (Evidence-of-Stake) consensus––a transition this is stated to occur in 3 levels. Because of this, the community goes to be a lot larger, extremely energy-efficient, and extra safe than its present model.

What’s the Merge?

The Merge is an replace to the Ethereum blockchain protocol that will probably be rolled out between 2022 and 2023 in 3 levels. This can be a core technical exchange that can exchange the best way blocks are mined on Ethereum’s community.

In essence, this replace will in the end merge “the present Ethereum Mainnet… with the beacon chain proof-of-stake device,” states Ethereum.

Even supposing the Merge has been popularly known as Ethereum 2.0, the corporate has carried out away with that time period because it makes Eth2 sound like a brand new community, slightly than an replace to the present community.

After the replace, Eth1 will probably be known as the “execution layer” whilst Eth2 will probably be referred to as the “consensus layer” – the 3rd layer of the stack, which is helping put into effect the community regulations all over transactions.

Your capital is in danger.

What are Consensus and Consensus Mechanisms?

Consensus is a common however formalized settlement used to suggest that a minimum of 51% of the nodes agree on a state of the community. Consensus mechanisms dictate the best way a community of computer systems will validate the blocks whilst staying safe.

Consensus mechanisms come with consensus protocols and consensus algorithms. And whilst they’re each used interchangeably, protocols are a algorithm that assist standardize a transaction, while algorithms are used to in reality resolve the mathematical downside.

How does Evidence of Stake Vary from Evidence of Paintings?

PoW and PoS are two forms of consensus mechanisms utilized in crypto mining. Recently, Ethereum is determined by the proof-of-work consensus for validating all of the transactions carried out on its community.

In proof-of-work (PoW), miners compete to unravel mathematical puzzles with a purpose to validate transactions and upload them to the blockchain. They get rewarded according to how a lot effort they put into mining blocks (i.e., fixing advanced math issues). As a result of it’s such an energy-intensive procedure, the miner who effectively processes a block first enjoys some hard-earned rewards.

Like Ethereum, the most well liked implementation of PoW is Bitcoin (BTC). In an effort to mine bitcoin, miners will have to first resolve a cryptographic puzzle that calls for important quantities of computing energy and electrical energy. The primary miner to unravel this puzzle is rewarded with new BTCs for his or her paintings.

An apt instance of the Distinction between PoW and PoS Mechanism

Some cryptocurrencies, alternatively, use proof-of-stake (PoS) to succeed in allotted consensus. On this consensus protocol, a subset of nodes is chosen to ensure the following block, which is selected according to the scale in their stake. Should you personal 10% of all tokens, for instance, then you will have a 10% likelihood of being decided on as any such nodes.

There is not any mining all for PoS as a result of validators are selected at random as a substitute of competing towards each and every different. They obtain rewards proportional to their stake so long as they take part in validating transactions at the community steadily and in truth.

So, when you have 10% of all of the cash in stream, you get 10% of all of the community rewards. Which means that so long as you stay your cash within the community, you are going to proceed to obtain a proportion of the overall rewards. Will have to you spend them, your rewards will in the end forestall coming in altogether.

Invest in Ethereum via FCA Regulated eToro

Your capital is in danger.

Why is that this Shift Vital?

The Merge will give you the long run customers of Ethereum with a significantly better and extra seamless enjoy. Right here’s how:

Scalability

Scalability is a serious problem in PoW on account of its energy-intensive nature. At this time, Ethereum can take care of about 30 transactions consistent with 2d. As soon as the community transitions into PoS, it is going to be capable of strengthen 100,000 transactions consistent with 2d, making it quicker and larger. This shift guarantees to force the costs of ETH to more recent heights.

Power-Potency

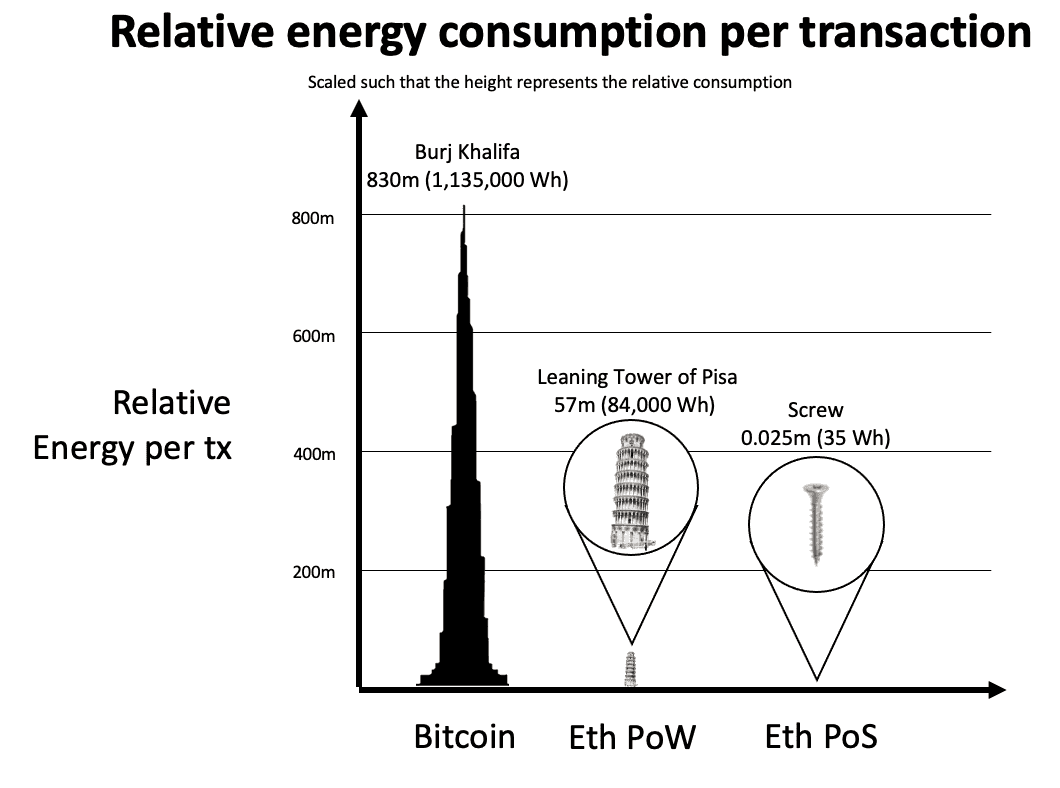

Even with crypto’s immense recognition, individuals are nonetheless involved in regards to the depth of the carbon footprint left by means of the mining procedure. The tougher the issue, the extra calories it calls for.

On this sense, proof-of-stake methods are extra energy-efficient as a result of they don’t require top computing energy to ensure blocks. As a substitute, validators on PoS networks will now vote on which blocks will have to be added to the blockchain.

Different validators will attest to the block proposition to turn consensus. As soon as the consensus is reached and the block is effectively added to the chain, all will validators obtain their respective ETH.

Safety

Evidence-of-work methods face important safety problems because of their open nature and top stage of centralization as just a small staff of miners are answerable for validating the blocks. However proof-of-stake consensus mechanism provides advanced safety since there aren’t any miners with sufficient hashing energy to keep watch over 51% or better of all the community directly like in PoW methods.

ETH 2.Zero will want a minimum of 16,384 validators to achieve a consensus, which can make it extra decentralized and thus, extra safe than Eth1.

As Ethereum explains it, “[The Merge] will sign the top of proof-of-work for Ethereum and get started the generation of a extra sustainable, eco-friendly Ethereum. At this level, Ethereum will probably be one step nearer to attaining the total scale, safety, and sustainability defined in its Ethereum imaginative and prescient.”

Different Highlights from the Merge

The Merge will be sure that it reduces the block time to simply 12 seconds consistent with block from its present, which fluctuates between 13 to 14 seconds.

But even so, there can be a cutback at the fuel charges because the community will strengthen a greater and extra energy-efficient validation manner. This could also be because of the shard chain that has already been carried out, which has allowed the diversification of all operations throughout 64 chains as a substitute of on a unmarried chain.

Vitalik Buterin, CEO of Ethereum, has additionally said that Ethereum 2.Zero will in large part depend on ZK-rollups and its different scaling strategies at this time for no less than a few years prior to the shard chains are correctly carried out.

Up to now, validators have staked 12.6 million price of ETH, the rewards for which might be stated to free up after the Merge improve is entire.

Learn extra:

eToro – Our Really useful Ethereum Platform

- Per thirty days Staking Rewards for Maintaining Ethereum (ETH)

- Unfastened Protected ETH Pockets – Unlosable Personal Key

- Regulated by means of FCA, ASIC and CySEC – Thousands and thousands of Customers

- Copytrade Winning Ethereum Buyers

- Purchase with Bank card, Financial institution twine, Paypal, Skrill, Neteller, Sofort

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)