The beneath is an excerpt from a up to date version of Bitcoin Mag Professional, Bitcoin Mag’s top class markets publication. To be a number of the first to obtain those insights and different on-chain bitcoin marketplace research immediately for your inbox, subscribe now.

LFG Trade Inflows

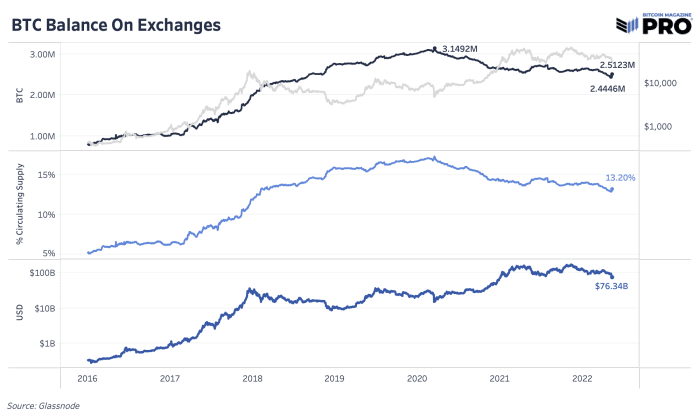

On account of this week’s chaos, exchanges had an estimated 52,333 of bitcoin inflows in large part pushed by means of the depletion of the Luna Basis Guard (LFG) reserve steadiness. This doesn’t trade the bigger macro development of trade outflows over the past two years, however it’s the biggest day by day influx of bitcoin to exchanges since November 2017 and the all time perfect USD worth of bitcoin moved.

From what we all know up to now, with out a transparent LFG observation but on the newest standing of reserves, 52,189 bitcoin has left identified addresses losing the reserve steadiness from 80,395 BTC to 28,206. At top, that was once just about $three billion in reserves (with a $10 billion objective) to make stronger Terra’s earlier $18 billion marketplace cap. A big chew of 37,836 BTC (approximately $1.13B) looks to have been sent to Gemini.

General reserves fell after LFG introduced that $750 million in bitcoin was once deployed as a mortgage to marketplace makers with efforts to shield the UST peg. It’s no longer as transparent as to the precise p.c of reserves that have been totally bought directly to the marketplace as opposed to what’s been loaned to marketplace makers. The query now’s how a lot bitcoin will make its as far back as LFG’s reserves, or again to the marketplace amid every other possible wave of promote drive if the restoration efforts fail and accept as true with on this stablecoin experiment doesn’t go back?

Even if this was once a ancient influx day, it’s a slightly small overall per month influx as a proportion of marketplace cap up to now. In a similar fashion, on a 30-day rolling foundation, trade outflows are nonetheless dominant with 15,012 BTC outflows from exchanges up from just about 100okay BTC in outflows on the fresh top.

April 2022 was once the third-highest trade steadiness outflow month of all time. Throughout each March and April, just about 161,000 BTC left exchanges whilst up to now, Would possibly has an estimated influx of just about 51,000 BTC 9 days into the month.

With markets changing into extra subtle over the years, balances on exchanges on my own don’t inform the entire tale — with relatively noisy, insignificant correlations to momentary value motion when taking a look at rolling 90-day correlations the usage of 30-day flows. Trade balances are nonetheless helpful at working out flows, tracking financial job and examining longer-term developments, however they’re surely nuanced.

Subscribe to get right of entry to the overall Bitcoin Mag Professional publication.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)