Be a part of Our Telegram channel to remain updated on breaking information protection

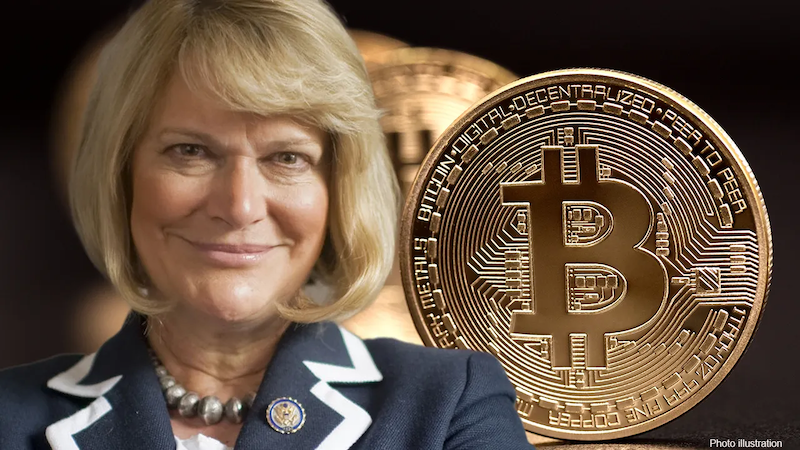

Two outstanding U.S. Senators, Cynthia Lummis (R-WY) and Kirsten Gilibrand (D-NY), are making a renewed effort to create a legislative framework to supervise the evolving digital asset sector. The pair’s newest initiative to move an up to date model of a cryptocurrency regulation invoice they collectively proposed final yr was revealed on CNBC’s Squawk Field. This comes amid a digital forex business that’s concurrently experiencing favorable situations and vital hurdles.

Highlighting the authorized points dealing with the business, the Securities and Trade Fee launched authorized actions towards the 2 main cryptocurrency exchanges, Binance and Coinbase, in June. This transfer, designating practically a dozen tokens as securities, unexpectedly threw the business into turmoil and triggered considerations in regards to the future trajectory of digital currencies in America.

On the brighter aspect, the business noticed a number of companies, together with BlackRock, Invesco, Valkyrie, and Ark Make investments, following BlackRock’s lead by submitting purposes for exchange-traded funds in Bitcoin spot markets on June 15. This pattern considerably drove Bitcoin costs, pushing them to a degree unseen because the earlier yr.

Hopeful A couple of Higher Invoice

Regardless of these challenges and alternatives, Lummis and Gilibrand are hopeful in regards to the new model of their invoice – an up to date type of final yr’s Accountable Monetary Innovation Act. The unique model aimed to make clear a few of the trickiest elements of crypto regulation, together with categorizing a token as both a safety or a commodity, which in flip would decide whether or not the SEC or the Commodity Futures Buying and selling Fee (CFTC) can be the accountable regulator.

Bipartisan laws is the simplest path in direction of regulatory readability, shopper safety, and market reform within the digital asset ecosystem.

Addressing the SEC’s present strategy to crypto regulation, Lummis famous that each the SEC and Congress share blame for the present unclear regulatory surroundings. She acknowledged, “The present erratic regulatory framework is the results of each Congress’s hesitation to move a invoice and the SEC’s failure to supply proactive steering to corporations.” She assured that the streamlined model of the draft will mirror suggestions from each regulators and business stakeholders.

The crypto group reacted positively to the up to date RFIA. Georgia Quinn, common counsel for Anchorage Digital, mentioned in an e mail that it represents a “vital step ahead from the Senate.” She highlighted that “bipartisan laws is the simplest path in direction of regulatory readability, shopper safety, and market reform within the digital asset ecosystem.”

Nonetheless, the up to date laws drew a extra reserved response from Gabriel Shapiro, common counsel for Delphi Labs. He warned about potential confusion as a result of invoice showing “too deferential” to present securities legal guidelines and expressed reservations over different elements that would trigger misunderstanding.

Whereas the invoice remains to be in progress, having been maneuvered by two GOP-led Home committees, its proponents are in search of to make it a bipartisan effort. Rep. Patrick McHenry, the chair of the Home Monetary Providers Committee and one of many main supporters of the invoice, expressed his intention to make the ultimate invoice bipartisan. Home Democrats, although not ruling out the invoice, have voiced reservations over elements they imagine may shield wrongdoers and weaken the SEC.

Associated Information

Wall Road Memes – Subsequent Large Crypto

- Early Entry Presale Reside Now

- Established Neighborhood of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Finest Crypto to Purchase Now In Meme Coin Sector

- Crew Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)