The surprising crash

Again in April 2022, Terra was once nonetheless a public chain with a marketplace cap of $41 billion and a number of rosy visions. Then again, in only one month, its local algorithmic stablecoin UST de-pegged from the greenback because of manipulation via giant establishments and improper mechanisms. In consequence, Terra’s marketplace cap plummeted from $41 billion to $1.2 billion (as of Might 17), a 97% drop. After UST misplaced its peg, its TVL additionally collapsed, shedding from $21 billion to $300 million in only one week. No egg remains unbroken when the nest is overturned. As UST de-pegged from the greenback, the TVL of tasks sponsored via the enabling ecosystem of Terra up to now fell from $21 billion to $300 million inside of every week. How will the Terra-powered tasks have the opportunity out? Will they get away from the meltdown? Or will they only disappear for excellent?

We labored out the timeline of the cave in and summarized its have an effect on in our earlier article The Collapse of LUNA. These days, we can focal point on the newest construction of Terra-powered tasks after the meltdown, whether or not they’re looking to meet the prevailing problem, and the place they’re heading.

The place are Terra-powered tasks heading?

Astroport

Astroport is a number one DEX on Terra. As a Terra-exclusive mission, the DEX is sure up with the Terra ecosystem, so it basically trades the cryptos of Terra tasks. As such, the TVL and buying and selling quantity of Astroport were each hit exhausting via the crash.

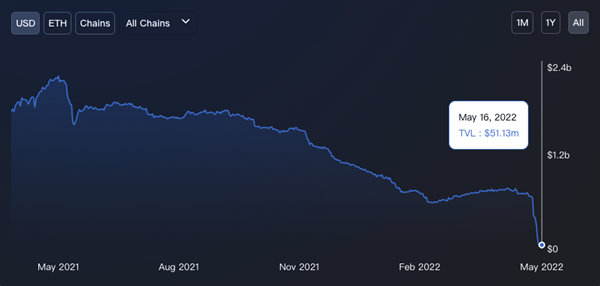

In relation to TVL, consistent with Deflamama.com, on Might 9, sooner than UST de-pegged, Astroport’s TVL stood at round $1.26 billion however nosedived to $23 million on Might 15, a drop of greater than 50 occasions. The TVL drop signifies that LUNA and UST don’t seem to be the one cryptos that crashed, and tasks together with Replicate, Anchor, and Astroport have additionally witnessed repeated slumps. As for the buying and selling quantity, information from Coingecko means that Astroport’s buying and selling quantity stood at $350 million on Might 9, surged to $1 billion on Might 11, after which plummeted to $16 million on Might 13, 1/20 of the dimensions sooner than the meltdown. It seems that, initially of the UST de-peg, buyers hoping to shop for low and speculators making plans to arbitrage thru UST’s value mechanisms flocked to Terra, pushing up the buying and selling quantity of Astroport to a degree a lot upper than same old within the first few days however quickly riding it down right into a bottomless pit.

Sooner than the meltdown, the Astroport workforce by no means printed themselves to the general public. But after the cave in, they introduced on Might 11 that they was hoping the individuals of the network may talk about the place Astroport must move someday and the way the Terra ecosystem might be stored. As Astroport is tied at the side of Terra, liquidity is its easiest moat. As soon as the mission loses liquidity, within the DEX sector with low technical obstacles however intense festival, even supposing Astroport migrates to different public chains, its marketplace possibilities stay dim.

Anchor Protocol

Anchor is the biggest stablecoin lending mission on Terra. It used to supply an APY as prime as 20% for depositors thru mortgage pursuits and staking rewards. As well as, depositors too can stake property that come with LUNA and ETH to borrow UST. As a key a part of the Terra ecosystem, Anchor guarantees a solid ROI of about 20% and is derived as one of the most riding forces at the back of Terra’s hovering TVL.

Anchor’s rates of interest turned into ordinary even sooner than UST deviated from its peg: the borrowing rate of interest went from sure to detrimental. Even though Anchor diminished the rate of interest to inspire customers to stake property like LUNA to borrow UST, the real share of customers borrowing remained low. As customers all began to withdraw their UST deposits, Anchor witnessed the most simple have an effect on of the UST de-peg. As well as, because the Luna value plummeted, the compelled liquidation of bLuna endured, sending it right into a downward spiral. Anchor’s TVL additionally fell off the cliff, shedding from 14 billion UST to one.39 billion UST (as of Might 16).

In relation to multi-chain deployment, aside from bLuna, Anchor additionally helps collaterals that come with bETH, wasAVAX, bATOM, and bSOL. Then again, following the UST de-peg, customers additionally began to redeem those collaterals on different chains. As of Might 16, Anchor’s TCV (Overall Collateral Price) of bETH, wasAVAX, bATOM, and bsol stood at $59.65 million, $5.05 million, $2.21 million, and $3,391, respectively. The large withdrawal of property signifies that buyers don’t seem to be assured in Anchor’s reboot.

After UST misplaced its peg, Anchor didn’t factor any quick bulletins to calm buyers. As an alternative, it handiest tweeted that the blockchain have been suspended and known as on customers to prevent interacting with Anchor. With out freeing any countermeasures, Anchor simply requested customers to watch for an replace. In the meantime, its respectable Discord server was once locked, and customers may handiest whinge on Twitter. In the case of the UST de-peg, for the reason that the workforce at the back of Anchor is Terraform Labs, it may well be too busy to imagine the long run prospect of Anchor for the instant being.

We imagine that the issue with Anchor lies within the excessively low exact share of customers borrowing. As many of the price range keep idle, Anchor has been eating its reserves, which ultimately ended in the imbalance between borrowing and lending. In March, the Anchor network sought different answers, equivalent to adjusting the APY to a semi-dynamic rate of interest, upgrading the protocol to Anchor v2, and permitting customers to stake auto-compound derivatives. Then again, hit via the UST de-peg, Anchor’s strive failed midway thru. If Anchor needs to stay working, it will have to first repair investor self belief after which support the product common sense to make ends meet.

Replicate Protocol

Replicate Protocol is a Terra-based decentralized platform the place customers can industry artificial property equivalent to mTSLA which can be pegged to Tesla’s inventory value. Like Anchor, Replicate was once additionally one of the most main programs for UST to make bigger its protection. For the reason that finish of 2021, Replicate has were given trapped in rumors of SEC investigations, and its TVL has long gone downhill. The UST crash got here as any other main blow to Replicate. Consistent with Replicate’s product mechanism, the protocol receives real-world inventory costs thru oracles after which adjustments the collateral ratio to lead artificial property on Replicate to trace the costs of real-world property. Then again, the factitious property on Replicate are all priced and traded in UST. Subsequently, as UST deviates from its peg, the cost of artificial property on Replicate additionally considerably deviated, with a top rate of as much as 40%.

Replicate is sponsored via Terraform Labs, which hasn’t launched any knowledge on Twitter since Might 5, nor did it reply to the Terra/UST meltdown. In the meantime, customers have no longer been in a position to enroll in its Discord channel since Might 11. Because of regulatory drive and the UST de-peg, Replicate would possibly no longer make any giant strikes any time quickly.

Mars Protocol

Instead of Anchor, the Terra ecosystem additionally options any other lending protocol known as Mars, which may be a joint mission led via Terraform Lab, Delphi Labs, and IDEO CoLab. When compared with Anchor, Mars goals to supply collateralized lending services and products for extra tokens. To support the usage fee of loans, it innovatively supplies purposes very similar to credit score line for different protocols that grant credit score to the protocol (equivalent to Apollo, an Astroport-based income technique platform).

After UST de-pegged, since many of the TVL of Mars comes from UST that customers deposited right through the Lockdrop stage, its TVL loss has been smaller when compared with protocols that had been closely invested in LUNA (UST is now value round $0.15). Additionally, because the protocol has no longer but been totally introduced, the unhealthy money owed generated via collateralized lending are restricted. On the identical time, when UST began to de-peg, the protocol instantly suspended the borrowing serve as and followed pressing measures regarding present UST liquidity suppliers. Right through Lockdrop, many customers’ UST deposit was once locked for three to 15 months. The Mars workforce unlocked such deposits thru emergency multisig, which allowed customers to withdraw their locked UST deposit freely. From proposal to execution, Mars moved somewhat rapid.

But, it’s noteworthy that unlocking UST, to a point, displays the mission workforce’s insecurity in its reboot. That is the case as a result of consistent with the respectable reimbursement program, Terra will allocate new LUNA tokens to UST holders, however Mars has allowed customers to redeem UST tokens that are meant to were locked till subsequent yr (the typical lock-up time), which additionally way it has given up the correct to make use of new LUNA tokens allotted to the locked UST for a yr or so. This dilutes the underlying price of MARS tokens, and in addition releases a sign that the workforce may well be making an allowance for giving up or transferring in different places.

Total, the way forward for Mars, which is a lending protocol tied at the side of the Terra ecosystem, is stuffed with uncertainties and demanding situations. In the meantime, for the reason that mission workforce at the back of Mars is Terra Lab itself, we will be able to principally rule out the potential for migration to different chains. We must give credit score for the fast choices and swift movements taken via Mars right through the meltdown. When compared with maximum Terra tasks, Mars has accomplished a really perfect activity in dealing with the disaster and calming and compensating the network.

Mars introduced the suspension of borrowing services and products on Might 10.

On Might 13, Mars counted the unhealthy money owed and instructed that Delphi Lab, one of the most groups at the back of the mission, would repay the money owed.

On Might 13, Mars counted the unhealthy money owed and instructed that Delphi Lab, one of the most groups at the back of the mission, would repay the money owed.

On Might 13, Mars unlocked the lockdrop UST.

Nexus Protocol

Nexus is a income technique protocol. Its primary technique is according to Anchor’s bLUNA (a small section being bETH and wasAVAX). The core era of Nexus is to make use of oracles to front-run Anchor’s liquidation mechanism, which permits customers to mine with the utmost loan-to-value ratio, with out the danger of compelled liquidation.

Because the UST de-peg immediately zeroed out the worth of LUNA, the TVL of Nexus’s bLUNA technique may be coming near 0, and handiest bETH and wasAVAX nonetheless have a ultimate TVL. But, since customers panicked and ran away, the full TVL of Nexus has been depleted. Consistent with Deflama.com, Nexus’s TVL as soon as peaked at $153 million, and now handiest $500,000+ is left.

What’s worse, after UST broke its peg, the community of Terra additionally bumped into some issues, and Nexus nodes had been not able to sync with the mainnet, rendering the anti-liquidation mechanism invalid. As for the protocol methods, roughly $600,000 of property had been liquidated. Right away after the incident, the workforce performed a technical research to analyze the explanations and drafted and proposed reimbursement plans.

For the Nexus protocol, the UST de-peg way it nearly has to rebuild the mission from scratch. Then again, making an allowance for Nexus’s cutting edge era and design in addition to the first rate choices to the bottom-layer lending protocols like Anchor on different chains, the workforce may get redeployed on different chains and migrate its tokens. As Nexus isn’t a mission evolved via the Terra workforce, there is not any want for it to stay working inside the Terra ecosystem. Consistent with the workforce’s bulletins, Nexus continues to be discussing its long run chances, and it kind of feels that the workforce nonetheless hopes to stay working with out a aim of agreement or dissolution.

On Might 12, Nexus tweeted that “serious blockchain flooding” averted its node from syncing with Terra.

On Might 12, the day of the sudden liquidation, Nexus launched the reason for the incident and reimbursement plan.

On Might 15, Nexus stated that it was once interested by “what to do subsequent” and was once open to quite a lot of chances.

Orion Cash

Orion Cash, a cross-chain stablecoin financial institution on Terra, converts stablecoins on other chains into wrapped property to earn constant stablecoin returns on Anchor. First introduced on ETH, Orion Cash was once later deployed on Terra, BSC, and Polygon.

Orion Cash’s TVL additionally fell off the cliff, shedding from just about $75 million to $15.96 million. As of Might 16, 4.95 million UST stays on Orion Cash, and maximum different stablecoins were utterly withdrawn or nearly so.

To their credit score, the Orion Cash workforce instantly tweeted after the UST de-peg to retain the arrogance of buyers, which signifies that they had been already discussing the right way to unravel the disaster. Additionally, after UST broke its peg, the workforce has taken energetic strikes to be sure that customers can withdraw their stablecoins with minimum losses. On Might 14, the workforce issued a report to assist customers withdraw UST sooner and in addition reminded customers of the possible airdrop of recent LUNA. On Telegram, the individuals of the workforce disclosed that that they had participated in Terra’s early funding and at the moment are working at a loss. In addition they stated that the Orion reserved for the workforce had no longer been unlocked within the hope of restoring investor self belief.

Orion Cash’s expansion is according to Anchor, which makes the mission an adjunct for Anchor that handiest transfers stablecoins from different chains to Terra. This implies a loss of technical obstacles. If deployment on Anchor fails, Orion Cash may handiest to find differently out, shift the point of interest of the mission, or search redeployment on different chains which can be very similar to Anchor.

PRISM Protocol

PRISM Protocol was once as soon as regarded as Terraform Labs’ maximum cutting edge product. With PRISM, customers can cut up their property into yield and predominant elements. Presently, the protocol handiest helps the splitting of LUNA, which will also be cut up into pLUNA (predominant) and yLUNA (yield).

This present day, the LUNA value is just about 0, and PRISM has additionally been hit exhausting. Knowledge from DeFiLIama presentations that PRISM’s TVL stood at just about $500 million on Might 7, however pushed via LUNA’s plummet that started on Might 8, coupled with the UST de-peg, a number of customers withdrew price range from the protocol, and its TVL stored falling. PRISM’s TVL now stands at handiest $87. Going through bleak possibilities, the mission is at the verge of death.

PRISM, a mission introduced via Terraform Labs, stated in its newest tweet on Might 13: The workforce may also discover different alternatives within the coming weeks, together with redeploying the protocol on any community-supported Terra forks or different public chains. On the identical time, PRISM additionally inspired network individuals to proportion their ideas on Prism Discussion board (discussion board.prismprotocol.app). As of this writing, the PRISM workforce has no longer introduced to any extent further plans for long run construction.

To our network:

The previous few days it’s been tough to observe what’s took place on Terra & our middle is going out to the LUNAtics & Refractooors available in the market who’ve been affected.

We had handiest simply finished our v1 release and we had been occupied with beginning to roll out our v2 product.

— PRISM (@prism_protocol) May 13, 2022

Pylon Protocol

Constructed on Anchor, a fixed-rate garage protocol, Pylon Protocol introduces a yields-based IDO launchpad and long run payments-in-cashflow to DeFi. Up to now, it introduced Pylon Gateway Launchpad, wherein many Terra-powered tasks finished their IDO. Pylon Gateway Launchpad additionally permits customers to earn token rewards via staking UST to other swimming pools, thereby taking part within the IDO of various tasks.

Pylon Protocol is the 5th mission immediately incubated via TerraForm Labs. Its distinctive IDO mechanism makes the protocol strongly depending on UST and Anchor. Following UST’s stunning de-peg and the large withdrawal of price range from Anchor, Pylon Protocol has additionally suffered a heavy blow. Consistent with DeFiLIama, UST had a TVL of about $240 million sooner than its de-peg. Because the have an effect on of Terra’s meltdown expanded, Pylon Protocol needed to open up all swimming pools and make allowance customers to withdraw UST. As of now, Pylon Protocol’s TVL has plunged to simply $5.Four million.

Pylon Protocol stated in a protracted tweet posted on Might 12 that the workforce is operating at the factor of contract migration and that UST withdrawals were spread out for all swimming pools, nevertheless it has no longer up to date any development and specifics since then.

Unique tweet:

Terra Identify Provider

Terra Identify Provider is a decentralized identify carrier constructed on Terra. It turns lengthy, random, unreadable Terra addresses into brief, personalised, team-specific addresses (.UST).

The LUNA crash and the UST de-peg additionally affected Terra Identify Provider’s local token TNS, which slumped just about 20 occasions since Might 8 (from $0.2 to $0.014), and only a few customers have registered new domains since then.

Terra Identify Provider tweeted on Might 12 that it’s going to announce the next move once conceivable however has no longer up to date any development or remedial measures to this point.

Conclusion

The dying spiral of UST ended in the full cave in of all the Terra ecosystem. Do Kwon, Terra’s founder, introduced the Terra Reconstruction Plan on Might 14, hoping to offer protection to the network and the developer ecosystem via forking Terra into a brand new chain. Extra in particular, 40% of the tokens to be issued via the brand new chain will move to Luna holders sooner than the UST de-peg, 40% to UST holders on the time of the brand new community improve, 10% to LUNA holders sooner than the chain halt, and 10% to the Neighborhood Pool to fund long run construction. At the moment, the proposal continues to be underneath dialogue, and there are lots of disputes, together with the direct doubt mentioned via Binance’s CEO CZ about whether or not the fork would deliver any price to the brand new chain.

On the identical time, Terra’s competitors also are soaring over its ecosystem. Ryan Wyatt, CEO of Polygon Studios, tweeted that he was once operating with positive Terra tasks to assist them migrate from Terra to Polygon and “can be striking capital and sources in opposition to those migrations to welcome the builders and their respective communities” to Polygon. On Might 15, Juno Community, a Cosmos-based good contract public chain that makes use of the similar technical structure as Terra, introduced an offer for beginning the Terra Construction Fund and plans to supply 1 million JUNO (value greater than $Four million) to assist Terra tasks migrate to Juno. In the meantime, any other public chains (equivalent to CSC) or communities have additionally proven a gesture of welcome for the migration of Terra tasks.

On Might 17, Do Kwon launched any other proposal on Twitter, hoping to fork Terra into a brand new chain that can now not function the stablecoin UST. The full quantity of tokens to be issued via the brand new chain is 1 billion, which can be dispensed pro-rata to LUNAUST holders, communities, and builders of the previous chain. If the proposal were given handed, the brand new chain can be introduced on Might 27. In spite of everything, there is not any doubt that Terra’s person base and price range, in addition to the arrogance in its ecosystem, have all suffered a heavy blow and won’t recuperate any time quickly.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)