The article beneath is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Who Holds The Bitcoin?

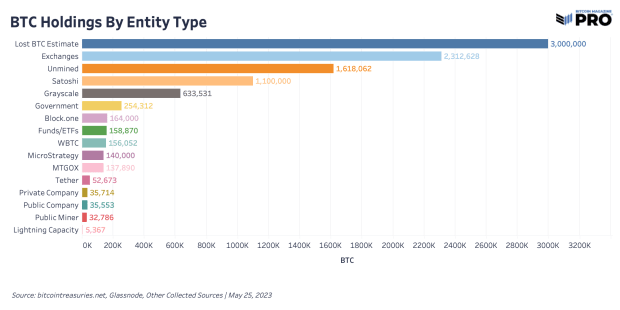

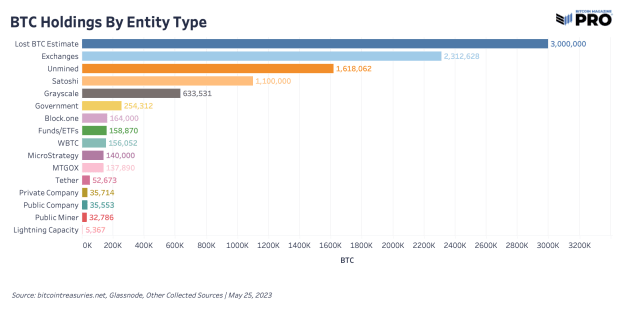

Bitcoin’s public ledger comes with a novel stage of transparency that features important info detailing the place the bitcoin provide lives. With the assistance of tackle monitoring, public bulletins and a few estimation throughout knowledge sources, we are able to get a way of the place practically 47% of whole bitcoin provide is in the present day. A substantial portion of bitcoin’s 21-million provide is estimated to be misplaced, which incorporates Satoshi Nakamoto’s cash. There’s helpful knowledge from each Glassnode and Chainalysis to recommend that almost 4 million bitcoin has been misplaced.

Different massive quantities of bitcoin are on exchanges, within the Grayscale belief, or in bitcoin miners’ wallets. Swaths of bitcoin have been accrued by the likes of MicroStrategy, and extra just lately Tether. Some 5,500 bitcoin are locked up on the Lightning Community, whereas different sums exist as wrapped bitcoin (WBTC) on blockchains apart from Bitcoin.

Most bitcoin estimates may be tracked on a routine foundation when examples, like identified U.S. government-associated on-chain addresses from numerous bitcoin seizures, or when analyzing month-to-month manufacturing updates from public bitcoin miners, whereas different holding particulars may be a lot more durable to come back by. A non-public establishment might have indicated bitcoin holdings years in the past, however isn’t required to publicly announce updates of their stash. Different situations embrace uncertainty round authorities holdings. China might have 194,000 bitcoin from seizure, but it surely’s tough to confirm if this quantity is present.

All that mentioned, the beneath chart is a tough lower of accessible knowledge that may be expanded upon and improved for higher accuracy throughout totally different teams. These figures come from on-chain forensics, public SEC filings and steadiness sheet attestations.

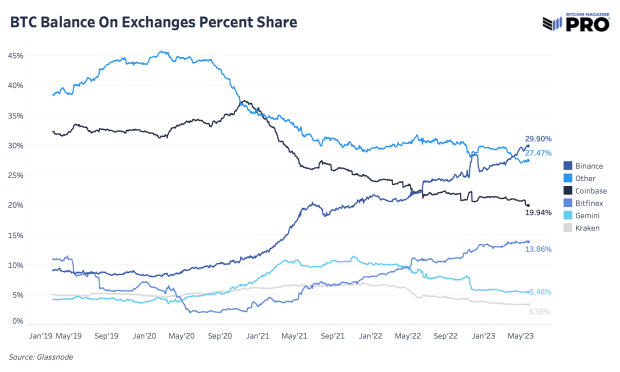

Of the two.3 million of bitcoin on exchanges, the bulk resides on Binance and Coinbase. This wouldn’t embrace bitcoin in funding custody merchandise like Grayscale and Coinbase Custody, for instance. Binance’s share of bitcoin on exchanges has risen from beneath 10% in 2019 as much as 30% in the present day. The corporate is estimated to have practically 700,000 bitcoin on their platform, which might predominantly be attributed to their derivatives market dominance and their worldwide presence, whereas Coinbase is especially a spot trade with a heavy U.S. presence.

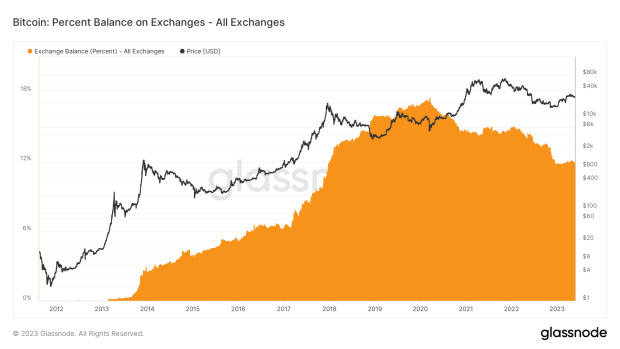

Over time, the quantity of circulating bitcoin provide on exchanges has reached 17.5% of circulating provide, reaching its peak in March 2020 earlier than declining to only 11.89%. We suspect that the development of declining bitcoin on exchanges as a share of circulating provide will proceed as bitcoin distributes throughout an elevated variety of international adopters, thanks to stylish private custody options turning into extra mainstream and sturdy as time goes on.

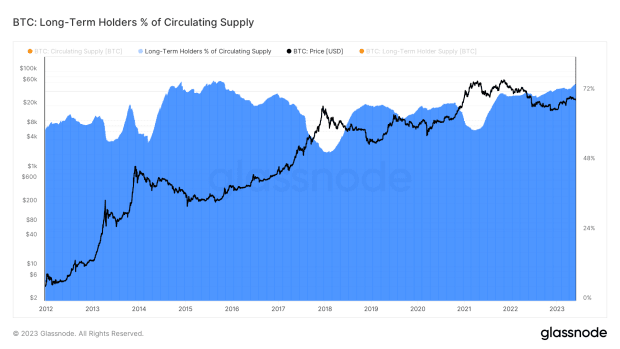

In absolute phrases, there has by no means been this stage of long-term holders in bitcoin. In relative phrases, the one two occasions in historical past with a bigger share of long-term holder cash is in 2009 earlier than bitcoin had an trade charge, and within the depths of the 2015 bear market. With a lot of the provision off the market, sell-side strain within the interim can lead to massive worth changes to the draw back, since many market members are partaking in additional of a passive function.

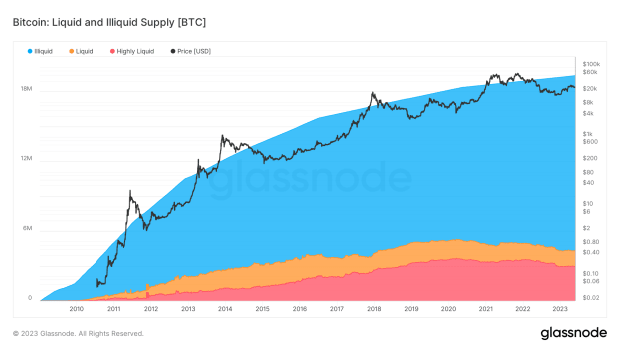

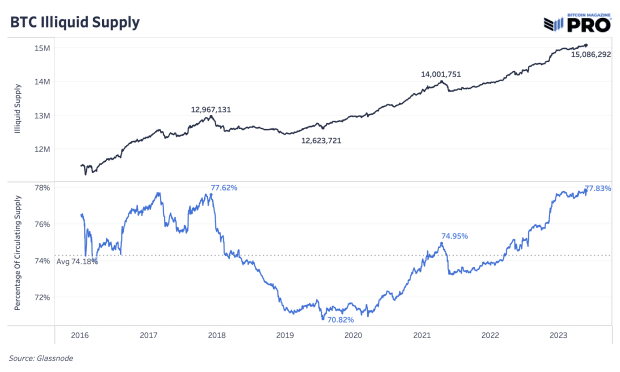

We are able to additionally take a look at bitcoin’s illiquid provide to quantify holder dynamics. The time period “illiquid provide” refers to bitcoin which are held by entities that not often promote, that means these cash aren’t available for buying and selling. To quantify this, an entity’s bitcoin holdings are deemed illiquid if lower than 25% of its acquired bitcoins have been spent, liquid if 25% to 75% have been spent, and extremely liquid if over 75% have been spent.

Within the post-2016 halving period, bitcoin’s illiquid provide as a share of circulating provide is at its highest stage, with holder accumulation taking cash off the market sooner than miner issuance can distribute them.

As of this April 2023, bitcoin’s illiquid provide surpassed 15,000,000 cash.

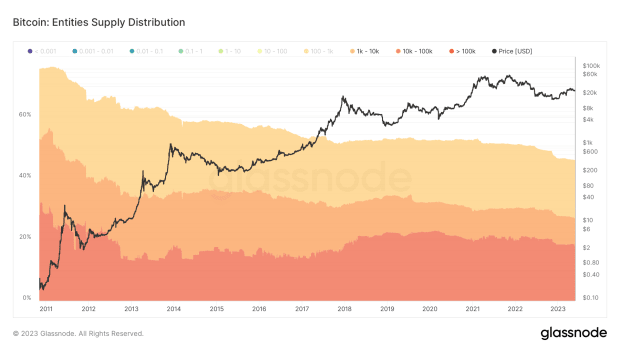

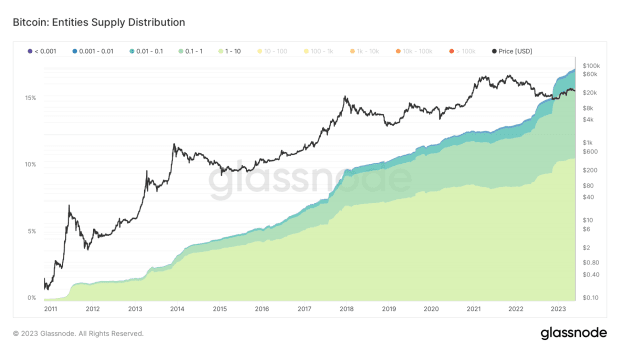

The development is obvious: Bitcoin continues to distribute into extra arms, with a larger focus of provide shifting from entities holding massive quantities of bitcoin — balances of 1,000-10,000 BTC, 10,000-100,000 BTC, and larger than 100,000 BTC — to entities holding balances of 10 BTC or much less.

It’s vital to notice that entities holding massive quantities of bitcoin, notably these with 10,000-plus BTC, are seemingly managing keys for hundreds and even thousands and thousands of customers, exchanges being an apparent instance. That is usually a traditional supply of mischaracterization and misinformation when folks make claims relating to an absence of wealth distribution of bitcoin. Sure, there are clumps of addresses with massive holdings of bitcoin, however that is like claiming that one company owns 14% of all U.S. {dollars} within the business banking system. Whereas JPMorgan Chase has $2.4 trillion out of $17.1 trillion of deposits in home banks and the deposits are a legal responsibility of JPMorgan, if truth be told, they’re custodied for thousands and thousands of distinctive people and companies.

The important thing distinction — other than the authorized versus cryptographic possession construction — is the truth that bitcoin’s possession construction, the UTXO set, is way more clear and simply auditable. This makes it simple for anybody to take a look at the info and make knowledgeable claims about bitcoin’s provide focus.

Last Observe

Bitcoin has been profitable in attracting a broad spectrum of holders, from people to firms, non-public entities and even nation-states. As evidenced by rising retail possession and traditionally excessive ranges of long-term holders, it’s clear that bitcoin’s provide is getting distributed extra evenly throughout this huge array of adopters. This development is additional bolstered by a declining quantity of bitcoin held on exchanges and an rising illiquid provide.

Shifting ahead, we anticipate these developments of elevated distribution and declining focus to proceed, as bitcoin’s 21,000,000 arduous capped provide is split up between the world’s people, establishments, firms and nation states.

That concludes the excerpt from a current version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles immediately in your inbox.

Related Previous Articles:

- PRO Market Keys Of The Week: Tether’s Huge Treasury Portfolio

- Earlier Than You Assume: An Goal Look At Bitcoin Adoption

- One 12 months Till The Bitcoin Halving: Analyzing Holder Dynamics

- Bitcoin Sellers Exhausted, Accumulators HODL The Line

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)