That is an opinion editorial through Leon Wankum, one of the most first monetary economics scholars to write down a thesis about Bitcoin in 2015.

Bitcoin has a singular worth proposition. As a protocol for exchanging worth it permits you to at once personal a part of it. The Bitcoin community is a transaction processing device. From transaction processing comes the power to switch cash, specifically bitcoin, the community’s local forex, which represents the price of the underlying device. It’s each a cost community and an asset, sponsored through essentially the most resilient laptop community on the planet.

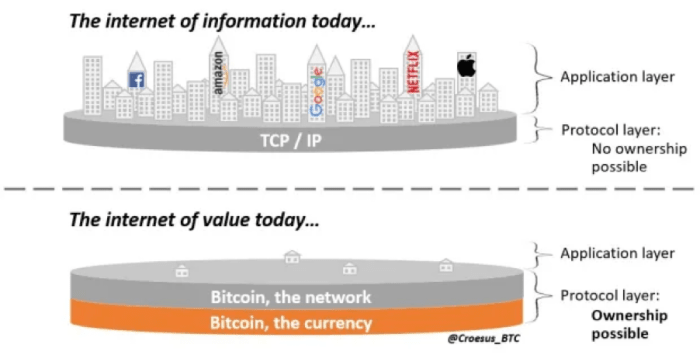

If you need to personal a part of the web, would you assert no? In reality, this is proudly owning bitcoin — proudly owning stocks in a brand new step forward protocol that may develop into the web from an area the place no longer handiest data, but additionally worth, will also be freely exchanged.

With Bitcoin, it is conceivable to take an possession stake in all the web of worth. This was once by no means conceivable with the web of knowledge. Possession and worth seize is constructed at once into the community (Guy Swann). This can be a paradigm shift that new traders wish to “wrap their heads round” to know Bitcoin’s complete doable (Croesus_BTC).

Supply: Croesus_BTC

Michael Saylor has famously compared purchasing bitcoin to shopping for actual property in downtown New york 100 years in the past. A few of New York’s wealthiest households have made their fortunes proudly owning actual property. When one thing this is restricted is in prime call for, it will increase in worth.

Shortage has reasonably so much to do with the price of items, which is why sure distinctive items of artwork are value such a lot and why actual property in a densely populated house is costlier than in a non-densely populated house(surferjim, 2020. Bitcoin As Real Estate). Certain, actual property has worth as a result of folks pay hire to are living in it, however the worth is essentially made up our minds through the restricted provide of establishing land. There are handiest “such a lot of” houses to be inbuilt high places. Bitcoin’s enchantment additionally stems from the truth that its provide is proscribed (Brown, R. 2014. “Welcome to Bitcoin Island). There will never be more than 21,000,000 bitcoin.

However bitcoin, not like actual property, does no longer generate any source of revenue. It is like bitcoin is a virtual belongings that does not earn hire.

So would not calling bitcoin land be a extra correct comparability?

In reality, as described through Richard Brown, bitcoin is similar to land because of the community’s accounting construction. However I wish to construct on that and amplify this comparability as a result of bitcoin has a far upper complexity in its utility than land, for which actual property is the most productive comparability. In idea, proudly owning actual property is fascinating as it generates source of revenue (hire) and can be utilized as a way of manufacturing (production). However for essentially the most section, actual property now serves a unique function. Given the prime ranges of economic inflation in fresh many years, merely protecting cash in a financial savings account isn’t sufficient to keep the price of cash and stay alongside of inflation. Because of this, many, together with rich folks, pension finances and establishments, normally make investments a good portion in their disposable money in actual property, which has turn out to be one of the most most well-liked shops of worth. The general public don’t need actual property so they may be able to are living in it or use it for manufacturing. They would like actual property so they may be able to retailer worth (Jimmy Song).

Retailer Of Worth

Bitcoin is broadly authorized as a virtual retailer of worth, which is handiest logical in an international the place financial growth is ever expanding.

Whilst the availability of bitcoin is finite, the houses related to bitcoin make it a perfect retailer of worth. It’s simply moveable, divisible, sturdy, fungible, censorship-resistant and noncustodial. Actual property can not compete with bitcoin as a shop of worth. Bitcoin is rarer, extra liquid, more uncomplicated to transport and more difficult to confiscate. It may be despatched any place on the planet at virtually no price on the pace of sunshine. Actual property, then again, is simple to confiscate and really tricky to liquidate in occasions of disaster. This was once lately illustrated in Ukraine. After the Russian invasion on February 24, 2022, many Ukrainians turned to bitcoin to protect their wealth, bring their money with them, accept transfers and donations, and meet daily needs. Actual property, then again, would have needed to had been left in the back of.

Collateral

Except for getting used as a shop of worth, actual property is among the maximum commonplace sorts of collateral used within the conventional banking device. It’s usually used as collateral from a borrower to a lender to safe the reimbursement of a mortgage. Banks lend to folks and establishments that personal actual property. For comparability: bitcoin possession has turn out to be synonymous with “creditworthiness” within the bitcoin house and the most popular collateral authorized through bitcoin monetary carrier suppliers. The use of bitcoin as collateral to safe the reimbursement of a mortgage has sure benefits for each debtors and lenders. As virtual belongings, bitcoin has a far upper pace than actual property, which is bodily. It’s more uncomplicated to get entry to, purchase, retailer, use and handle. You may are living in a far off village, however so long as you’ve got a turn telephone and will send and receive texts, you’ll purchase and cling bitcoin. It has the power for use any place on the planet. It is advisable to are living in Berlin however get a mortgage from a financial institution in Singapore in the event that they settle for your bitcoin as collateral.

As collateral, actual property has a belongings that makes conventional banks make a choice it over bitcoin. They’re much less unstable. Conventional monetary carrier suppliers don’t seem to be used to the prime volatility of bitcoin. Each and every asset has its personal specifics. With bitcoin, it is volatility, which is if truth be told no longer unhealthy in any respect. Whilst bitcoin’s volatility will also be disastrous for marketplace members who do not be expecting it, it is usually advisable to the economic system. Bitcoin’s volatility will in all probability lead to a extra resilient marketplace. Corporations wish to be higher ready to save lots of and no longer leverage as a lot, as value declines may just temporarily result in a margin name, as we noticed after essentially the most recent 70% crash in bitcoin. After that, quite a lot of closely indebted corporations went bankrupt. The Bitcoin marketplace is continuously trying out its “innovations in the crucible of a competitive market.” Then again, this text isn’t supposed to speak about the precise traits of the 2 belongings as collateral or to make any predictions about bitcoin’s volatility, however is meant to turn the other use instances of bitcoin. I will be able to display a comparability of the houses of each belongings as collateral in a separate article.

Conclusion

In abstract, actual property isn’t like bitcoin within the literal sense, however it’s the maximum suitable metaphor to explain the quite a lot of programs of bitcoin and one of the vital alternatives it items. Bitcoin is a part of a basic step against digitizing the sector round us. This can be a software that may assist society prepare itself extra successfully. Simply because the advent of personal belongings rights enabled the introduction of towns, bitcoin permits a brand new manner of wealth introduction within the virtual house (Bitcoin Magazine, 10 Year Anniversary Edition). This can be a basis for achieving the following nice section of financial development and the betterment of lifestyles on earth (”Bitcoin is Venice” p. 172).

This can be a visitor publish through Leon Wankum. Critiques expressed are totally their very own and don’t essentially mirror the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)