The Bitcoin worth witnessed a 2.8% dip immediately, hitting a contemporary native low at $28,353. Earlier, BTC was buying and selling above $29,100 earlier than the bears took management and pushed the value down by over $700. At press time, BTC noticed a slight restoration. However, the BTC worth is now at an essential inflection level.

Based on legendary dealer Peter Model’s chart evaluation, $29,000 is the essential worth degree for Bitcoin. He shared the next chart and tweeted:

Bitcoin severely difficult multi-contact level trendline from 2023 backside. Transfer by means of Aug low can be bear sign or bear entice. As a swing dealer I might respect the violation of the trendline. So, my positions can be both quick or flat. Provided that a bear entice is definitely “sprung” would I take into account it a bullish growth. I strongly desire horizontal chart development.

Why Is Bitcoin Down Right now?

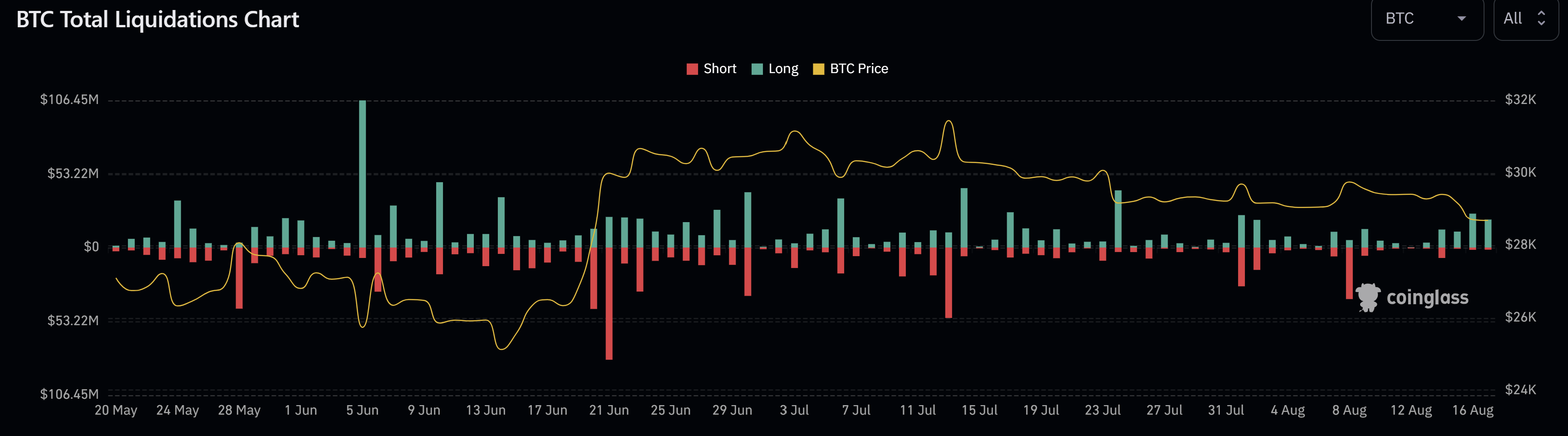

The Bitcoin Futures market has performed a key position. Over the previous 2 days, lengthy positions price $24,76 and $20,17 million respectively have been liquidated in response to Coinglass knowledge. Open curiosity had constructed up rapidly earlier than the bitcoin worth collapsed. A squeeze was solely a matter of time.

Famend analyst Byzantine Normal commented: “That is brutal. Longs hold getting liquidated again and again. Open curiosity lastly moved, however solely so little. Funding hasn’t budged in any respect.”

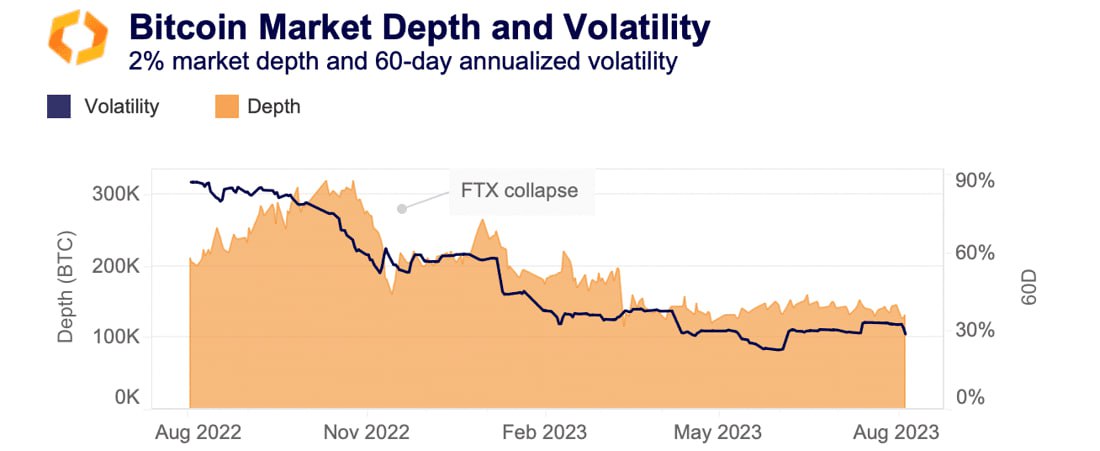

One factor to think about is that the Bitcoin and crypto market is extra illiquid than it has been in a very long time. Thus, BTC is susceptible to greater worth fluctuations way more rapidly than in a extra liquid market. Operation Choke Level 2.0 has been extraordinarily damaging to the market, with market makers disappearing and US greenback rails being reduce off. Based on Kaiko knowledge, BTC buying and selling quantity throughout all exchanges has fallen to 2-year lows.

Famend on-chain analyst Willy Woo commented on Peter Brandt’s evaluation: “Crunch time for BTC. Macro headwinds from US greenback energy. In the meantime there’s growing demand on futures market (professional merchants) and on-chain fundamentals choosing up. Both means, up or down, we are actually establishing for a robust transfer. Volatility squeeze incoming.”

With that, Woo cites one other consider Bitcoin’s worth plunge immediately, the DXY. Glassnode founders Jan Happel and Yann Allemann added in an evaluation that “this 12 months’s important strikes have come from the dynamics within the DXY and US10Y, that are an impact of the macro setting.” In consequence, BTC is feeling heavy unexpectedly. Nonetheless, Happel and Allemann are optimistic:

We consider this turmoil is short-term. The DXY and charges will start to high out within the coming week (2 weeks tops) and the Bitcoin Threat Sign (65) ought to drop.

The DXY is at the moment in a transparent uptrend on decrease time frames, buying and selling at 103.4. Nonetheless, as Happel and Allemann emphasize, the DXY nonetheless wants to substantiate this uptrend. 104.65 might be essential for this. If the DXY will get rejected, the BTC worth may begin a brand new upward momentum.

Typically, macro components and the fears of a recession additionally weigh on the Bitcoin market. Within the first week of August, Fitch downgraded the US long-term credit standing and conventional monetary markets tanked. Then, JP Morgan stated they not count on a recession and markets tanked extra. This marked the native high for the S&P 500. Since then, the S&P has misplaced $850 billion.

Final however not least, the look ahead to a Bitcoin ETF is more likely to be a deciding issue for the market in the mean time. The Bitcoin spot ETF hype has died down for the second. The decline in ETF hype is obvious by trying on the US buying and selling hour premium, which ramped up after the preliminary Blackrock ETF announcement alongside CME futures open curiosity.

If these premiums return, it may sign new momentum. Till then, buyers might wait impassively for the primary Bitcoin spot ETF to be authorized in the US, leaving the market additional in no-man’s land.

At press time, BTC stood at $28,619.

Featured picture from iStock, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)