“Endure markets are the most efficient time to be alive and within the sector. It’s miserable for people that don’t know what they’re doing, it’s superior for people that have a longer-term view.” – Simon Dixon

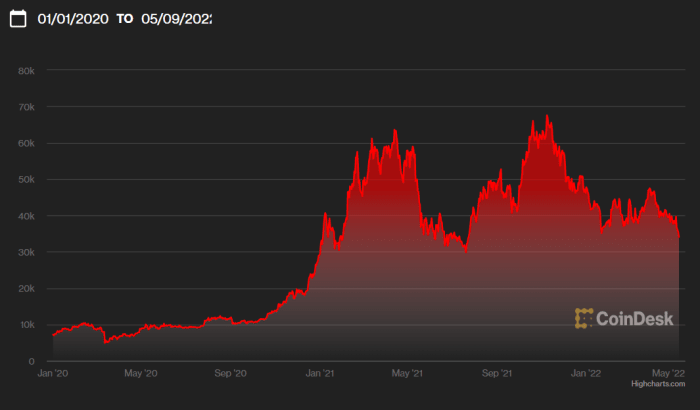

The variation between Bitcoin and the whole thing else is that the cost of bitcoin doesn’t subject. Over the long run the cost of bitcoin has long past up, sure, however the price proposition of bitcoin as exhausting, non-confiscatable and in reality decentralized cash is in point of fact what issues. No longer the associated fee hype and now not the pump. This is the reason buyers and speculators have misplaced passion in Bitcoin, and proceed to flock to the latest pumping decentralized finance (DeFi) or non-fungible token (NFT) undertaking on the drop of a hat. This lack of passion from the speculators is considered by means of many as a unfavourable building for Bitcoin, however it’s in reality an overly sure one. What we’re seeing now represented within the decrease bitcoin value is the price of its precise purposeful software and the absence of retail hypothesis capital that used to be there ahead of. This text will describe why that’s a excellent factor.

Since its inception, misguided analysts have described Bitcoin as a Ponzi scheme depending on continued artificial speculation pumping into the gap. As any one with revel in can let you know, speculators are shiny-object chasers by means of nature and pull out of any place the minute one thing shinier comes alongside. Neatly, the bitcoin “endure marketplace” has arrived and all of the speculators are long past. They were given bored and took their toys house with them. Even with them long past, bitcoin remains to be valued at a ways upper than its 2020 and 2021 lows and is expanding adoption on an institutional (and sovereign) degree. This adoption represents actual price.

The inventory marketplace sugar rush brought about by means of Federal Reserve Board cash printing and unfavourable actual rates of interest is finishing, and the curler coaster is now happening from the highest. This has had an have an effect on now not most effective on bitcoin, however at the inventory marketplace and the opposite altcoins as smartly. Put merely, the whole thing is happening and after the chaos subsides we can see what property, shares and initiatives in reality be offering tangible, purpose price. That’s what funding used to be all the time intended to be about. In spite of the perplexed dichotomy between “enlargement shares” and “price shares,” making an investment is by means of definition intended to be about your long-term trust within the price of one thing, now not in its temporary enlargement projections. Retail traders have struggled to understand this as a result of the get-rich-quick, everybody’s-a-genius marketplace tradition of the previous few years. Certainly, if an asset like bitcoin isn’t continuously appreciating on a double- or triple-digit foundation, then it’s a “failing” asset to those other folks. The marketplace is on its head. Consequently, the meme-stock crowd is out of bitcoin now, similar to they’re out of the inventory marketplace as an entire. Seems the memers had paper fingers all alongside.

This text by means of Bloomberg, titled “Day Trader Army Loses All The Money It Made In Meme-Stock Era,” main points how most of the new buyers that entered the gap have “by no means noticed a marketplace that wasn’t supported by means of the Fed.” Retail buyers misplaced all of the positive aspects they made within the Dogecoin, AMC and GameStop rallies, and are precisely again at sq. one.

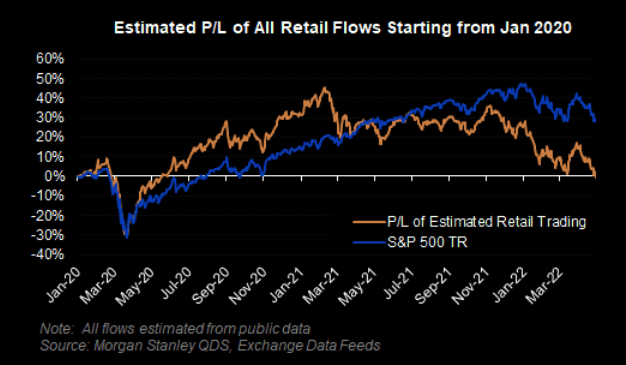

The entire market is falling right now and we wish to reconsider what a “excellent funding” is. Just like the above chart from Morgan Stanley presentations, the total actions of retail buying and selling have canceled out to 0 since January 2020 regardless of their quickly oversized positive aspects in 2021. If we evaluate these days’s bitcoin value to the January 2020 value, we nonetheless see a acquire of 331% for bitcoin, outdoing the S&P 500’s go back by means of a big margin and beating the total retail buying and selling benefit of completely not anything by means of a margin of infinity. Do we want any longer evidence that HODLing is a awesome technique?

Sure, bitcoin is down from its all-time top by means of part, however factoring within the improbable marketplace distortions brought about by means of remarkable cash printing, memestock manipulations and post-COVID-19 rates of interest since early 2020, bitcoin nonetheless blows the rest out of the water. We simply wish to zoom out to a extra “truthful” marketplace window with a view to see this. Everyone is performing just like the sky is falling, however once more, this is most effective as a result of maximum retail traders most effective entered the marketplace in 2020 or 2021 and feature by no means noticed a marketplace that wasn’t supported by means of the Fed.

There’s a tradition within the Bitcoin neighborhood at the present time of “low (i.e., long-term) time choice,” which essentially counters the Ponzi scheme-minded speculators that want short positive aspects the entire time. Top (temporary) time choice fuels the perpetual “passive source of revenue” lie that freshmen all the time fall for. Against this, the “modest” two-year acquire of 331% in bitcoin is greater than sufficient for HODLers which were purchasing since ahead of the feeding frenzy of the previous two years. Lengthy-term time choice works for bitcoin as a result of its basic price proposition has held true since its inception, and it’ll proceed to carry true at some point for individuals who wait. Those that can’t wait are washed out by means of the marketplace over a protracted sufficient period of time in any marketplace, similar to we’ve got noticed with the 0% internet acquire for beginner retail buyers that pull out and in an excessive amount of. The positive aspects brought about by means of hype, stimulus and cultural insanity have been fleeting, however the positive aspects in Bitcoin software and adoption were actual all alongside.

Detractors were criticizing Bitcoin for wanting meme-stock speculators to make it paintings, however now that the meme-stock speculators are long past, the detractors are criticizing Bitcoin for the speculators now not being there. That is merely illogical, and evidence that Bitcoin isn’t in reality a Ponzi scheme. The same can not be said for other cryptocurrencies. Ponzi schemes by means of definition can’t exist for many years and the honesty in present bitcoin value attests to the honesty of its basic price proposition. Sure, it is going down every now and then. That is a hallmark of well being and transparency. One thing that simply is going up and up and up endlessly? That’s a Ponzi scheme and the ground will all the time fall out sooner or later.

No person’s singing “Pump It Up” anymore, and regardless of how amusing and euphoric the 2021 rally used to be for some time, the gap is in point of fact with out the memers round. It’s time for a extra grown-up tradition of building and adoption round Bitcoin, and time for a extra grown-up value dialog as smartly.

This can be a visitor put up by means of Nico Cooper. Reviews expressed are fully their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)