5 main South Korean exchanges introduced their intentions to delist Litecoin (LTC). The cryptocurrency just lately applied an replace to reinforce its privateness and scalability options.

Comparable Studying | Litecoin Reveals Rollout Date For MimbleWimble, Will LTC See Relief?

Because of this, Upbit, Bithumb, Korbit, Gopax, and Coinone will prevent providing to their shoppers. The replace has made Litecoin incompatible with South Korean laws.

Within the legitimate delisting announcement posted via Upbit, the platform claims the next buying and selling pairs will likely be unavailable once these days, June 8th: LTC/KRW, LTC/BTC, and LTC/USDT. The core explanation why at the back of this determination, the trade stated, is:

(…) it’s believed that the improve has been performed with a diffusion serve as that doesn’t disclose transaction knowledge.

The verdict is guided, the put up endured, via South Korea’s Particular Monetary Knowledge Act. This legislation calls for trade platforms to test a blockchain’s transaction for “transparency”.

In that method, Upbit and different South Korean exchanges can check that the person or the transaction doesn’t violate the rustic’s anti-money laundering laws. The rule of thumb could also be geared toward fighting dangerous actors to acquire finances by way of unlawful actions.

The South Korean exchanges declare the MimbleWimble replace will give you the Litecoin community with those functions:

(LTC) has room to peer the addition of era that makes those switch data unidentifiable, so we determined to designate it as a major problem. Up to now, there were no deposits made the use of the Mimblewimble serve as with Upbit, and we don’t plan to replicate deposits someday.

The MimbleWimble and Litecoin’s new privateness options appear to have an effect on South Korean exchanges. On the other hand, privateness cash had been outcasted from main buying and selling platforms during the last two years.

Monero (XMR), Zcash (ZEC), and others suffered from a equivalent determination taken via many exchanges internationally. The MimbleWimble may just unharness this risk for LTC.

Litecoin Unaffected By means of South Korean Exchanges’ Choice

On the time of writing, LTC’s worth turns out unaffected via fresh trends. The cryptocurrency continues to transport sideways and trades at $62.

Greater cryptocurrencies, akin to Bitcoin and Ethereum, proceed at the similar trail as they continue to be rangebound and not able to damage above native resistance. Simplest Cardano (ADA), because of a surge in community job, and Chainlink (LINK), because of its roadmap on staking, appear to be decoupling from the full marketplace.

Analysis company Santiment noted:

Crypto costs chopped wildly within the opening week of June, however the outcome has been basically no motion for Bitcoin and Ethereum. Altcoins, alternatively, have proven main decouplings from one some other, with ADA, LINK and HNT acting smartly.

Comparable Studying | Litecoin Drops 87% Trading Volume In Q1 2022

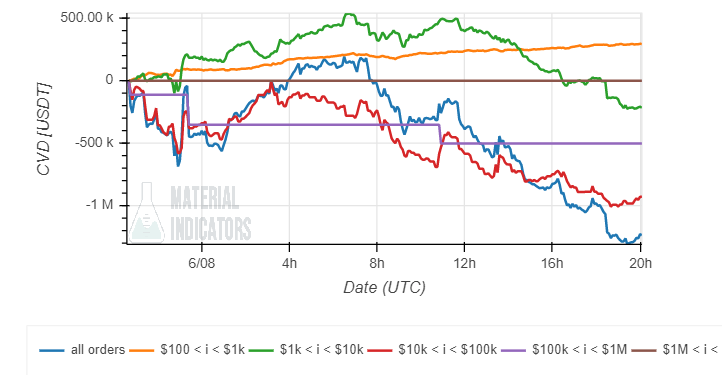

Further knowledge from subject matter signs, for low timeframes, data an build up in purchasing orders from retail buyers. Greater buyers appear to be promoting into the present worth motion, however it’s too early to inform if this pattern will maintain for the approaching days.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)