Be part of Our Telegram channel to remain updated on breaking information protection

Roughly a yr in the past, just a few crypto trade heavyweights made sassy debuts on the Tremendous Bowl advert lineup, airing expensive advertisements with slogans like “Don’t miss out” (FTX) and “Fortune favors the courageous” (Crypto.com).

Then the cryptocurrency market crashed and FTX filed for chapter.

At present, companies within the sector as a complete are using advertising and marketing and PR initiatives to guard their manufacturers, separate themselves from questionable gamers like FTX, and, in lots of instances, painting a friendlier face to each buyers and regulators.

As house owners of invaluable belongings, they’re confronted with an amazing discount in belief, in accordance with Tom Wason, international principal at Wolff Olins, a model technique firm that has labored with main cryptocurrency corporations. In accordance with him, companies within the house are trying to take care of their present ranges of progress—or survival—whereas reassuring each the federal government authorities beneath stress to regulate them and the crypto religious.

In accordance with Mr. Wason, their advertising and marketing should additionally advance in tandem. He likened the slew of Tremendous Bowl commercials from the earlier yr to the dot-com startup commercials from the 2000 Tremendous Bowl, “the place VC cash [was] being burned for recognition.”

Altering the technique

Commercial spending by cryptocurrency entrepreneurs has considerably decreased lengthy earlier than the FTX chapter in November. Corporations have been pressured to rethink their method consequently, they usually did so.

Buying and selling firm OKX lately deserted its plans to buy a Tremendous Bowl LVII commercial as FTX began to take over the information cycle. The corporate’s option to skip this month’s Tremendous Bowl was defined by Haider Rafique, the corporate’s international chief advertising and marketing officer, as “Shoppers are responding higher to steady campaigns that promote openness and belief.” Final week, Advert Age was the primary to interrupt the information about OKX’s alternative.

Nonetheless, in accordance with measurement firm iSpot.television, the top-spending corporations Coinbase World Inc. and eToro Group Ltd. elevated their expenditure on broadcast TV commercials to $2.8 million and $1.9 million, respectively, in December. Though the portions are decrease than they have been a yr in the past, they’ve elevated from tiny quantities within the latest previous.

To adapt to the setting, they modified their messaging.

Quickly after FTX filed for chapter, Coinbase responded with a “Belief us” full-page print commercial in The Wall Road Journal. Moreover, a brand-new tagline, “Ignore the noise. Maintain increasing,” it stated in a December commercial that emphasised reliability qualities (as a listed, routinely audited company) and straight countered the dangerous information cycle.

In accordance with Chief Advertising and marketing Officer Kate Rouch, Coinbase desires to reveal its religion in cryptocurrencies “whereas preserving our place as probably the most trusted model out there.”

One other cryptocurrency alternate, Bittrex World GmbH, repositioned itself in December with a marketing campaign that referred to as it “the world’s most safe regulated digital asset alternate” and ended with the brand new tagline, “Right here at present. Right here tomorrow.”

In accordance with Oliver Linch, CEO of Bittrex World,

one in every of individuals’s essential anxieties is that individuals who take part in cryptocurrencies are right here now, gone tomorrow, they usually could or could not have stolen your cash with them.

Now, he remarked, “it resonates extra true than ever.” Since a 2021 marketing campaign with the slogan “Don’t allow them to inform you what to commerce” that focused so-called meme inventory buyers, Bittrex World’s advertising and marketing has superior. He continued, “The corporate now locations a robust emphasis on reliability, and boring is just not a foul factor.”

The “Originality Is Overrated” marketing campaign from EToro, which additionally began airing in December, distinguishes the platform by using social media-like options and makes the case that crowdsourced insights should be invaluable to buyers.

All through this yr, EToro will proceed its advertising and marketing initiatives, in accordance with U.S. Chief Government Lule Demmissie. “We imagine that now could be the perfect time to behave. When issues are somewhat troublesome for individuals, you present up, she added.

Trying to forestall the unfold of contagion

A number of exchanges have pretended nothing has modified within the cryptocurrency world, implying that they continue to be aloof from the haze that has engulfed the trade.

The primary model marketing campaign for Binance Holdings Ltd. was unveiled in November, and Cristiano Ronaldo’s NFT assortment served because the marketing campaign’s centerpiece. Nonetheless, the marketing campaign was created earlier than FTX’s chapter submitting on November eleventh, in accordance with Binance.

In accordance with Chief Technique Officer Patrick Hillmann, future advertising and marketing would focus on the corporate’s merchandise slightly than separating Binance from FTX and different doubtful rivals or straight addressing the rising scrutiny of its personal enterprise.

To extend consciousness of its platform, which is at present unavailable in the US, OKX has continued to buy commercials on Twitter and TikTok and broadcast its preliminary “What Is OKX?” marketing campaign on CNBC streaming properties. The industrial, which additionally features a centaur, house invaders, a wrestler, and race autos, pays homage to crypto’s early hipster-fantasy sensibility. The corporate’s goal, in accordance with Mr. Rafique, is to focus on accountable investing with out particularly addressing the latest upheaval.

In latest weeks, many cryptocurrency gamers have additionally elevated their expenditure on lobbying and public relations, both by hiring new corporations or broadening the scope of their current corporations, in accordance with executives.

Decentralized finance-based companies, which permit customers to transact in belongings straight with each other on the blockchain versus using an middleman platform like FTX or Coinbase, are trying to ascertain themselves other than centralized alternate corporations.

Talking to media sources like Bloomberg Information in latest weeks, Chief Government Antonio Juliano of dYdX, a decentralized alternate that offers in a form of speculative crypto by-product often known as perpetuals, has tried to higher describe and promote so-called DeFi among the many wider enterprise world.

With the intention to head up its lobbying efforts and fend off the “attainable regulatory blowback” introduced on by FTX’s chapter, the corporate additionally employed Rashan A. Colbert, a former staffer to Sen. Cory Booker (D, N.J.), in December, as head of coverage, in accordance with Mr. Juliano.

He acknowledged:

I believe there was an amazing demand for that throughout your entire crypto sector, particularly after the FTX collapse.

C+Cost Presale

An thrilling mission value mentioning has already secured pre-sale funding of $800,000. C+Cost is cryptocurrency enterprise for electrical automobile charging.

The workforce has acknowledged at present that the construction of the presale pricing ladder, which sees the $CCHG token climb in worth over the course of the presale, is altering in response to the mission receiving loads of curiosity.There was 4 phases to the presale; now there can be eight, dividing the fundraising into extra manageable parts.

Presale phases

Stage 1 of the fundraising marketing campaign completed yesterday at $780,000 as an alternative of the $2 million that had been anticipated. Pre-sale for the mission is at present in Stage 2.

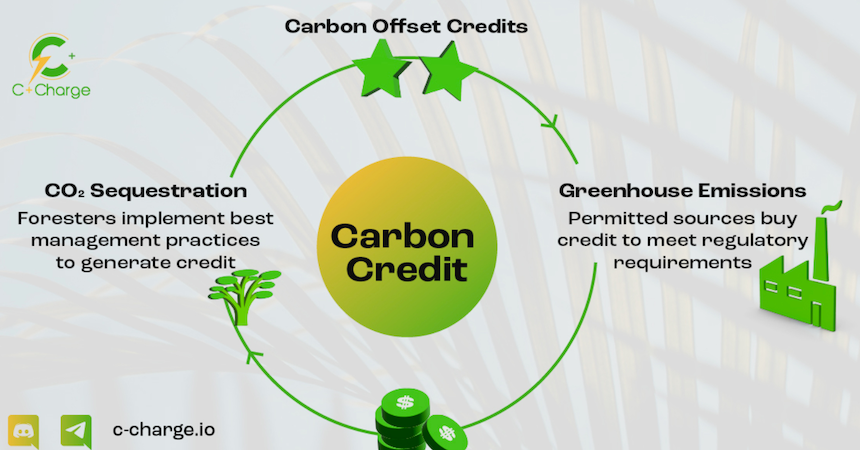

The popular inexperienced cryptocurrency mission is a peer-to-peer fee system that makes carbon credit out there to EV drivers and aids within the growth of the community of charging stations they depend on.

Demand for the coin is rising as extra buyers be taught in regards to the mission since C+Cost is the best reply on the proper time. To keep away from the primary of the seven worth will increase that may happen as every spherical of the presale is accomplished, potential purchasers of the CCHG token should act shortly.

The Stage 1 worth elevated by 11.5% in Stage 2, from $0.01300 to $0.01450. Stage 3 is now solely seven days away, on February 15, when the worth will climb by 10.3% to $0.0160.

By addressing these points, C+Cost concentrates on use instances which can be future-proof:

1. For the primary time, electrical automobile drivers will obtain carbon credit for recharging their batteries.

Isn’t it time that everybody had entry to carbon credit after they topped off their electrical vehicles? Sadly, that isn’t the case proper now. Earlier than the introduction of C+Cost, there was no platform that allowed EV drivers to earn carbon credit for every battery cost they made. C+Cost seeks to entice long-term buyers who’re dedicated to financing the success of this worthwhile use case that may assist the setting.

However, it is very important keep in mind that Stage 1 buyers would find yourself with a nominal revenue of 80%.

Moreover, once you pay for EV charging with the CCHG token, these tokens are later taken out of circulation, making a deflationary price-supportive mechanism.

2. Enhancing the fee course of throughout charging networks

There are numerous competing strategies of measuring funds these days. Drivers use the CCHG token to make funds with C+Cost as an alternative of putting in expensive Level of Sale (PoS) {hardware}. C+Cost replaces these with a single, simple-to-use common funds system.

As well as, EV house owners will have the ability to accumulate Goodness Native Tokens (GNT), a kind of carbon credit score, along with CCHG by means of its relationship with Flowcarbon. Invesco, a16z Crypto, Samsung Subsequent, and different enterprise capital corporations help the GNT token, which stands for a verified voluntary carbon credit score. One ton of greenhouse gases could be launched with one carbon credit score.

3. Benefits for taxing community house owners and managers

As beforehand indicated, blockchain expertise lowers the price of sustaining the stations by eliminating expensive PoS, however it may additionally ship correct real-time knowledge on every station’s standing and perform diagnostic actions.

With the intention to handle their fleet, C+Cost turns into an important software for, instance, municipalities or these offering residential neighborhood charging options.

It additionally offers EV house owners a method to precisely observe the presence of absolutely useful charging stations.

Moreover, because the platform is fully blockchain-powered, all an EV driver must work together with it’s an web connection and the C+Cost app.

4. C+Cost will increase the uptake of EVs and democratizes carbon credit.

Although EV gross sales have been rising, carbon credit aren’t being utilized as broadly as they need to be as a driving drive behind EV adoption. The best way that carbon credit are skewed in direction of giant enterprise to the detriment of others, together with EV drivers, is one other issue impeding the implementation of a enough and accessible charging infrastructure.

Even worse, huge companies incessantly make use of carbon credit as a polluting-related tax. This prevents them from having to implement low- or non-carbon emission options, permitting them to maintain producing carbon and different greenhouse gases.

Those that create or eat merchandise that allow using much less carbon are the winners within the current carbon credit score system, whereas EV drivers are unfairly excluded.

Promoting carbon credit to polluters can herald tens of millions of {dollars} for EV producers like Tesla.

The purpose of C+Cost is to democratize carbon credit in order that EV house owners who’re making an attempt to do the best factor however aren’t getting the advantages they’re due a bigger portion of the carbon credit score income, which was estimated to be $851 billion in 2022.

By 2027, the carbon credit score market can be value $2.4 trillion, making it extraordinarily worthwhile to permit EV autos entry.

Associated

Combat Out (FGHT) – Transfer to Earn within the Metaverse

- CertiK audited & CoinSniper KYC Verified

- Early Stage Presale Reside Now

- Earn Free Crypto & Meet Health Targets

- LBank Labs Venture

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Be part of Our Telegram channel to remain updated on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)