In occasions of concern of a WWIII, inflation, recession and effort scarcity lots of the funding tools undergo really extensive losses. Shares, gold and most commonly cryptocurrencies are a great deal suffering from the difficult surroundings all over the world.

With Ether down roughly 64% year-to-date, adopted via Bitcoin down roughly 58% year-to-date, BestBrokers analyst group determined to seem into blockchain transaction knowledge and learn the way this drop impacts crypto customers in reality.

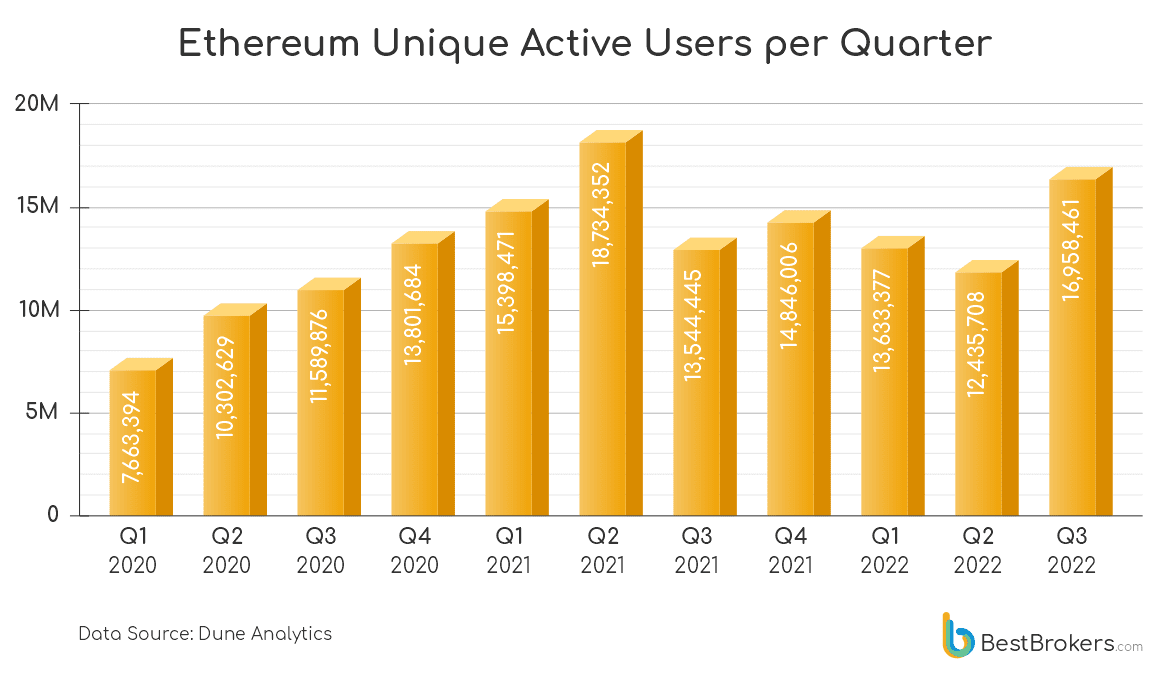

The uncooked knowledge, queried from Dune Analytics obviously presentations a really perfect build up in passion in Ether because the selection of energetic Ethereum customers rose over 36% in Q3 2022, in comparison to Q2. In fact, that is the primary certain quarter since This autumn 2021 when Ether’s worth rose to a document all time top of simply over $4,890.

|

Alan Goldberg, analyst at BestBrokers feedback:

“The Ethereum 2.zero replace went reside simply 3 weeks in the past. It indisputably introduced extra passion within the Ethereum community nevertheless it can’t justify the sort of nice upward push. Different components need to be taken into consideration, together with the truth that other folks in reality in finding cryptocurrencies as an funding choice and the document lows of Q3 2022 appeared like a discount to a large number of particular person buyers.”

The long-awaited Ethereum 2.zero replace undeniably had a favorable have an effect on on Еthereum person rely. Alternatively, it used to be finished so overdue in Q3 2022 that it’s no doubt no longer the one reason why for the uptrend. The expectancy and the scoop in mid July, confirming the general replace date no doubt contributed to the inreased industry, however we additionally need to have in mind the truth that Ether worth dropped under the $900 mark in overdue Q2 2022 and that low worth should have appeared like a discount cut price to positive buyers. Since then the fee went stable up with a couple of occasions touching the $1,000 resistance however remodeled 100% upward push to only over $2,000 in August 2022.

Regardless of the present worth sitting at round $1,360 or by hook or by crook round 33% less than the August heights, Ether had nice worth swings, conventional to lots of the cryptocurrencies. In the end, the fee volatility and top quantity are a number of the components which power investor passion into the crypto markets and that’s precisely what Ethereum delivered in Q3, obviously appearing that the markets have attainable to get again on a favorable pattern.

Alan additionally provides that the 36% build up within the energetic customers inside of simply three months might be interpreted as an indication that the crypto markets are getting again at the certain pattern. He says, ”The truth that the selection of energetic customers is over 14% upper than This autumn 2021, when each Bitcoin and Ether costs have been at an all time top, most effective reinforces crypto analysts’ expectancies that the markets have a really perfect attainable to upward push once more.”

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)