The Federal Reserve has an upcoming FOMC assembly in Might, during which many of us be expecting them to lift rates of interest for the second one time this yr.

The Federal Reserve has an upcoming FOMC assembly in Might, during which many of us be expecting them to lift rates of interest for the second one time this yr.

Pay attention To The Episode Right here:

On this episode of the “Fed Watch” podcast, I give a large replace on central financial institution comparable information from world wide. It’s been a number of weeks since we’ve executed a down and grimy replace on subject matter from the financial international, so there’s a lot to hide. Pay attention to the episode for my whole protection. Under, I summarize Federal Reserve comparable headlines and their upcoming Federal Open Marketplace Committee (FOMC) assembly, shopper value index (CPI) and inflation expectancies, Europe and the Eu Central Financial institution’s predicament and finally, China’s terrible financial problems.

“Fed Watch” is a podcast for other folks taken with central financial institution present occasions and the way Bitcoin will combine or exchange facets of the growing older monetary gadget. To know how bitcoin will change into international cash, we will have to first perceive what’s taking place now.

Federal Reserve Calendar

Monetary headlines were awash with Federal Reserve presidents and governors looking to outdo every different of their requires price hikes. The most recent is from President James Bullard of the St. Louis Fed, calling for a 75 foundation issues (bps) hike and as much as 3.75% at the Fed price range price by way of the tip of the yr!

Federal Reserve Chair Jerome Powell is talking in entrance of the Volcker Alliance assembly by the use of pre-recorded remarks and gave the impression reside to talk to the IMF on April 21, 2022. (I were given the occasions combined up within the podcast.) I be expecting dialogue of the worldwide CPI state of affairs when it comes to other international locations’ financial insurance policies. We will have to have got some perception into Powell’s view of the present international financial system in those remarks, greater than the everyday, “The financial system is increasing at a reasonable tempo” vanilla feedback we in most cases get on the FOMC press meetings.

The much-anticipated subsequent FOMC assembly is scheduled for Might 3 – 4, 2022. The marketplace is pronouncing {that a} 50 bps hike is most likely, so the rest lower than that may be a dovish wonder. Up up to now, the Fed has simplest raised charges as soon as by way of 25 bps, but the onslaught of requires fast and massive price hikes has made it appear as despite the fact that they have got already executed extra.

The Fed’s primary coverage software is ahead steerage. They would like the marketplace to consider that the Fed goes to hike such a lot they smash one thing. In that method, the Fed economists consider they’re going to tampen inflation expectancies resulting in decrease precise inflation. Subsequently, these kinds of outrageous calls for very prime Fed price range price by way of the tip of the yr are supposed to mildew your expectancies, now not precise prescriptions for financial coverage.

CPI, Inflation Expectancies And Yield Curve

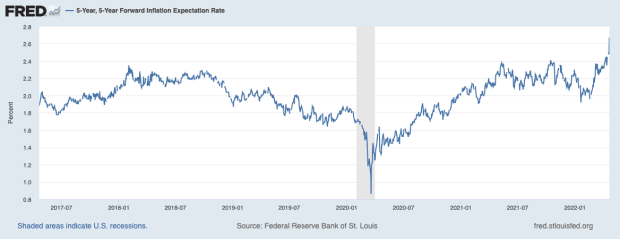

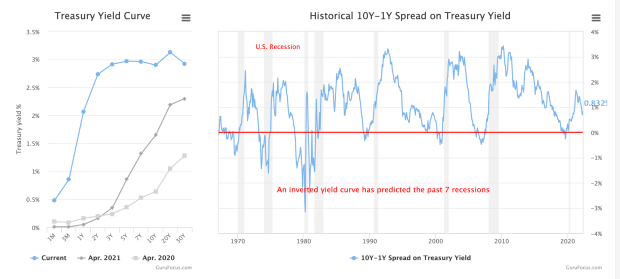

The following section of the podcast is all about inflation expectancies. Under are the charts I am going over with some simplified statement.

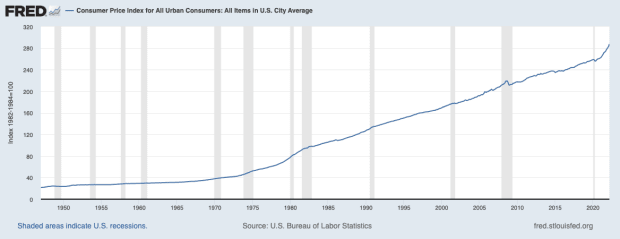

Above, we see the CPI year-over-year. The newest quantity is 8.55%, then again in April we’re getting into the year-over-year house of the acceleration of CPI ultimate yr. April 2021’s CPI jumped from 2.6% that March to 4.1%. That suggests we will be able to wish to see equivalent acceleration in costs between this March and April, which I don’t suppose we will be able to get.

And the remainder of the inflation expectation metrics underneath don’t agree CPI will proceed to irritate (for the U.S.).

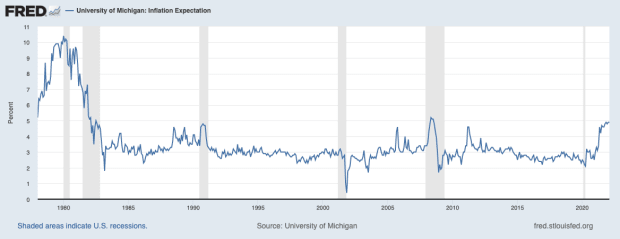

The College of Michigan Client CPI expectancies have successfully been capped underneath 5%, and as we method recession that are meant to transfer downward temporarily, placating Fed economists, I’d like so as to add.

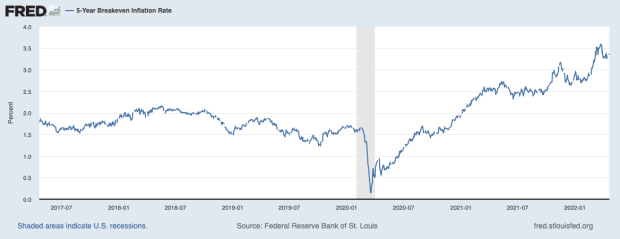

The 5-year breakeven is relatively increased from historic norms at 3.3%, however this can be a great distance from confirming the 8% of the CPI.

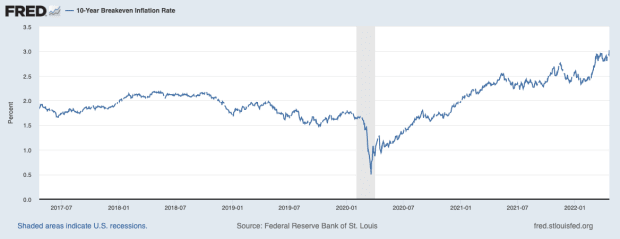

Similar with the 10-year breakeven. It’s even much less increased from historic norms, coming in at 2.9%, a long way from the 8% CPI.

Probably the most highest-regarded inflation expectancies measures is the 5-year, 5-year ahead. It’s nonetheless underneath its historic norm, coming in at 2.48%.

All of those measures accept as true with every different in being a long way underneath the 8% CPI, added to the flat yield curve with some inversions proven underneath, and the shakiness of the financial system leads me to be expecting an orderly go back of CPI to its historic norm within the 1-3% vary.

Transitory has change into a meme at this level, however we will be able to see that it has simplest been a yr of increased CPI readings and there are indicators of top CPI already. Transitory merely intended that this used to be now not a multi-decade pattern trade for inflation, this can be a transient duration of upper than moderate ranges. Each and every different metric but even so CPI is telling us simply that.

Europe And The Eu Central Financial institution

On this podcast, I additionally duvet the deteriorating state of affairs for Europe and the euro. The Eu Central Financial institution (ECB) just lately introduced that they might be preventing asset purchases in Q3 of this yr to get a deal with on inflation. Europe’s CPI has are available in at 7.5%, nonetheless underneath the U.S. Alternatively, their financial state of affairs is far worse than the U.S.

Europe is in the course of many alternative crises immediately, an power disaster, a debt disaster, a deglobalization disaster, in all probability a meals disaster and a demographic disaster. All of that whilst the ECB is easing. What occurs when they are trying to tighten? Not anything just right.

For those causes I be expecting the euro to drop considerably towards the greenback and different currencies. Under you to find a number of charts I discuss at the podcast for the audio listeners.

China’s Rising Issues

The Other people’s Financial institution of China (PBOC) has decreased the reserve requirement ratio (RRR) as soon as once more, efficient April 25, 2022. On this section, I learn via an article by FXStreet and make statement alongside the best way.

Contemporary traits in China simplest reinforce the case I’ve been making for years, that China is a paper tiger constructed on credit score this is going to cave in in a horrifying model.

The Chinese language have now not been ready to gradual the true property cave in or the unfold of COVID-19. They disastrously resorted once more to lockdown in Shanghai and different towns, which is able to simplest serve to cripple their financial system extra. They can’t force call for for loans or for lending on this surroundings, therefore the a couple of makes an attempt to spur lending by way of decreasing RRR.

What the PBOC will perhaps flip to subsequent is mandating loans be made. They’re determined to extend credit score and stay the bubble from collapsing totally. That is harking back to Japan within the 1990s, after they mandated loans to be made in a equivalent try to stimulate the financial system. It didn’t paintings for Japan and it gained’t paintings for China. At very best China is taking a look at a repeat of the misplaced a long time in Japan.

That does it for this week. Because of the readers and listeners. For those who experience this content material please SUBSCRIBE, and REVIEW on iTunes, and SHARE!

Hyperlinks

It is a visitor publish by way of Ansel Lindner. Reviews expressed are totally their very own and don’t essentially mirror the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)