Be a part of Our Telegram channel to remain updated on breaking information protection

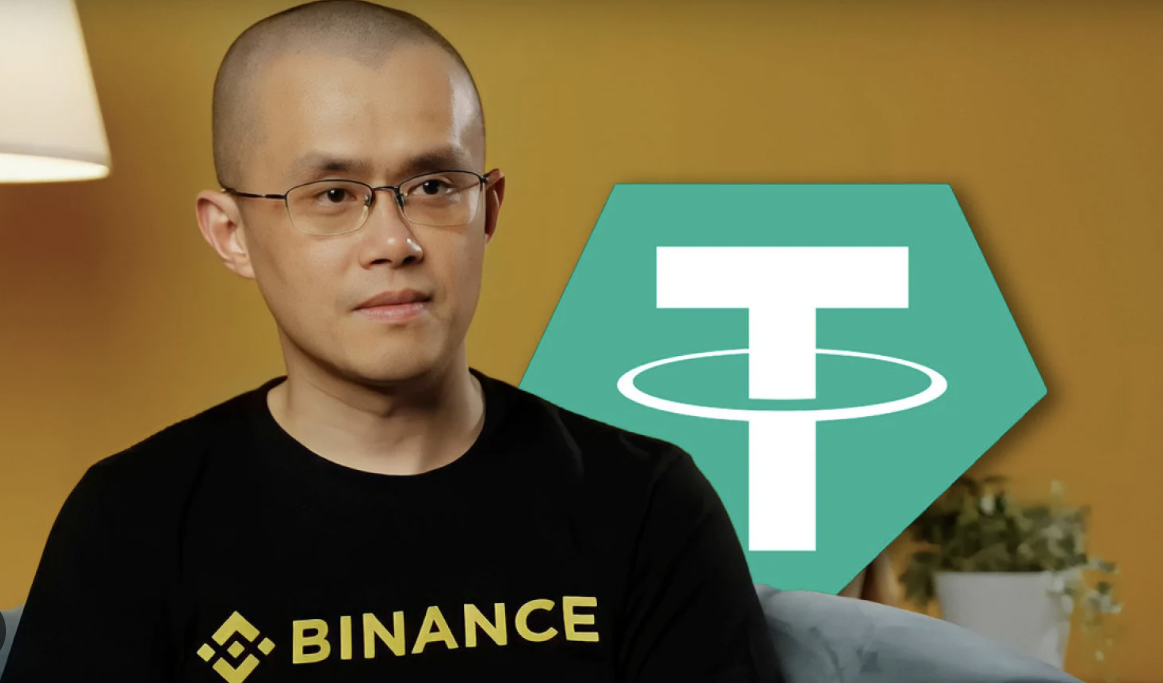

Binance CEO Changpeng Zhao criticized Tether USDT for a scarcity of transparency, likened it to ”a block field,” and mentioned his agency goals to introduce smaller algorithmic stablecoins to offer buyers alternate options.

Tether USDT, the biggest stablecoin within the digital asset business by market capitalization, is paired with many cryptocurrencies to allow conversions to {dollars}. Although it’s backed by reserves held by its mother or father agency, iFinex, and is pegged 1:1 to the U.S. greenback, Zhao mentioned it has dangers.

“I personally haven’t seen any audit experiences of USDT,” he mentioned in an Ask Me Something session on Twitter. “I don’t suppose most individuals I spoke to haven’t seen that both. So it’s form of a black field as a result of we simply don’t know.”

Within the newest AMA, CZ revealed that:

– Along with FDUSD, Binance will announce the companion of one other USD stablecoin.

– Binance has a small staff attempting algorithmic stablecoin

– He criticized that not enought audit experiences of USDT, USDT a bit like black field

– Binance will…— Wu Blockchain (@WuBlockchain) July 31, 2023

Binance Warns of Hazards

As a result of neither he or his colleagues had seen USDT audits, Binance began issuing Binance USD earlier than the SEC shut it down. However he warned that even well-governed and totally examined stablecoins have their very own distinctive set of unanticipated hazards.

He referred to the collapse of TerraUSD, which he described as “poorly designed, poorly executed, and poorly maintained.”

Binance plans to diversify its listing of stablecoins in a bid to cut back dangers. It is usually working by itself algorithmic stablecoins so as to add to the listing of choices.

“We even have a small staff engaged on algo stablecoins elsewhere that aren’t excessive scale, however they’re very related regionally in these locations,” he mentioned. “So our method is, you realize, given every thing has some threat, let’s simply diversify and see which one grows greater.”

Binance listed a brand new stablecoin referred to as First Digital USD (FDUSD) on July 26 and Zhao talked about that one other stablecoin based mostly on the greenback will be added quickly. FDUSD is a programmable stablecoin that’s pegged to the greenback and is issued by First Digital, a Hong Kong-licensed firm.

We at First Digital are each excited and delighted on the assist we have recieved to this point with this initiative. Thanks @cz_binance for the nod!! #stablecoin #innovation https://t.co/o61PXj0mad

— First Digital (@FirstDigitalHQ) June 1, 2023

The trade can be trying to listing one other stablecoin pegged to the greenback, Zhao mentioned.

Tether’s transparency has drawn criticism earlier than. In 2021, its mother or father agency was hit with substantial fines totaling as much as $60 million for allegedly mismanaging and misrepresenting its reserves.

Tether Says Transparency Not a ‘Buzzword’

Tether, the corporate behind USDT, on Monday launched an attestation report from BDO, an unbiased accounting agency, that confirmed an $850 million rise in extra reserves, which now whole $3.3 billion.

The agency mentioned that “Tether’s reserves stay extraordinarily liquid, with 85% of its investments held in money and money equivalents.”

Tether claims that its stablecoins are backed by U.S. Treasury notes price round $72.5 billion. The corporate additionally reported operational earnings of almost $1 billion, a 30% enhance over the earlier quarter, and a $115 million share buyback.

“Transparency isn’t just a buzzword for us, it’s the cornerstone of our philosophy,” mentioned CTO Paolo Ardoino. “We consider that open communication and powerful financials foster belief and reliability, and that is what the worldwide group deserves particularly in a yr devastated by many failures throughout the banking and crypto business.”

Associated Articles:

Wall Avenue Memes – Subsequent Huge Crypto

- Early Entry Presale Dwell Now

- Established Group of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Finest Crypto to Purchase Now In Meme Coin Sector

- Group Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)