CryptoCompare’s newest per month file presentations that Binance captured just about one-third of the whole quantity traded on crypto spot platforms in March 2022.

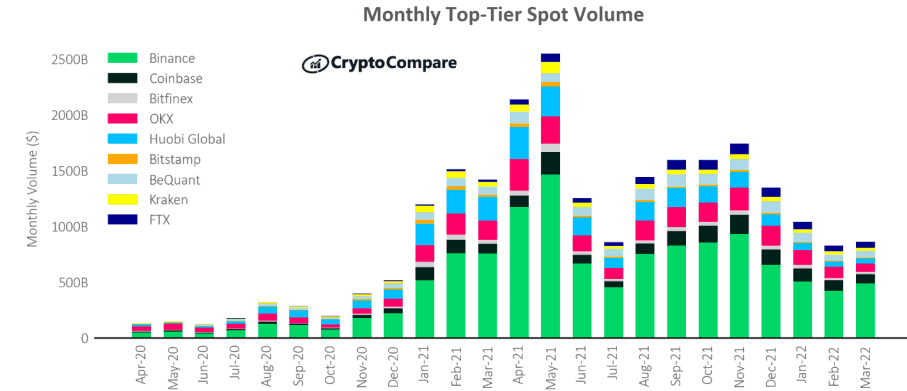

Consistent with a contemporary file from international crypto marketplace real-time knowledge supplier CryptoCompare, the whole spot marketplace rose by way of 10.5% in March, with transaction volumes achieving $1.6 trillion.

The file additional published that roughly 69.9% of the whole quantity was once collected by way of 15 of the arena’s biggest crypto exchanges, together with Binance, Coinbase, Bitfinex, OKX, Huobi, FTX, and Kraken.

Binance Dominates the Crypto Spot Marketplace

Binance by myself captured 30.2% of the whole spot marketplace volumes, processing about $490 billion in spot transactions, a 15% building up from February volumes. Whilst this determine is marginally underneath the change’s file marketplace percentage of 33.7% in November 2021, Binance nonetheless controlled to dominate the crypto spot marketplace.

Binance was once intently adopted by way of Coinbase and OKX, amassing a place marketplace percentage of five% and four.7%, respectively. Coinbase treated $81.Nine billion value of spot transactions, down 12% from its worth the month prior, and OKX with $75.Nine billion, down by way of 26%.

King of Crypto Derivatives

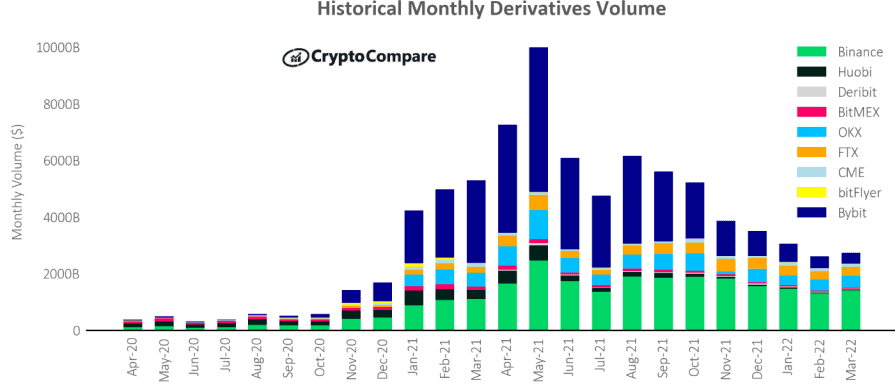

After six consecutive months of diminished volumes, the derivatives marketplace witnessed higher job, and its volumes noticed a big spike in March.

Consistent with the CryptoCompare file, derivatives volumes rose by way of 4.58% to $2.74 trillion, accounting for 62.8% of the whole centralized change volumes, whilst spot volumes accounted for the remainder 37.2%.

Regardless of being spectacular for the six months of diminished job, the March derivatives marketplace volumes are nonetheless considerably not up to the all time highs (ATH) reached in Would possibly 2021. Derivatives volumes reached a whopping $9.99 trillion all the way through the Would possibly 2021 bull marketplace, reaching a marketplace percentage of 68%.

CoinCompare famous that the derivatives marketplace is recording greater transaction volumes than spot as a result of buyers are wary of the dangers related to spot buying and selling.

“Marketplace members stay wary and proceed to get crypto publicity via derivatives to hedge and speculate in opposition to spot markets.”

Crypto derivatives are secondary contracts that mimic the cost of their underlying property. Maximum buyers like to take derivatives contracts because it permits them to diversify their publicity to other cryptocurrencies and safeguard them from excessive value volatility.

According to the file, Binance emerged as the biggest derivatives change in March, main the marketplace with about 52% of general derivatives volumes. The change treated over $1.Four trillion in derivatives transactions in March, an building up of 8.3% from its February quantity.

It was once additionally intently adopted by way of OKX with $446 billion quantity (up 12.5%), Bybit with $380 (down 8.8%), and FTX with $295 billion (up 2.07%).

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)