David Puell, an on-chain researcher at Ark Make investments, immediately shared his insights in an in depth report, providing a nuanced perspective on Bitcoin’s present standing and future prospects. The report, titled “The Bitcoin Month-to-month: July 2023,” addresses a number of key subjects which are central to understanding the present state of Bitcoin.

These subjects embrace a complete market abstract, an evaluation of Bitcoin’s low volatility and whether or not it signifies a possible breakdown or breakout, in addition to a dialogue on the affect of the Federal Reserve’s tightening coverage as a number one indicator of worth deflation.

Ark Make investments’s Close to-Time period Bitcoin Worth Prediction

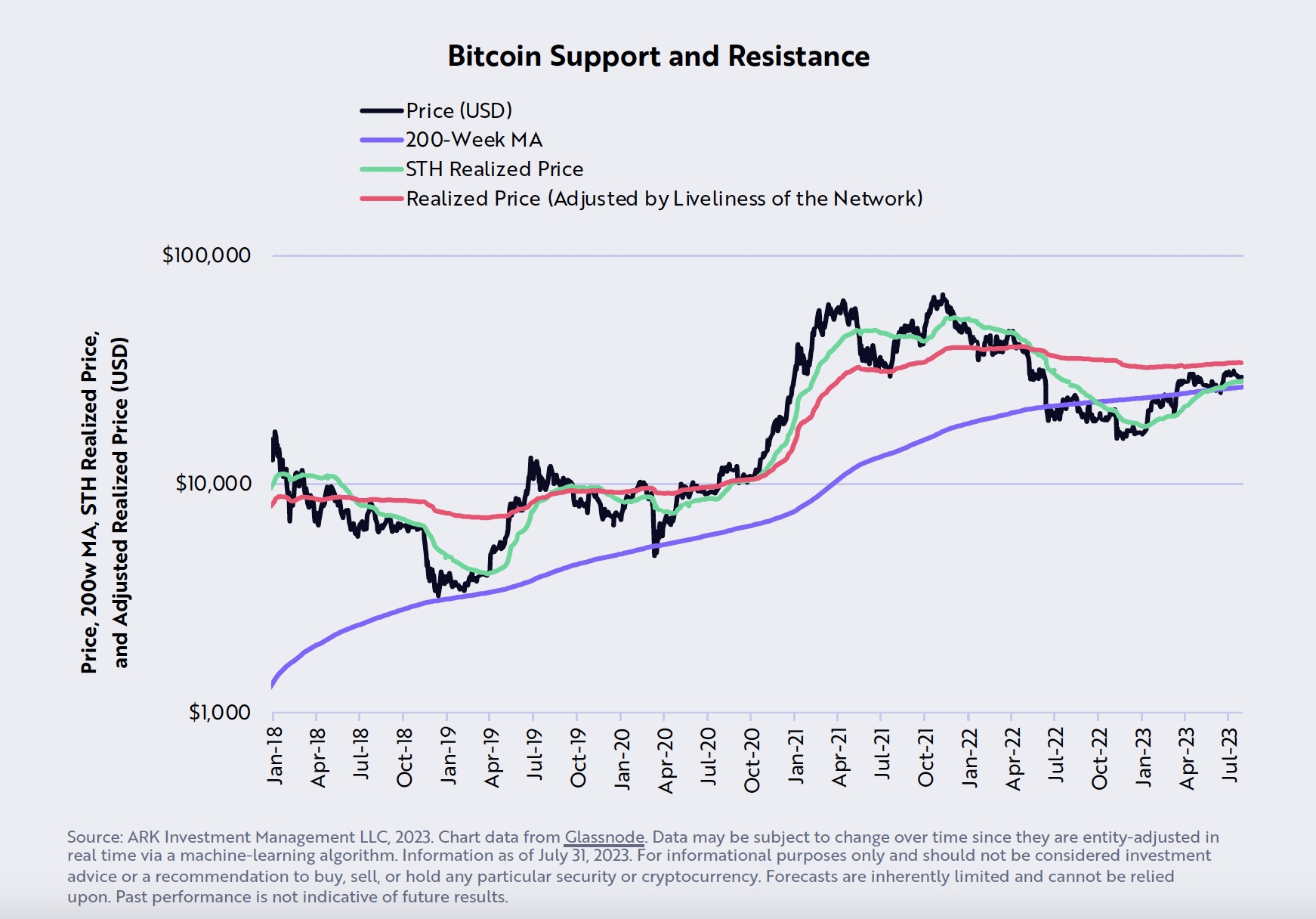

Puell’s evaluation reveals a combined, however primarily bullish outlook for Bitcoin, with the cryptocurrency ending July at $29,230, above its 200-week shifting common and its short-term-holder (STH) value foundation of $28,328. This implies a robust help degree for Bitcoin, indicating a possible upward pattern, notes Puell.

Nevertheless, Bitcoin’s 90-day volatility, which dropped to 36% in July, a degree not seen since January 2017, presents a impartial outlook. Puell explains, “Primarily based on its low degree of volatility, we imagine the Bitcoin worth might be setting as much as transfer dramatically in a single route or the opposite in the course of the subsequent few months.” This might imply a big worth motion, however the route – up or down – is unsure.

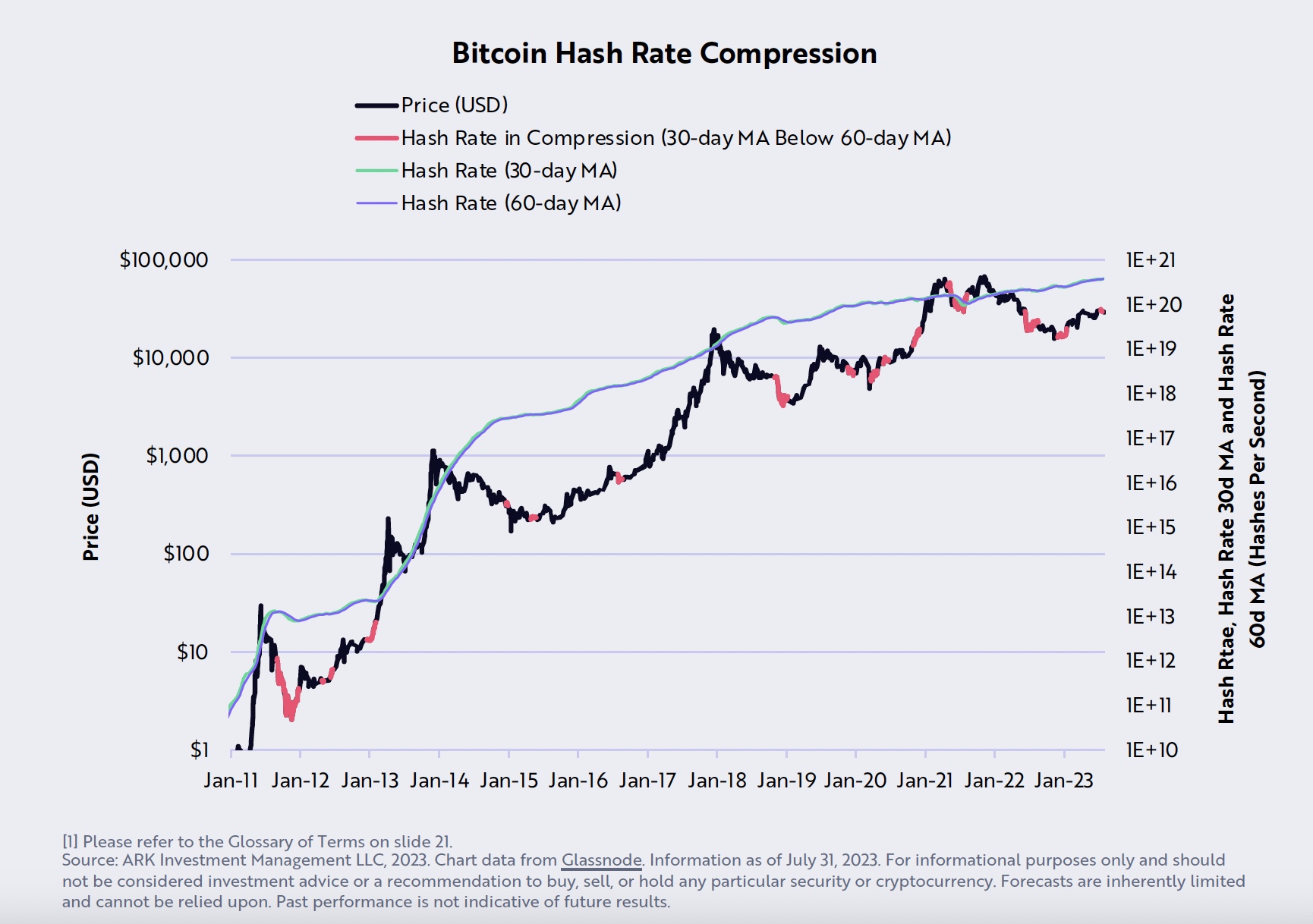

Puell additionally factors to indicators of miner capitulation as a bullish indicator. “Throughout July, the 30-day shifting common of Bitcoin’s hash price dropped beneath its 60-day shifting common, suggesting that miner exercise had capitulated,” he states. Miner capitulation is usually related to oversold circumstances in BTC worth, hinting at a possible bullish reversal.

The “liveliness” metric, which measures potential promoting stress relative to present holding conduct, additionally suggests a bullish pattern. The analyst notes, “In July, liveliness dropped beneath 60%, suggesting the strongest long-term holding conduct because the final quarter of 2020.” This means that extra holders are preserving their cash relatively than promoting them, which may drive the value up.

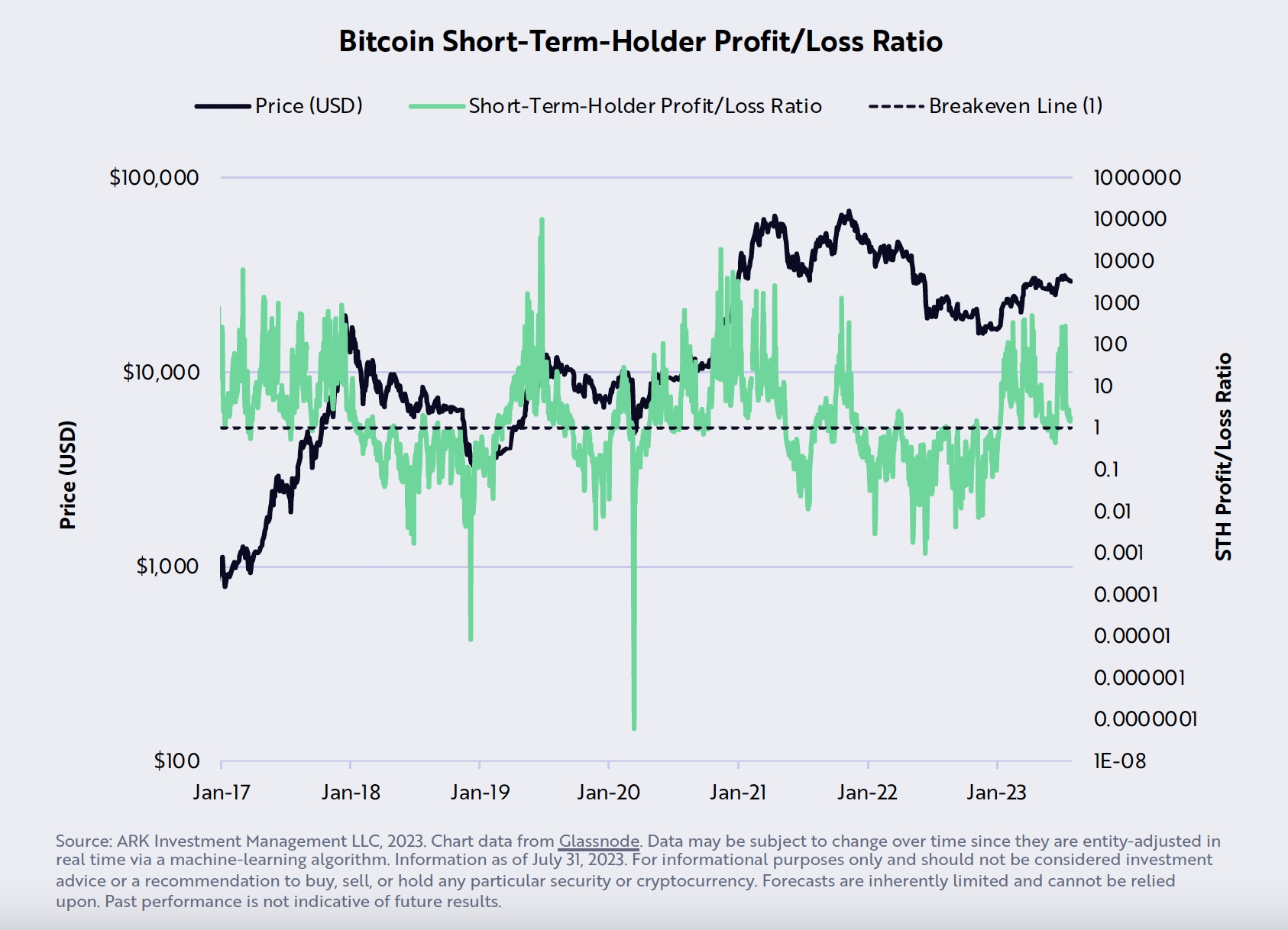

ARK’s personal short-term-holder revenue/loss ratio, which ended July at ~1, can be seen as a bullish signal. Puell explains, “This breakeven degree correlates each with native bottoms throughout major bull markets and with native tops throughout bear market environments.”

Nevertheless, the way forward for Binance’s BNB token, which is dealing with elevated regulatory stress, appears to be like bearish in response to Puell. He warns, “As regulatory stress will increase on crypto alternate Binance, its native token, BNB, might be on the edge of great turbulence.” If BNB breaks down, it may probably affect the general stability of the crypto market, together with BTC.

Macro Outlook

On the macroeconomic entrance, Puell discusses the potential affect of the Fed’s 22-fold enhance in rates of interest, which he views as bearish for Bitcoin and the broader financial system. He states, “In keeping with famend economist Milton Friedman, financial coverage works with ‘lengthy and variable lags’ that final 12-18 months, suggesting that the complete affect of the Fed’s 22-fold enhance in rates of interest has but to hit.”

The Zillow Hire Index, which leads the House owners’ Equal Hire (OER) by roughly 9 months, means that Shopper Worth Index (CPI) inflation may decelerate considerably beneath 2% by year-end. Puell views this as a bullish signal for Bitcoin, because it may probably enhance the attractiveness of non-inflationary belongings like Bitcoin.

Lastly, Ark Make investments takes a impartial stance on the falling US import costs from China, regardless of the yuan’s depreciation by ~12% since February 2022. He notes, “All else equal, China exporters ought to have elevated costs to offset the depreciation of the yuan. As an alternative, they’ve reduce costs, harming their profitability.”

In conclusion, Puell’s report presents a fancy image for Bitcoin. Whereas there are a number of indicators for a possible bullish pattern, there are additionally vital dangers and uncertainties that might result in bearish outcomes.

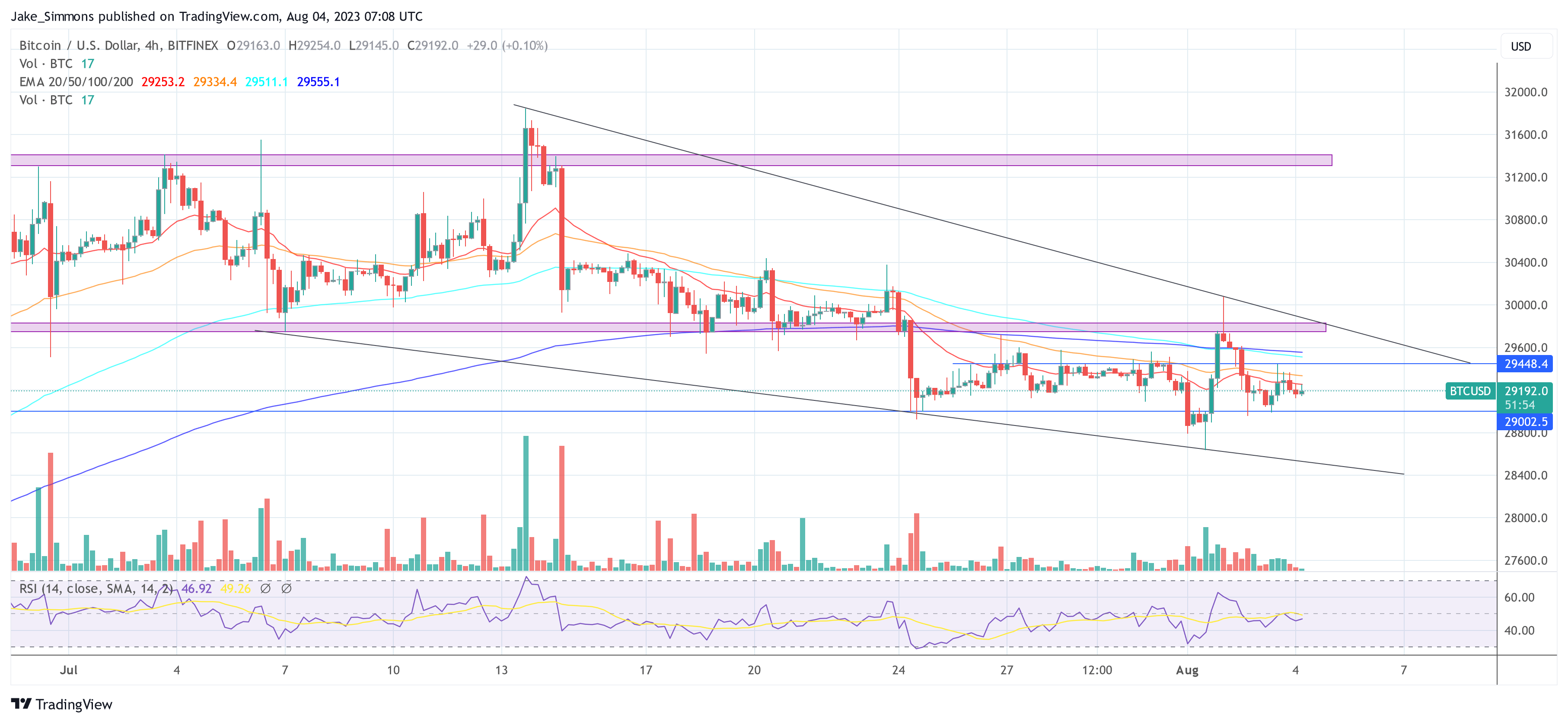

At press time, the BTC worth was at $29.152. Probably the most essential resistance in the meanwhile lies at $29.450. If BTC can overcome this resistance, a breakout from the multi-week downtrend is likely to be doable.

Featured picture from Kanchanara / Unsplash, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)