Bitcoin (BTC) has been no stranger to dramatic worth swings within the risky cryptocurrency world. As September approaches, market analysts intently monitor BTC’s risk of plunging beneath the $25,000 mark.

Nevertheless, historical past has proven that September’s struggles typically pave the best way for a resurgence in October, with huge rallies that rekindle investor optimism.

Potential For BTC To Drop Beneath $25,000 Earlier than A Promising October

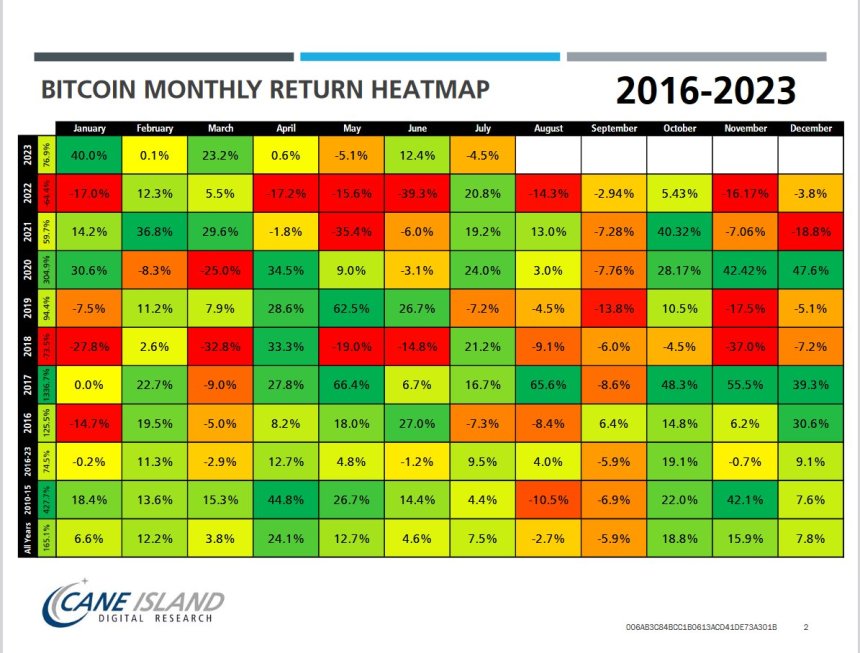

When inspecting Bitcoin’s historic efficiency throughout September, it turns into evident that the month has posed challenges for the world’s most famous cryptocurrency.

Earlier September has witnessed BTC experiencing declines of as much as 13%. This downward pattern has undoubtedly involved merchants and buyers, elevating questions concerning the sustainability of Bitcoin’s bullish momentum.

In accordance to Timothy Peterson, market analyst and funding Supervisor, primarily based on present market evaluation, there’s a 50% likelihood that Bitcoin’s worth will dip beneath the $25,000 threshold earlier than September concludes.

Whereas a possible drop beneath $25,000 would possibly trigger non permanent unease amongst Bitcoin lovers, historic patterns recommend that October might be the month to stay up for.

Up to now, September’s worth declines have typically catalyzed vital rallies within the subsequent month. Observing the heatmap above, Peterson recognized cases the place Bitcoin rebounded with features as excessive as 48% following sharp declines in September.

If Bitcoin does certainly expertise a dip beneath $25,000 in September, it could mark the ultimate vital correction earlier than the graduation of a brand new bull run cycle.

On this observe, Peterson believes that such a dip, coupled with the following restoration and October’s potential rally, may set the stage for substantial features within the coming months.

Bitcoin Bullish Divergence

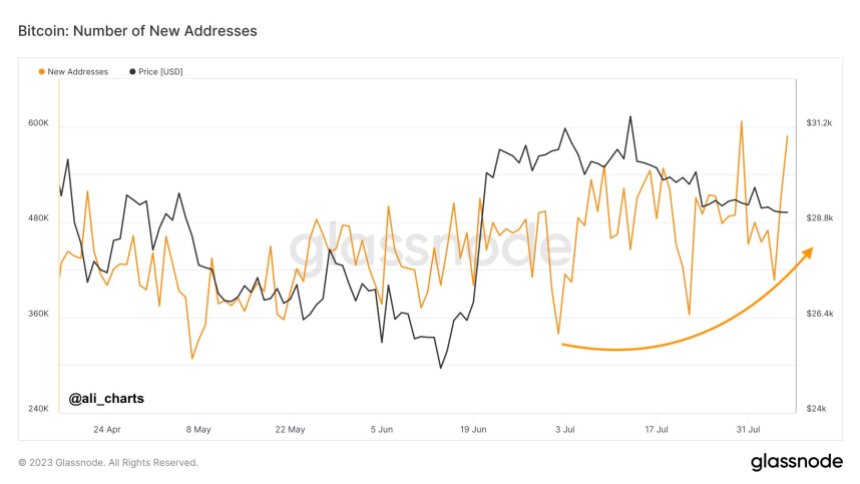

As BTC skilled a drop from $32,000 to $29,000, dealer Ali Martinez highlighted a big pattern; the variety of new Bitcoin addresses continued to rise steadily.

This intriguing divergence between worth and community development gives insights into BTC’s probably steady long-term uptrend.

Whereas Bitcoin’s worth exhibited a downward trajectory, the variety of newly created Bitcoin addresses has persistently grown.

This divergence is noteworthy, suggesting that regardless of short-term worth fluctuations, the community’s growth stays sturdy. It signifies a rising curiosity in Bitcoin adoption and utilization, which, in flip, helps the notion of a steady and sustainable long-term uptrend.

Conversely, Bitcoin stays trapped inside a worth vary of $29,200 and $28,900, a sample that has persevered because the begin of August. As of the time of writing, BTC is buying and selling at $28,960, reflecting a 0.5% lower within the final 24 hours.

Featured picture from iStock, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)