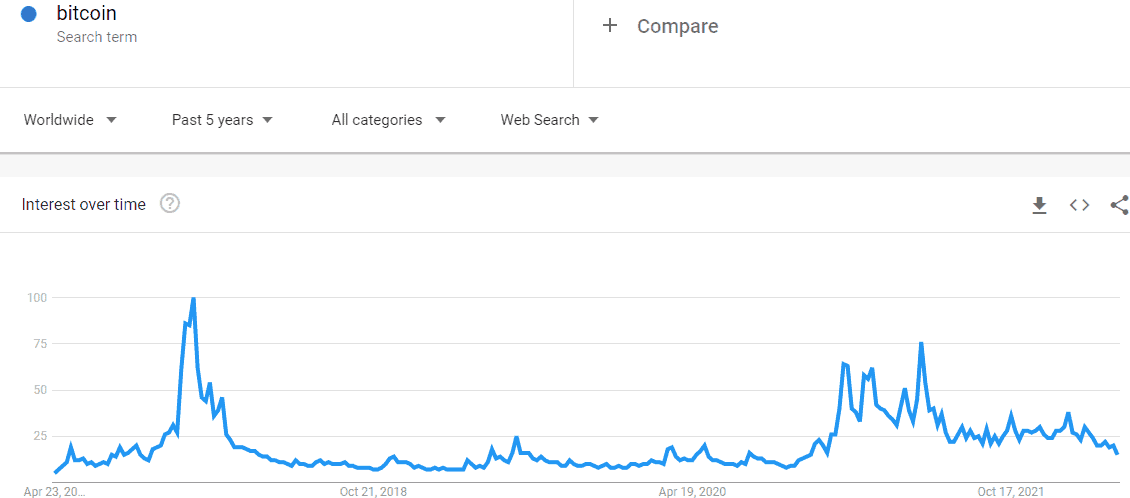

Retail passion in bitcoin appears to be fading because the Google searches plummeted to lows now not noticed in over a 12 months.

Consistent with the loss of huge worth actions from bitcoin, the choice of Google searches for the asset have declined to the bottom ranges since overdue 2020.

One after the other, the preferred Bitcoin Concern and Greed index has settled in a “concern” territory regardless of BTC’s two-day restoration after the sub-$40,000 dip.

Loss of Retail Passion

CryptoPotato reported the day prior to this the hot spike in whale job in opposition to the principle cryptocurrency. On the other hand, it sort of feels that the call for from retail traders has declined prior to now a number of months, no less than in line with knowledge from Google Traits.

The choice of queries at the international’s greatest seek engine most often displays the conduct of smaller traders, which generally tend to reach on the scene amid essentially the most really extensive bull runs. This used to be the case again in overdue 2017 when BTC spiked to its then-ATH at kind of $20,000.

Because the asset went right into a year-long endure marketplace, the searches disappeared. One thing an identical transpired all over ultimate 12 months’s worth will increase when BTC went on a tear in April and later in November, in the long run peaking at $69,000.

On the other hand, the cryptocurrency began retracing as soon as once more, resulting in a near-50% decline in about part a 12 months. Moderately expectedly, Google Traits knowledge now displays that the “Bitcoin” searches have plummeted and feature declined to lows ultimate noticed in December 2020.

Concern Is Again Amongst Bitcoin Traders

The Bitcoin Fear and Greed Index estimates the overall sentiment throughout the cryptocurrency neighborhood by means of analyzing quite a lot of components, reminiscent of worth volatility, surveys, BTC dominance, buying and selling quantity, social media interactions, and so on.

Its ultimate effects are displayed on a 0-100 foundation, the place 0 represents “excessive concern” and 100 is “excessive greed.”

Again in overdue March, when BTC used to be marching on in opposition to the $50,000 mark, the metric went into extreme greed for the primary time since November. On the other hand, as BTC began to chill off or even dumped under $40,000 in April, the Index went right down to excessive concern (the day prior to this).

Lately, it displays simply concern, as bitcoin controlled to get better the Monday retracement or even touched the January 2021 ATH of $42,000.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)