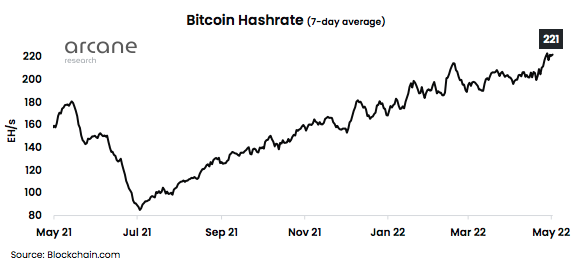

As Bitcoin jumped to $40okay within the day following Federal Reserve’s carry hike by way of part some degree, any other quantity on the upward push is its hash charge, which hit an all-time prime of 221 EH/s.

Bitcoin, Hash Price, And Value

The Hash Price is the Bitcoin community’s measuring unit of the computational energy and pace used to hold at the mathematical operations that ascertain and procedure transactions at the blockchain. Because of this, the Hash Price can mirror the worldwide task of bitcoin mining, expanding or reducing aspect by way of aspect.

The cost of Bitcoin and the measure of the Hash Price are believed to be similar. The upper the Hash Price, the more healthy and extra safe the community is, and this may end up in an building up in worth. Then again, this isn’t a ensure as a result of macroeconomic uncertainty is a very powerful issue that might dominate the way forward for its buying and selling price.

Additionally, many miners allege that the worth of Bitcoin has an have an effect on at the Hash Price and now not the wrong way round because the miners paintings across the community –becoming a member of or now not– relying at the second’s profitability.

Hash Price And Problem Going Up At The Similar Time

Only one week in the past, Bitcoin issue hit an all-time prime of 29.79 trillion after achieving block top 733,824. As the newest Arcane Analysis weekly record notes, the set of rules did this issue adjustment as a way to decrease the block manufacturing to the required degree, and now it hasn’t ever been as tricky to mine bitcoin.

The trouble used to be anticipated to drop 0.07% round subsequent week right through the following adjustment. Then again, the similar Arcane record notes that this building up in issue has now not been a disadvantage to a upward thrust within the new hashrate coming on-line. Because of this the following adjustment may reasonably become any other building up, “pushing the trouble even additional upwards.”

Despite the fact that March and April were gradual months for the Bitcoin Hash Price, it has now sped up its tempo and risen to an all-time prime of 221 EH/s.

Similar Studying | Bitcoin Hashrate Swells 15% Since Last Week As Analysts Expect Mining Difficulty To Increase

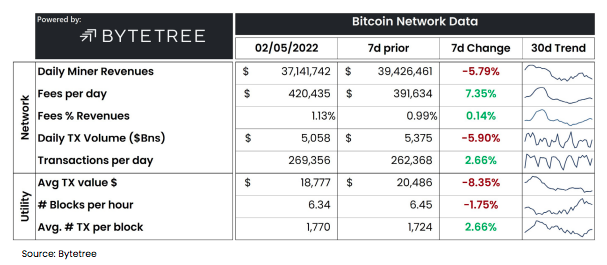

The specified degree of block manufacturing is 6 blocks according to hour, however the surge in Hash Price every week in the past changed into a fast block manufacturing charge of 6.45 blocks according to hour.

The Arcane Analysis knowledge additionally stories a 7% building up in Bitcoin’s day-to-day transaction charges, going from $391,634 to $420,435 in every week. Ethereum, on the other hand, nonetheless takes the lead within the prime day-to-day transaction charges enviornment with an all-time prime of $231 million ultimate weekend, two occasions the previous all-time prime of $117 million.

This came about because of Yuga Labs’ minting of 55,000 NFTs, which demanded a large amount of fuel given the task of patrons higher. Ethereum’s scalability downside outshines Bitcoin’s 7% surge in day-to-day charges.

This additionally highlights the upper income of Ether miners in comparison to Bitcoin’s for over a yr.

“Bitcoin transaction charges had been minuscule because the summer season of 2021, most effective making up round 1% of miner revenues, whilst the remaining comes from the block subsidy,” Arcane Analysis explains, including that Ether miners in finding upper profitability on account of the increased fuel charges, even supposing their income also are extra risky.

Similar Studying | Bitcoin Could See 10% Jump, As Volatility Drops To 18-Month Low

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)