We’re now not within the throes of late-stage capitalism; we’re dwelling in the course of the overdue phases and the demise rattle of the post-1971 fiat machine. Mistaking the 2 (and basing answers or insurance policies in this mistake) is a recipe for counterproductive interventions and ignored alternatives.

By no means in my lifestyles have I felt a extra urgent sense that we’re coming near the top of one thing; that, to paraphrase William Butler Yeats, the metaphorical middle cannot and is not holding. I feel this sensation of coming near finality, of ancient transition and of fraying order has saturated and knowledgeable our politics as effectively.

The collective creativeness and can of our two political events is restricted to revivifying Franklin D. Roosevelt or Ronald Reagan, with increasingly more decreased effects. Each and every celebration desires to go back the rustic to its most popular trajectory, however those paths have converged and ended. Therefore the creeping sense that we’ve got reached some terminal level.

Many, in particular the ones at the modern left, consult with this scenario, this liminal segment, as “late-stage capitalism,” a word rooted in Marxism (however now not coined via its founder). The time period’s which means has developed over the years however has just lately grow to be a type of nebulous catch-all time period, a meme of lament for the yawning wealth hole and the absurdity of on a regular basis lifestyles, which has come to resemble, in its (from time to time) cartoonish futility, a Samuel Beckett play.

Present occasions have handiest intensified the lament. This has led some to invest (or boldly assert) that we’ve got reached the top of capitalism as a viable financial machine; that capitalism, left to its personal gadgets, will proceed to take away or degrade our societal Jenga blocks till the whole thing collapses. We’re simply witnessing the inevitable conclusion of a self-defeating machine, they are saying. Its herbal finish level is both a neo-feudalism during which ultra-rich overlords mete out crumbs to the destitute plenty or a cave in that, in its wake, begets an anarchic, balkanized state of nature, favoring the sturdy and the well-endowed who, minimally constrained, will trample the vulnerable with impunity.

Confronted with this bleak outlook, why now not preemptively interfere and chart a route into a distinct machine? Why now not grant the state extra energy to coordinate financial task? Why now not redistribute the wealth sooner than all of it results in the arms of the already-powerful few?

I feel maximum folks perceive the impulse right here. The concept one thing is essentially damaged and that one thing elementary will have to exchange is pervasive. However the resolution isn’t to conjure the senile ghost of Reagan, neither is it to remix Roosevelt. And it’s not at all to desert capitalism altogether in choose of necessarily educational choices — whether or not socialism’s worker-run state or some imprecise conception of a prelapsarian, agrarian utopia. However too ceaselessly our discourse turns out confined to those paradigms.

There are a number of causes for this highbrow logjam. First, I feel we’re looking to jam spherical reality-pegs into sq., partisan holes. 2d, I feel we’re mislabeling the instant and misdiagnosing its flaws as a result of our language has now not evolved past Chilly Conflict binaries of capitalism and socialism, bourgeoisie and proletariat, staff and capitalists.

I posit that we’re, certainly, within the overdue phases of one thing, however this “one thing” isn’t capitalism. Now, we might sooner or later achieve the top of capitalism — I’m now not foreclosing that chance, nor am I suggesting that capitalism doesn’t have inherent, intractable problems. However a lot of the fresh tragicomic grotesqueness we ascribe to “late-stage capitalism” is uniquely enabled and facilitated via fiat foreign money and now not wholly inevitable or innate to capitalism. What we’re these days witnessing is late-stage fiat. Extra expansive tips in regards to the finish of capitalism are theoretical and untimely. Because of this, our efforts must now not be marshaled towards the jettisoning or transcendence of capitalism, however slightly towards error-correcting the creation and proliferation of the fiat financial order.

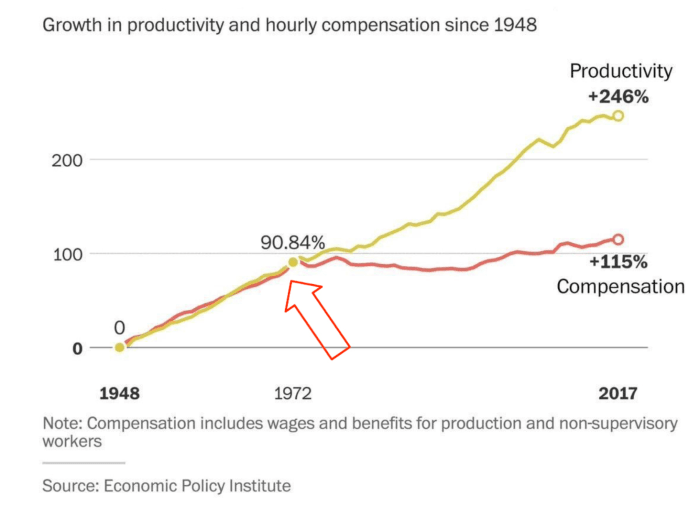

Recent conceptions of late-stage capitalism are essentially according to or born out of the accelerating and intensifying inequality of wealth, which is observed because the inevitable and inescapable results of capitalism. Those effects, the argument is going, are inherent to and thus predetermined via a capitalist machine.

However that is merely now not as axiomatically true as we’re ended in consider. Positive, capitalism includes levels of wealth inequality, excessive iterations of which we’ve traditionally sought to rein in with myriad criminal guardrails. However the obscenely stretched ranges we now have these days, and that have been particularly exacerbated within the final 15 years, are causally associated with financial insurance policies enabled via fiat foreign money.

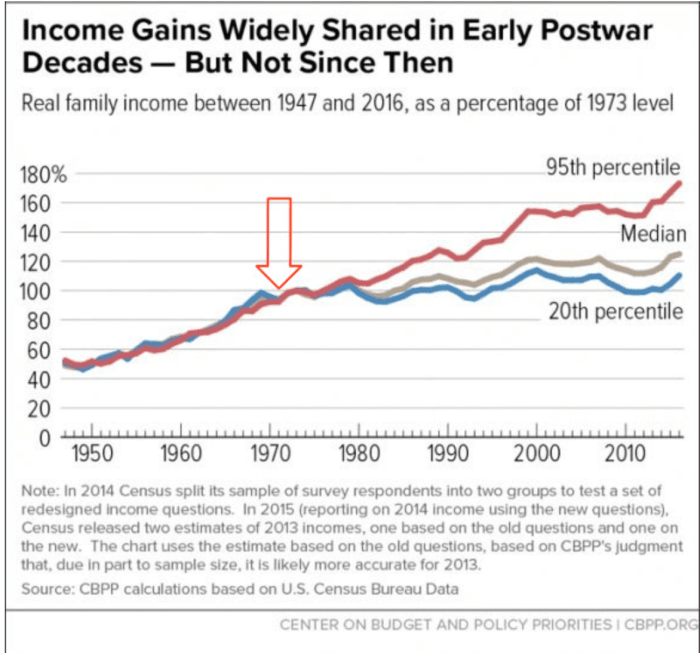

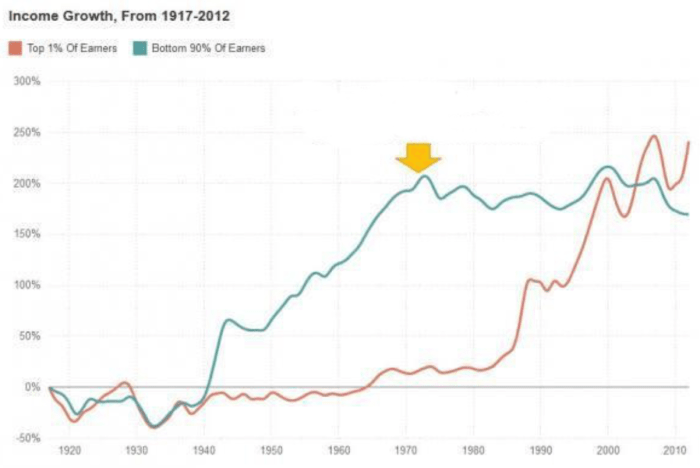

(Source)

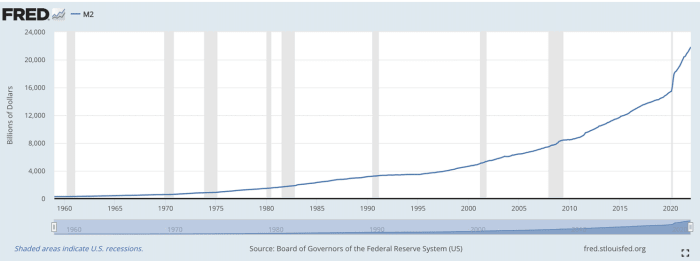

Those charts display an inequality of wealth that has grow to be increasingly more acute since 1971, after we officially deserted the gold usual and went to a complete fiat machine. From this level ahead, we began increasing the cash provide at an accelerating price, culminating within the COVID-19 liquidity infusions.

(Source)

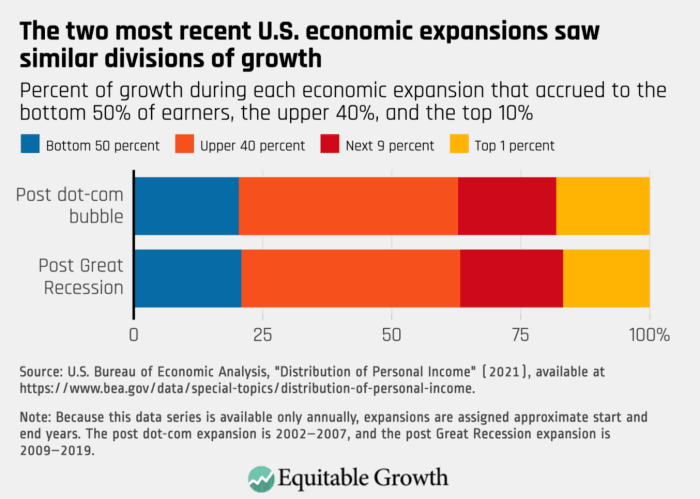

More and more, a emerging tide does now not carry all boats. It’s because the ground 50% of boats don’t seem to be uncovered to the tide. They’re now not even within the water as a result of they don’t personal property. This has handiest gotten worse in contemporary many years.

(Source)

The increasingly more acute disparity isn’t the inevitable results of capitalism. Quite, it’s the results of a fiat machine during which the ones closest to, and exercising essentially the most affect over, the foundations of the financial community reap essentially the most advantages.

The anti-capitalism refrain reached fever pitch within the run-up to the 2020 election, because the fortunes of lots of the global’s billionaires grew exponentially right through the process the COVID pandemic.

Virtually completely disregarded of this dialogue used to be the function performed via financial coverage. Let’s read about Elon Musk and Jeff Bezos, the poster boys of this rising wealth inequality all the way through COVID. I’m no apologist or cheerleader for both, however their fortunes had been higher essentially via the Federal Reserve’s financial coverage. We flooded the financial system with new cash which, on account of the Cantillon Impact, went first to essentially the most creditworthy establishments and folks, e.g., the rich, who then poured them again into property, juicing the costs of the ones property, which might be disproportionately owned via the rich. You get the theory.

Right here’s a chart of Tesla’s inventory. Glance what took place from March of 2020 onward:

(Source)

Right here’s Amazon, which mainly doubled after March of 2020:

(Source)

Somebody like Musk, who owns a ton of Tesla inventory, is made superbly rich on paper. It’s now not as a result of he used to be ramping up exploitation over the pandemic. It’s as a result of we revealed a ton of cash that, as is at all times the case, ended up pooling in property and growing asset-price inflation.

The facility to print cash at will (and bear in mind, 40% of the dollars these days in stream had been created in 2020-2021), is an inherent characteristic of fiat foreign money. It’s now not an inherent or vital characteristic of capitalism.

I’d argue different phenomena ceaselessly attributed to late-stage capitalism are uniquely enabled via a fiat machine. The facility to salary conflict completely on credit score, as an example, which distances the common citizen from the truth of conflict and thereby diminishes resistance to enticing in conflict, is enabled via the fiat machine. That is elucidated within the paintings of Alex Gladstein.

The offshoring of work and the hollowing out of our production capability, which has beaten the running categories, has been facilitated and, in truth, necessitated via the buck’s place because the reserve foreign money. This offshoring has handiest exacerbated wealth inequality.

I’d finally argue that the large and ubiquitous breakdown of consider in establishments is said to fiat foreign money, as effectively. In a fiat-currency global, cash itself lies. It may be manipulated and weaponized. To paraphrase Jeff Booth, when there’s incorrect information on the base layer of society (which is the cash), this incorrect information leaks out in all places. And we’re handiest initially of this procedure.

This isn’t an issue inherent to capitalism. It’s a fiat-currency downside. The binary isn’t capitalism vs. socialism; It’s fiat vs. sound cash. A lot of our politics now could be all for fixing the improper downside and jamming our very actual systemic flaws into totally misguided Chilly Conflict binaries.

Correctly figuring out the airplane on which the issue exists permits us to pursue efficient answers, like changing the fiat machine with one according to a impartial reserve asset with non-manipulable laws, i.e., Bitcoin.

This can be a visitor put up via Logan Bolinger. Evaluations expressed are completely their very own and don’t essentially mirror the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)