The inventory market continues to be inside putting distance from former all-time highs set in 2021, but Bitcoin and different cryptocurrencies really feel miles away by comparability.

The 2 vastly various kinds of property that after traded lock and step at the moment are experiencing a major divergence. Is it time for BTCUSD to kiss its correlation with the inventory market goodbye?

Is Crypto’s Correlation With The S&P 500 About To Finish?

All all through 2020 the correlation between the inventory market and cryptocurrencies was notable. Inventory market bubble “froth” because it was referred to on the time was spilling into Bitcoin and altcoins.

The connection stayed comparatively comparable all all through the bear market. The inventory market put in a backside forward of crypto as a result of FTX collapse in November. Since then, shares have made a stellar comeback, however total the as soon as unstable cryptocurrency market has been muted.

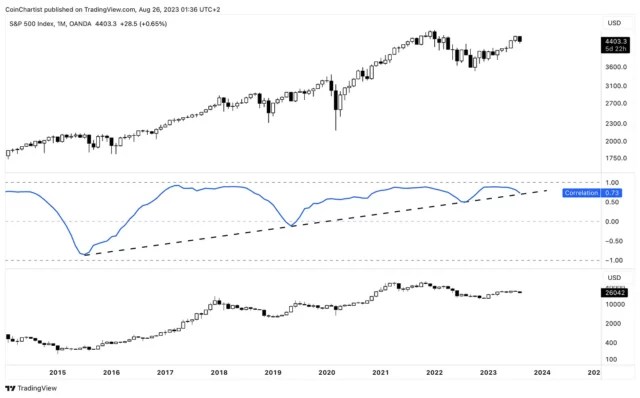

Is the inventory market correlation about to finish? | BTCUSD on TradingView.com

The 2 asset lessons beforehand exhibited a robust correlation in keeping with the Correlation Coefficient between the S&P 500 and BTCUSD, however it’s susceptible to breaking down within the coming months if worth motion doesn’t come extra into parity.

The Correlation Coefficient measures not simply the power however the route of the connection between any two property, and the route is presently pointed down. This implies that the correlation will proceed to weaken except the connection reverses course.

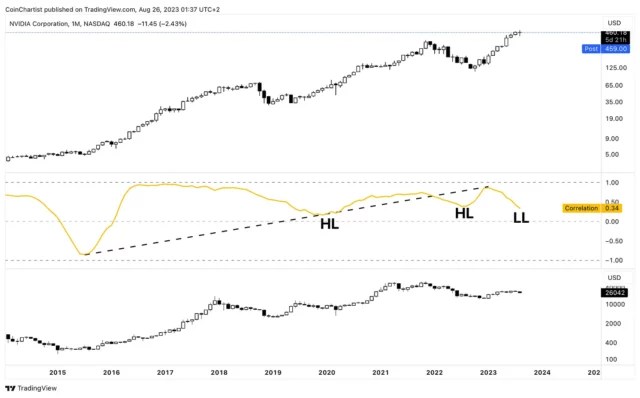

Nvidia/BTC Correlation Coefficient loses uptrend | BTCUSD on TradingView.com

Bitcoin Breaks Up With Nividia After 8-Yr Relationship

One potential early indication that the uptrend within the Correlation Coefficient between the S&P 500 and BTCUSD may break down, is as a result of the identical instrument and powerful correlation between Bitcoin and Nvidia has since began to fall.

The earlier sequence of upper highs and better lows simply met its first decrease low. If a decrease excessive on the Correlation Coefficient varieties subsequent, it may spell the top between any correlation between crypto and conventional markets.

This isn’t all unhealthy, nevertheless, as portfolio managers typically search to diversify with property which have a destructive correlation with shares. If the Correlation Coefficient drifts there, the asset may change into attention-grabbing for various causes. Up to now, Bitcoin was positioned as a substitute asset class with little to no correlation with the inventory market.

The COVID worth shock induced many uncorrelated property to sudden change into tightly correlated, and that relationship may now be fading. Bitcoin is as an alternative exhibiting an more and more sturdy correlation with Gold, which may finally bode effectively for the highest cryptocurrency by market cap.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)