Bitcoin Money (BCH) and several other distinguished altcoins are experiencing an upward trajectory of their buying and selling costs, attributed to a current report indicating a positive ruling by the US federal appeals court docket.

The court docket’s resolution means that the US Securities and Change Fee (SEC) erred in its rejection of Grayscale’s software for a spot bitcoin exchange-traded fund (ETF).

This growth has as soon as once more underscored the affect of constructive regulatory information on the sentiment and valuation of the cryptocurrency market.

Regulatory Reassurance Boosts BCH, Total Market Confidence

The crypto market has lengthy been vulnerable to fluctuations pushed by regulatory uncertainty. Nevertheless, situations of regulatory readability, such because the newest ruling relating to Grayscale’s ETF software, have repeatedly proven their potential to provoke constructive sentiment amongst buyers.

The maturation and legitimacy that regulatory approvals signify are sometimes interpreted as promising indicators for the trade’s future progress. This enhanced sentiment invariably piques curiosity not solely in Bitcoin but in addition in varied different cryptocurrencies, together with Bitcoin Money.

Bitcoin Money Seizes The Momentum

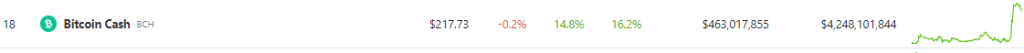

With Bitcoin Money exhibiting a sturdy worth rally, the digital asset’s worth soared to $217, as reported by CoinGecko. Over the span of 24 hours, the coin witnessed a formidable surge of 14.8%, which additional expanded to 16% over the course of the previous week.

BCH worth motion immediately. Supply: Coingecko

The outstanding good points will be largely attributed to the constructive ripple impact generated by the Grayscale-SEC ruling, which has reverberated throughout your entire cryptocurrency panorama.

BCH market cap at $4.2 billion immediately. Chart: TradingView.com

The Bitcoin Impact On Altcoins

Bitcoin, because the vanguard of cryptocurrencies, continues to wield substantial affect over the market. The surge in its worth to $27,456—a rise of greater than 5% inside a single day—epitomizes the profound affect of Grayscale’s conquer the SEC.

What makes this rally much more intriguing is its domino impact on altcoins like Bitcoin Money. As buyers search to diversify their portfolios, they inevitably discover different cryptocurrencies to maximise their potential good points. This pattern has triggered a surge in curiosity and funding in altcoins, propelling them to new heights.

The collective impact of those developments is clear within the substantial progress of the whole crypto market capitalization. A surge of practically $50 billion underscores the quick affect of regulatory developments available on the market’s valuation.

The truth that a number of the most important good points had been recorded by cryptocurrencies carefully linked to Bitcoin reinforces the notion that regulatory wins and main cryptocurrency efficiency are intertwined in a symbiotic relationship.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Once you make investments, your capital is topic to threat).

Featured picture from Getty Photographs

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)