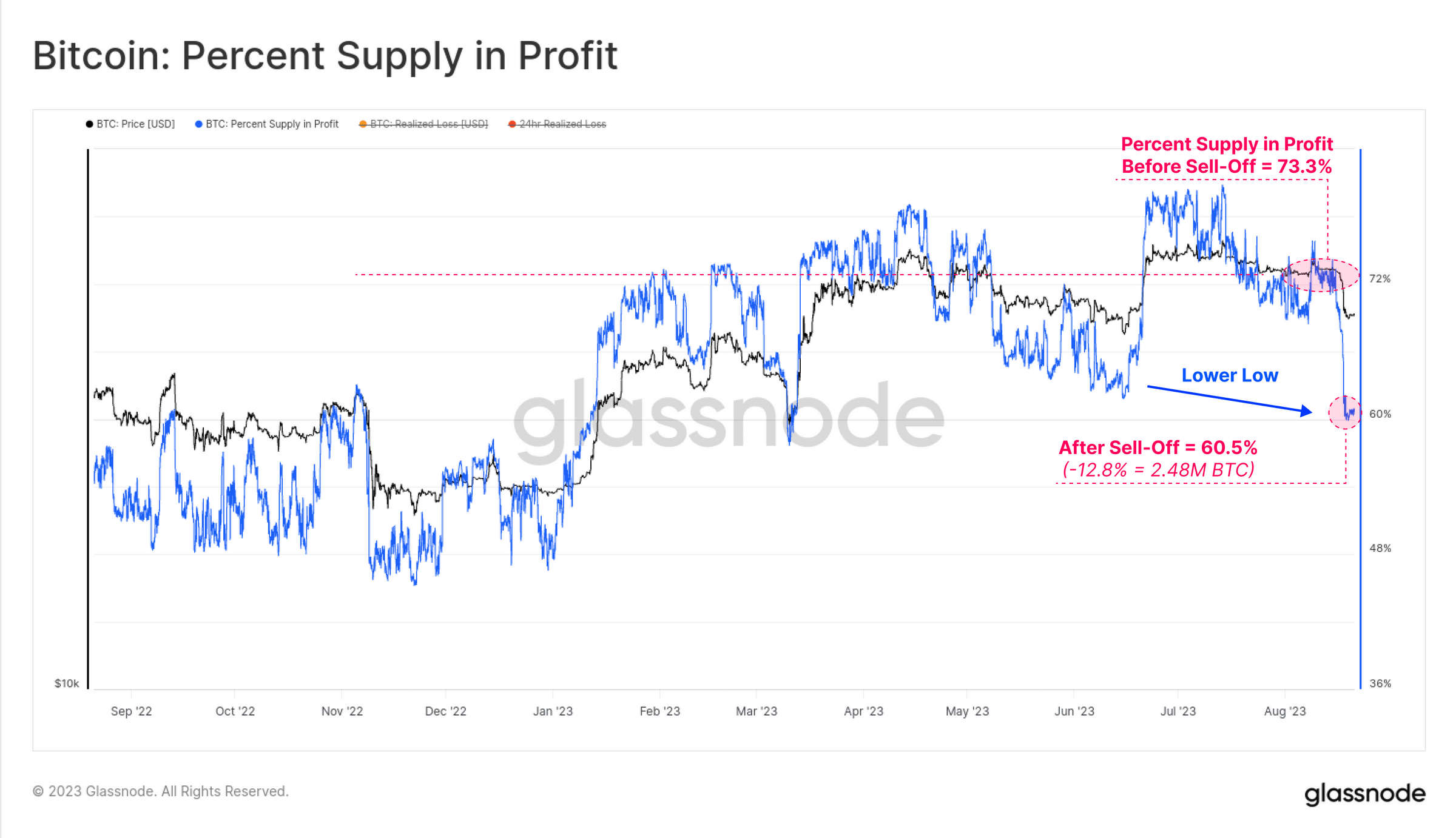

After the Bitcoin worth crash final week, on-chain information reveals an image that factors to a “top-heavy” worth. Glassnode’s newest insights make clear the present market dynamics, the place a big chunk of the BTC spot provide finds itself with a value foundation both close to or surpassing the prevailing worth.

“Right here we see that 12.8% (2.48M BTC) of the provision fell into an unrealized loss this week, setting a decrease low on this metric. This implies that ‘high heaviness’ in spot markets can also be a think about play,” commented Checkmate, Glassnode’s chief analyst.

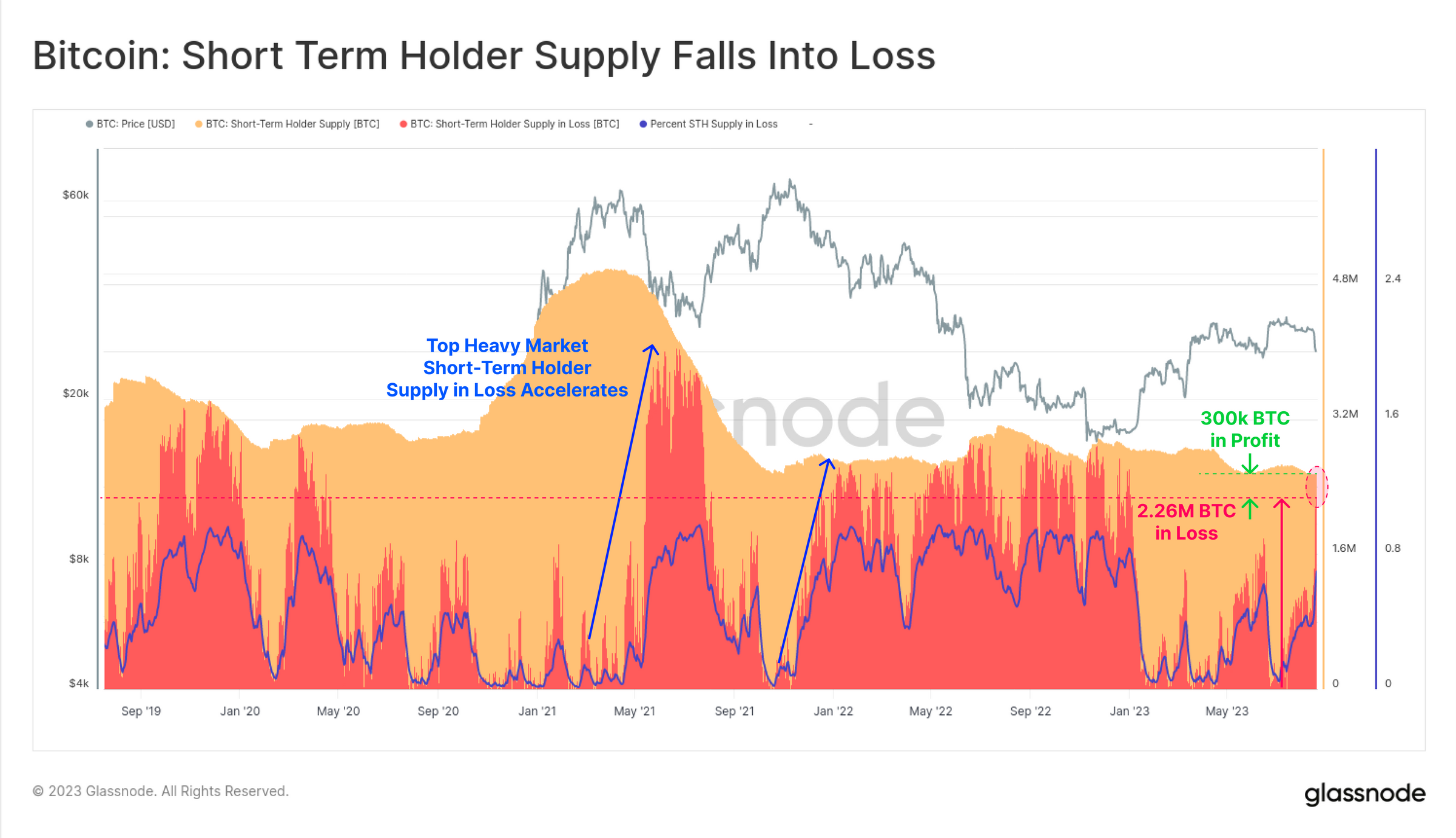

Notably, Lengthy-Time period Holders (LTHs) have displayed outstanding resilience on this turbulent interval. Their interplay with exchanges stays largely unaltered, with the combination steadiness of LTHs marking a brand new All-Time Excessive (ATH) this week. In stark distinction, the habits of Brief-Time period Holders (STHs) emerges as notably salient.

Checkmate notes, “With LTH provide at ATH, we will additionally see that STH provide stays at multi-year lows.” The information additional underscores this: out of the two.56M BTC held by STHs, a mere 300k BTC (11.7%) stays in revenue, which means that 88.3% are in loss. This must get better rapidly, else it provides to the bear case, in keeping with Checkmate.

Historic information signifies sharp upticks in STH provide losses following intervals characterised as ‘high heavy markets’ – just like the occasions noticed in Could 2021, December 2021, and as soon as once more, the final week.

Implications For Bitcoin Worth

The fluctuating dynamics between earnings and losses witnessed available in the market could be additional distilled via the Revenue or Loss Bias (dominance) metric. Because the 2023 rally unfolded, a discernible shift was famous within the STH cohort’s place: “This week we noticed the biggest loss dominance studying for the reason that March sell-off to $19.8k. This implies that the STH cohort are each largely underwater on their holdings, and more and more worth delicate,” added Checkmate.

An intriguing revelation comes from Glassnode’s experimental instrument geared toward discerning market inflection factors. With a meticulous design that maps macro developments of traders and the prevalence of profitability over losses (and vice versa), this instrument gives a nuanced ‘Momentum indicator’.

In keeping with Checkmate, “We are able to see that after a number of months of declining revenue dominance, Loss momentum and dominance have elevated meaningfully.” Notably, whereas false positives have been recorded – as noticed within the March 2023 correction – sustained declines have traditionally been precursors to sharper downtrends.

Total, the Bitcoin worth crash on August 17 stands as essentially the most important single-day decline YTD. The sell-off was primarily a futures market leverage flush out, and is thus primarily a results of short-term positioning and market construction.

Nevertheless, the predominant sentiment is one in all warning, largely as a result of essentially the most important affect has been technical, particularly falling beneath long-term transferring averages, an element that would sway market sentiment.

Lengthy-Time period Holders stay stoic, however the highlight is on the Brief-Time period Holders. With an amazing 88.3% (equal to 2.26M BTC) of their provide at an unrealized loss, mixed with an uptick in realized losses despatched to exchanges and a breach of key technical help, the onus is on the bulls to defend their stance. Checkmate concludes:

There may be for positive potential for additional draw back momentum, however the majority of the injury is positioning and technical. The bull case is that realistically nothing has modified except for the worth, and the R/R nonetheless favors the upside. Requires 12k are kidding themselves, however requires 100K are as properly.

Web Consequence == identical as each pre-halving yr ever.

At press time, the Bitcoin worth stood at $26,084.

Featured picture from iStock, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)