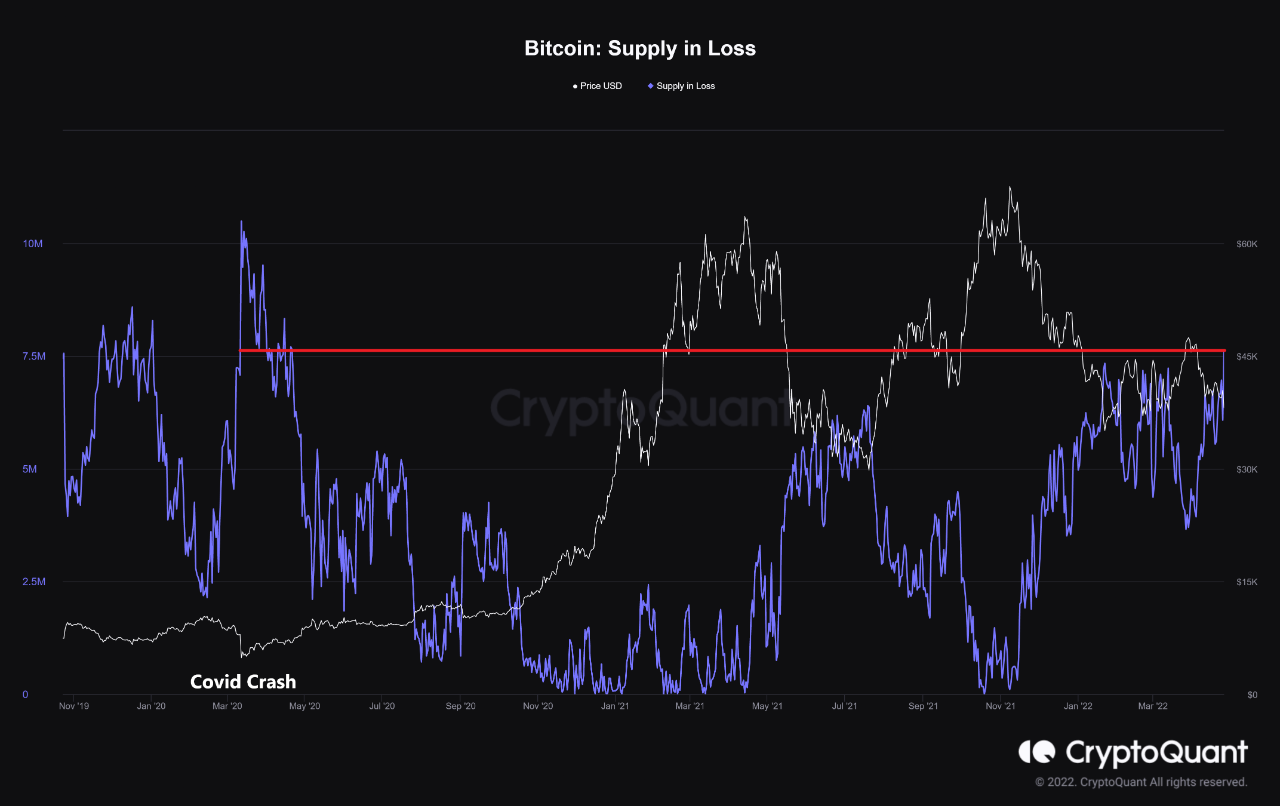

On-chain information displays the volume of Bitcoin provide in loss has now risen to the easiest worth for the reason that COVID-19 crash.

Bitcoin Provide In Loss Now Measures Round 7.6M BTC

As identified by means of an analyst in a CryptoQuant post, the BTC provide in loss hasn’t proven such prime values for the reason that first part of 2020.

The “BTC supply in loss” is a trademark that measures the overall quantity of Bitcoin that’s recently being held at a loss.

The metric works by means of checking the on-chain historical past of every coin to peer what worth it used to be ultimate moved at. If this previous worth used to be more than the present worth, then the coin is counted as being in loss.

Similar Studying | Bitcoin Trading Volume Continues To Remain At Unusually Low Values

When the worth of this metric is going up, it approach extra buyers are getting into the crimson. Prime values are most often seen following crashes in the cost of the crypto.

However, a downtrend within the indicator would counsel extra of the Bitcoin provide is getting into the golf green.

Now, here’s a chart that displays the fad within the BTC provide in loss during the last few years:

Seems like the worth of the indicator has risen not too long ago | Supply: CryptoQuant

As you’ll see within the above graph, the Bitcoin provide in loss has seen an uplift in fresh weeks. The metric’s worth is now round 7.6 million BTC.

The sort of prime worth hasn’t been observed for the reason that first part of 2020, the place the COVID-19 crash unexpectedly despatched provide into loss.

Similar Studying | The Central African Republic Actually Adopted Bitcoin. What Else Do We Know?

Typically, as cash get extra into the crimson, buyers turn out to be much more likely to capitulate with a view to bring to an end their losses and go out the marketplace.

It continues to be observed how holders react to this type of huge portion of the provision being in loss this time as it’s been some time for the reason that marketplace ultimate seen this type of development.

BTC Value

On the time of writing, Bitcoin’s price floats round $39.6k, down 6% within the ultimate seven days. During the last month, the crypto has misplaced 15% in worth.

The beneath chart displays the fad in the cost of the coin during the last 5 days.

The cost of BTC appears to be slowly rebounding again from the plunge a few days again | Supply: BTCUSD on TradingView

Bitcoin confirmed a temporary signal of upwards momentum a couple of days again, nevertheless it wasn’t lengthy till the coin dropped again to the beneath $40okay ranges.

These days, it’s unclear when the crypto might see any actual restoration and get away this apparently never-ending consolidation.

Featured symbol from Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)