Sign up for Our Telegram channel to stick up-to-the-minute on breaking information protection

Bitcoin threw a wave of pleasure because it crossed the $23okay worth goal a few days again, in consequence pulling above $24okay as smartly; resulting in an thrilled crypto marketplace. The birthday party, alternatively, used to be rather short-lived as bitcoin’s price dropped again to soaring between the above-mentioned worth ranges. Buyers at the moment are curious as to the place the frontrunner crypto is headed within the close to brief time period, and if it’ll move the $25okay degree anytime quickly. Neatly, let’s in finding out.

Bitcoin Worth Hovers Between $23okay and $24okay After Hinting A Conceivable $25okay

The price of Bitcoin noticed a vital build up not too long ago, achieving the $24,000 degree for the primary time since August. This surprising leap in price coincided with a extensive rally in shares, in particular the Nasdaq, in addition to a drop in U.S. Treasury yields and the U.S. Buck Forex Index (DXY). In spite of this certain development, many traders and analysts stay wary as they look forward to a pullback in costs sooner than stabilization.

The day sooner than the leap in Bitcoin price, the Federal Reserve raised its benchmark rate of interest, which some noticed as a dovish transfer. Alternatively, Fed Chairman Jerome Powell famous that despite the fact that inflation seems to be slowing, it nonetheless stays increased and extra proof is wanted sooner than the central financial institution can hopefully say inflation is coming near its 2% goal.

Ethereum additionally noticed a surge in price, nearly achieving $1,700, the perfect since September. Alternatively, if it does now not damage throughout the $1,700 resistance degree, a correction might happen.

On Friday, there used to be some benefit reserving in Bitcoin and different major altcoins after the rate of interest hike by means of the U.S. Federal Reserve. Bitcoin dropped 2% however remained above the $23,000 mark, whilst Ethereum dropped greater than 2% however held above the $1,600 degree. Different altcoins confirmed blended effects, with some buying and selling decrease and a couple of buying and selling upper. The entire buying and selling volumes have been flat, slipping just one% just about $61.25 billion.

The $24okay goal used to be deemed rather a very powerful by means of marketplace analysts because it opened doorways for the token to achieve $25okay and proceed to upward push from there. Alternatively, the newest contraction has raised some scepticism in opposition to those theories.

Bitcoin Technical Research

The arena’s biggest cryptocurrency Bitcoin is predicted to peer a “golden move” quickly. This technical tournament occurs when the 50-Day Easy Shifting Moderate crosses above the 200-Day SMA, which is steadily considered as a bullish signal by means of investors. So long as the cost of Bitcoin doesn’t see a vital drop, the golden move is anticipated to happen within the coming week.

Lately, Bitcoin’s worth has observed a surge of over 40% because the get started of the yr. Alternatively, the cryptocurrency confronted a drop on Friday as marketplace volatility higher sooner than the discharge of the U.S. non-farm payroll reports. The 14-day relative energy index used to be not able to damage a key resistance degree, resulting in a drop in the cost of Bitcoin.

As of now, the index is below the 70.00 reinforce degree. If it fails to carry, there’s a chance of the cost transferring underneath $23,000. Within the medium to long run, Bitcoin has damaged thru a falling development channel, indicating a slower charge of decline or a extra horizontal development.

The token is between reinforce at $21,400 and resistance at $25,000, and a definitive damage thru this sort of ranges will dictate the route Bitcoin follows. With a favorable quantity steadiness and RSI above 70, the forex is appearing robust certain momentum and an additional build up is predicted. Alternatively, a top RSI price may just additionally point out the coin is overbought and a response downwards is imaginable. On a purely technical entrance, Bitcoin is classed as impartial for the medium to long run.

Will Bitcoin Push Again Up?

After a difficult marketplace crash in 2022, Bitcoin (BTC) has made a powerful begin to the yr 2023, with over a 40% build up in worth over the past month, making it the finest January efficiency since 2013 and the best-performing month since October 2021.

The present marketplace stipulations are believed to be bullish for Bitcoin, with a imaginable finish to the tightening monetary stipulations and possible rate of interest cuts by means of the top of 2023. Consistent with a couple of on-chain and technical signs, the ground of the undergo marketplace in 2022 seems to have handed.

Buyers had been unfazed by means of the hot Fed choice to hike rates of interest, with the impending US jobs record anticipated to be the following catalyst for possibility. Crypto investors are assured heading into the record and are in search of alternatives to check Bitcoin’s resistance round $24,000, and even push it to close $25,000.

The ground in $BTC is a double walled fulcrum development. Extraordinarily uncommon. The 2X goal is mid 25’s. pic.twitter.com/NfffzbniO5

— Peter Brandt (@PeterLBrandt) January 29, 2023

At the moment, Bitcoin is buying and selling at $23,480 with a marketplace cap of $493 billion. If the cost strikes above the a very powerful resistance of $24,300, its subsequent goal might be $25,000. Seasoned dealer Peter Brandt has additionally predicted that the Bitcoin worth may just upward push to $25,000 within the close to long run, mentioning a “double-walled fulcrum development” available in the market.

Knowledge additionally displays that investors are constructive about the way forward for Bitcoin costs, with the long-short ratio and lending charges indicating that bulls are in keep watch over. Alternatively, some mavens warn that this overconfidence might sign that the present crypto rally is constructed on susceptible technical and elementary foundations, forming a brand new bubble.

Now that the Fed’s rate of interest hike is out, the long run worth motion of Bitcoin will very much rely on macro trends. As for the chart patterns, the present worth motion of Bitcoin resembles its worth efficiency per week again. Which has been constant for some time. If that data is to account for, then it’s protected to mention that the $25okay worth goal for Bitcoin isn’t too a long way.

Meta Masters Guild To Outperform Marketplace Leaders

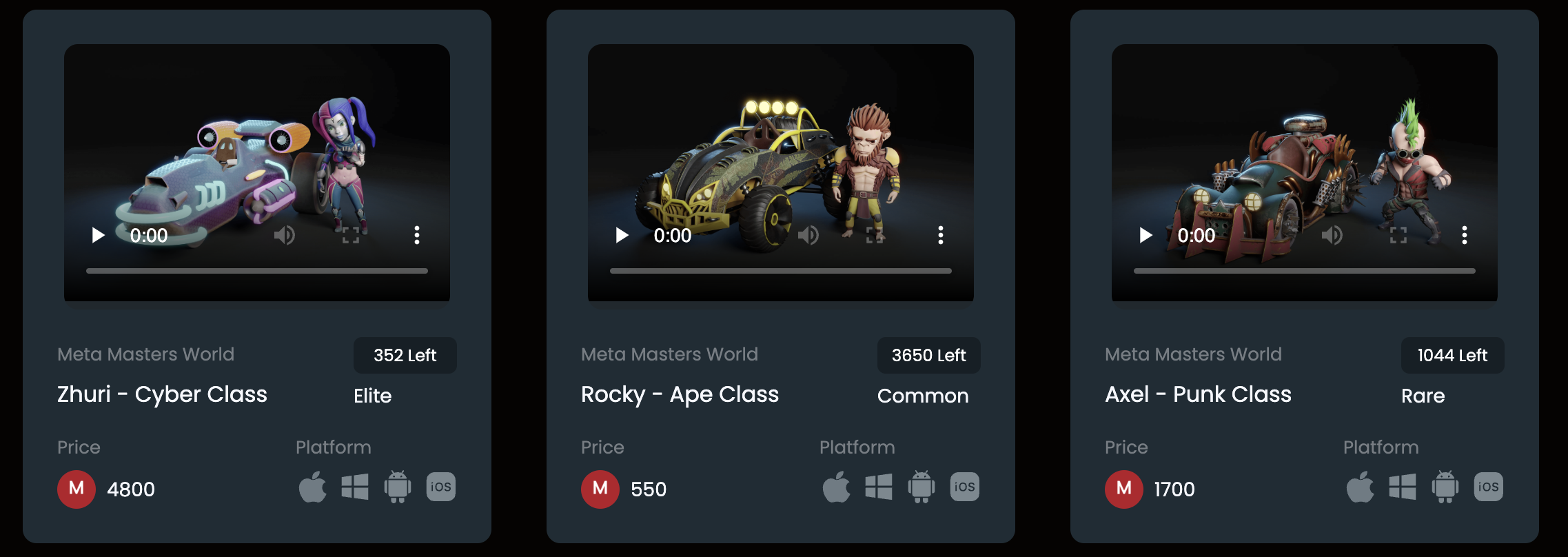

Meta Masters Guild is a phenomenal new mission that might carry innovation to cellular gaming and earn a living for early traders. It goals to struggle the average unethical practices within the gaming trade and supply a unified crypto platform for cellular video games.

The MEMAG token is an integral a part of the ecosystem and might be used for transactions, rewards, and buying and selling inside the video games. The MEMAG presale has already raised $2.7 million and is in level 5 of its presale, with a restricted time left to take a position at a reduced worth.

The point of interest is at the fastest-growing and maximum successful marketplace within the cellular gaming trade, which is estimated to generate a earnings of $172 billion in 2023. The mission lately has 3 video games below building, overlaying quite a lot of genres, and are deliberate for unencumber with new titles added incessantly.

The MEMAG token might be indexed on main exchanges and platforms post-presale, with a demo of Meta Kart Racers and NFT characters anticipated by means of the top of 2023. This can be a promising alternative, so don’t fail to spot making an investment in MEMAG sooner than the cost rises.

Learn Extra:

Struggle Out (FGHT) – Latest Transfer to Earn Venture

- CertiK audited & CoinSniper KYC Verified

- Early Level Presale Reside Now

- Earn Loose Crypto & Meet Health Objectives

- LBank Labs Venture

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Sign up for Our Telegram channel to stick up-to-the-minute on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)