Bitcoin is a historical alternative for retail and particular person traders to get right of entry to property and financial wealth sooner than main monetary establishments.

Bitcoin is a historical alternative for retail and particular person traders to get right of entry to property and financial wealth sooner than main monetary establishments.

The under is an excerpt from a up to date version of Bitcoin Mag Professional, Bitcoin Mag’s top rate markets e-newsletter. To be a number of the first to obtain those insights and different on-chain bitcoin marketplace research directly for your inbox, subscribe now.

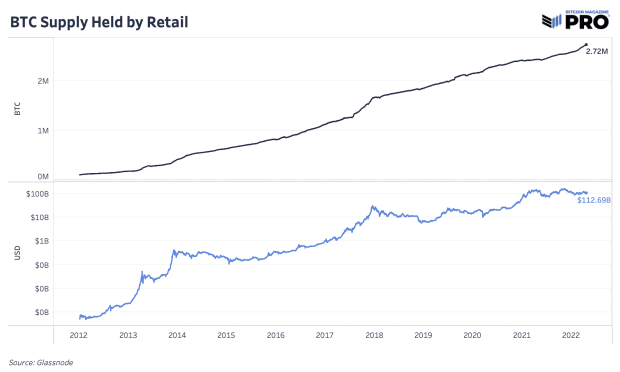

Retail Holds 14% Of Provide

One of the commonplace Bitcoin worry, uncertainty and doubt (FUD) evaluations is that almost all of provide is closely concentrated within the palms of the few. Like each monetary device or asset magnificence that exists these days, there’s some reality to that form of distribution however it’s nearly all the time exaggerated in Bitcoin’s case.

Bitcoin’s proportion of provide held by way of estimated retail folks has been taking extra proportion of the community annually. It’s one of the crucial simplest property on this planet the place any individual with an web connection and a smartphone can download, having extremely low adoption friction for the typical particular person.

Many critics cite an cope with chart like this one and phone it reality. In reality that monitoring provide distributions throughout addresses is extremely nuanced and it’s a key reason Glassnode has used a suite of heuristics and clustering algorithms to estimate entities, relatively than addresses, at the community.

What Glassnode discovered of their research a 12 months in the past, is that:

“We will be able to derive that round 2% of community entities regulate 71.5% of all Bitcoin. Notice that this determine is considerably other from the steadily propagated ‘2% regulate 95% of the provision.’”

And that 71.5% was once an higher sure, i.e., a top estimate of the provision distribution focus. There are lots of the explanation why the retail proportion is most likely greater as a result of bitcoin with custodians, provide on exchanges, misplaced cash, and a conservative method to spot entities.

When digging into the entities provide distribution information these days, we discover a transparent development of retail (entities retaining not up to 10 BTC) expanding their proportion of circulating provide from 1.51% in 2012 to 13.90% in 2022 on moderate. The most important proportion expansion of provide comes from entities retaining 1-10 BTC and nil.1 – 1 BTC.

Ultimate Notice

The information contributes to the case that Bitcoin is a cash designed for and obtainable to the typical world particular person. Despite the fact that establishments and institutional capital flowing into the community is most likely the following main value catalyst and can affect provide proportion, we proceed to look the community proportion of retail upward push as any individual on this planet can achieve and retailer bitcoin themselves.

It’s been a first-of-its-kind case find out about the place for as soon as, retail and persons are ready to get right of entry to property and financial wealth sooner than establishments.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)