The beneath is an excerpt from a contemporary version of Bitcoin Mag Professional, Bitcoin Mag’s top rate markets e-newsletter. To be some of the first to obtain those insights and different on-chain bitcoin marketplace research instantly for your inbox, subscribe now.

U.S. 30-Yr Treasury Yield Hits 3%

Just lately, the U.S. 30-year Treasury bond yield hit over 3% because the Treasury bond marketplace throughout periods and broader credit score markets proceed promoting off.

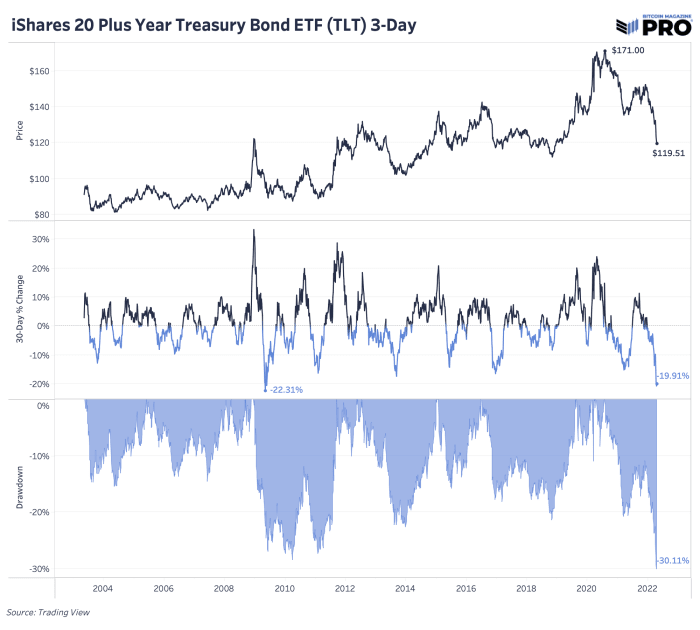

The upward push in yields has ended in a lot upper bond marketplace volatility and critical drawdowns for traders. The iShares 20-year Treasury Bond ETF, TLT, which tracks an index of lengthy period maturities, is now down over 30% from the all time top again in July 2020. The most recent drawdown is the quickest deceleration throughout a 30-day proportion alternate since Would possibly 2009.

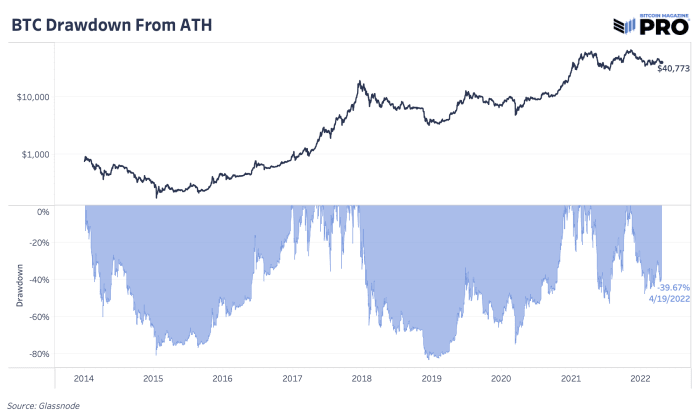

For context, bitcoin is handiest down more or less 39% from the all time top. Such a lot for long-dated U.S. Treasuries offering low volatility, portfolio hedging efficiency and “risk-free” charges.

It’s essential to bear in mind the long-term outlook of the worldwide financial device when comparing the efficiency of bitcoin and debt securities.

On account of the realities of a historical debt burden that worsened put up COVID-19 financial lockdowns, adopted by way of the historical stimulus that adopted, debt as an asset magnificence was once a promise of return-free menace. Debt isn’t simply an settlement between borrower and lender, however within the world economic system it underpins all of the monetary device as a liquid asset magnificence (the most important one at that).

On account of the truth of more or less $100 trillion price of credit score promising return-free menace (nevermind the belongings which are priced off of the traditionally damaging actual charges: equities, actual property, and so on.), our case has time and again been that the easiest asset in principle to carry at this degree of a long-term debt cycle is one and not using a counterparty menace and nil dilution menace.

Idea met fact with the arrival of the Bitcoin community in 2009.

Now, as all of the making an investment global is operating to determine outpace the historical inflation regime we’re confronted with as of late, there stands bitcoin, which continues to seem remarkably affordable in opposition to the marketplace valuation of each and every different asset in the world.

(Source)

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)