It’s conceivable that equities volatility has but to top this yr and extra volatility spikes will have a damaging affect at the bitcoin value.

It’s conceivable that equities volatility has but to top this yr and extra volatility spikes will have a damaging affect at the bitcoin value.

The underneath is an excerpt from a up to date version of Bitcoin Mag Professional, Bitcoin Mag’s top class markets publication. To be a number of the first to obtain those insights and different on-chain bitcoin marketplace research immediately in your inbox, subscribe now.

Bitcoin’s Correlation With Volatility

Bitcoin is a lot more than an “inverse VIX” however that doesn’t forestall the marketplace from buying and selling it as such. (“VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange’s CBOE Volatility Index, a well-liked measure of the inventory marketplace’s expectation of volatility according to S&P 500 index choices.”)

As Bitcoin’s schooling, adoption and monetization carries on, basics and community enlargement would be the extra vital driving force of value appreciation. However within the present atmosphere, risk-off marketplace alerts and broader marketplace volatility are within the driving force seat.

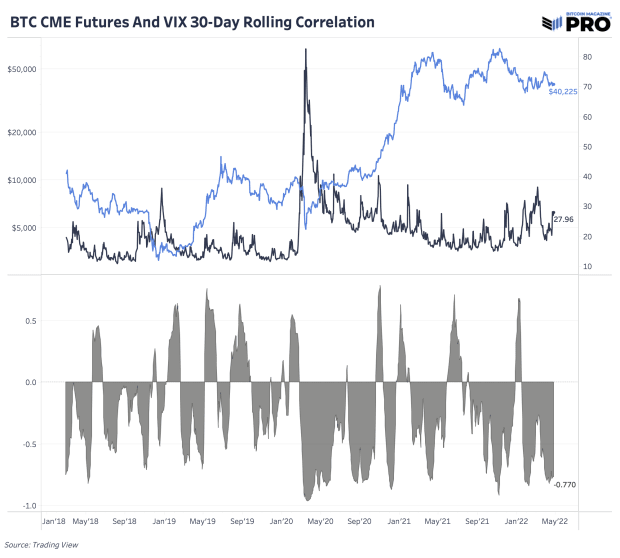

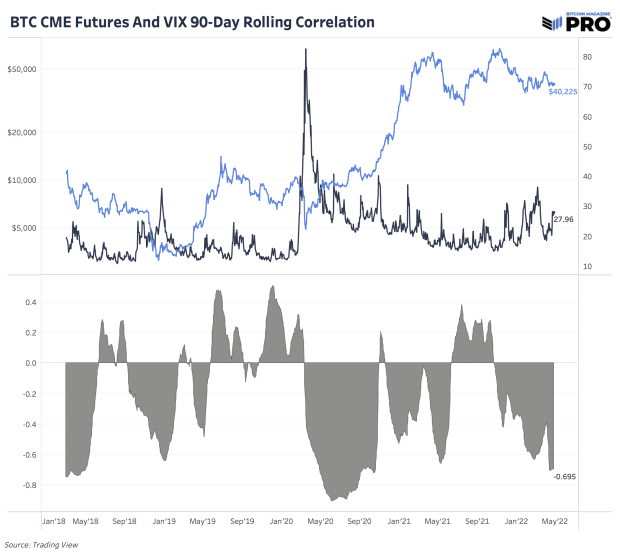

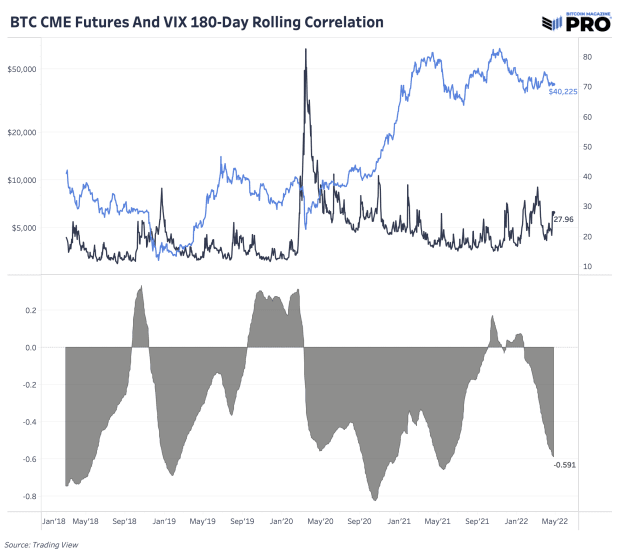

We will be able to kind of quantify this bitcoin and volatility dating via having a look on the Chicago Mercantile Change bitcoin futures and VIX rolling correlations throughout 30-day, 90-day and 180-day timeframes over the previous few years.

Alternatively, March 2020 gave us a fascinating instance of the way bitcoin might carry out publish marketplace crash, large volatility spike and higher debt monetization throughout financial and monetary insurance policies to lend a hand rescue the marketplace and financial stipulations. Bitcoin is now 716% up from its March 2020 backside of $4,930. Bitcoin’s correlation to the VIX is dangerous now right through a credit score unwind, nevertheless it’s a favorable characteristic right through reflationary sessions and falling volatility.

From a broader macroeconomic viewpoint, because of this we stay bullish on bitcoin on an extended time horizon publish every other state of affairs crash in threat belongings. If we’re to peer this state of affairs play out and when the mud settles, bitcoin will likely be primed to outperform virtually each and every different asset in our view according to its adoption curve, basics and as a awesome financial community.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)