The Crypto-friendly Custodia financial institution, based by Caitlin Lengthy, a widely known determine within the crypto business, has been denied its software to come back beneath the supervision of the U.S. Federal Reserve (Fed), based on an official announcement.

The Board had beforehand introduced the denial of the appliance. Nonetheless, the announcement confirmed that the order outlining the choice was not instantly obtainable as a result of have to assessment it for confidential data.

Fed’s Determination Based mostly On Custodia’s Ties With Crypto?

The order of the Federal Reserve Board notes “considerations” about Custodia Financial institution’s proposed enterprise plans, which focus solely on the crypto sector. The Board believes that banks with enterprise plans centered on a slender sector of the financial system might pose heightened dangers, as they could be extra “inclined” to financial or regulatory challenges.

Moreover, the lately launched denial by the Fed notes that the Board’s considerations are additional elevated regarding Custodia Financial institution. The monetary establishment believes that the crypto-friendly financial institution is an “uninsured depository establishment,” not backed by the Federal Deposit Insurance coverage Company (FDIC), and will pose better dangers to depositors and the general monetary system.

As well as, based on the launched Fed’s denial of the crypto-friendly financial institution, the Custodia Financial institution proposed the issuance of Avits, that are dollar-denominated tokens designed to operate as a programmable “digital negotiable instrument” and as deposits for functions of federal banking regulation.

In line with the press launch by the Fed, they word that Custodia Financial institution doesn’t discuss with Avits as “stablecoins” however that they’d probably operate equally to stablecoins like Tether USDT and USDC.

This proposed issuance of Avits by Custodia Financial institution might have been seen as a possible threat by the Fed, given the considerations round stablecoins and their potential use for “illicit functions.”

Custodia Financial institution’s Response To The Fed

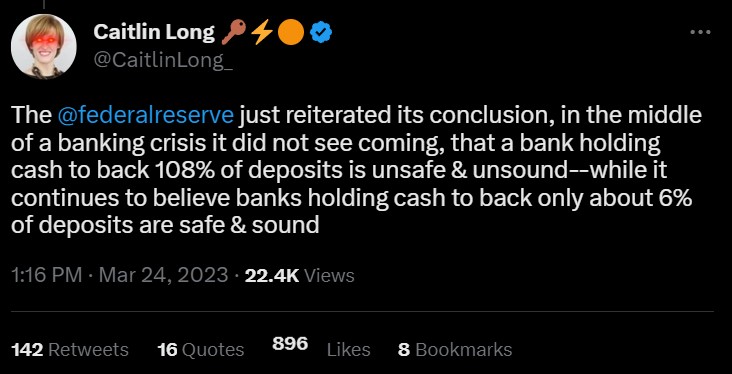

After the reiterated conclusion by the Fed, Custodia Financial institution emitted its response. The monetary establishment and its founder Caitlin Lengthy made a number of claims in regards to the want for absolutely solvent banks and the Federal Reserve’s dealing with of bank-run dangers and the crypto business.

Custodia Financial institution proposed a mannequin that may maintain $1.08 in money to again each greenback clients deposit, which can be seen as a extra conservative and risk-averse method to banking.

Custodia Financial institution’s assertion additionally highlights that there’s a dire want for absolutely solvent banks which can be outfitted to serve “fast-changing” industries in an period of quickly enhancing know-how, referring to the necessity for banks that may adapt to the demand and modifications of consumers in industries like fintech and the crypto-asset.

The assertion by Custodia Financial institution additionally means that Custodia has not been intimidated by what it perceives as coordinated “assaults” and press leaks of confidential data by the Fed.

The discover additionally means that the lately launched order denying Custodia Financial institution’s software for membership within the Federal Reserve System resulted from quite a few procedural “abnormalities, factual inaccuracies, and a common bias in opposition to the crypto business.”

Moreover, the claims by the Custodia Financial institution recommend that the financial institution may have to show to the courts to vindicate its rights and compel the Fed to “adjust to the regulation” in response to the denial of its software for membership within the Federal Reserve System.

Featured picture from Unsplash, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)