Virtual forex markets were tumultuous all the way through the previous month as bitcoin shed 15.43% and ethereum dropped 17.49% towards the U.S. greenback. Additionally, crypto spot volumes are down 18.95% less than the month prior, and each futures and choices volumes had been down in April as neatly. Not up to reasonable business volumes in most cases counsel general passion […]

Virtual forex markets were tumultuous all the way through the previous month as bitcoin shed 15.43% and ethereum dropped 17.49% towards the U.S. greenback. Additionally, crypto spot volumes are down 18.95% less than the month prior, and each futures and choices volumes had been down in April as neatly. Not up to reasonable business volumes in most cases counsel general passion has declined, and traders could also be ready at the sidelines for decrease costs.

April’s Crypto Marketplace Spot Volumes Slip Just about 19% Decrease Than Remaining Month

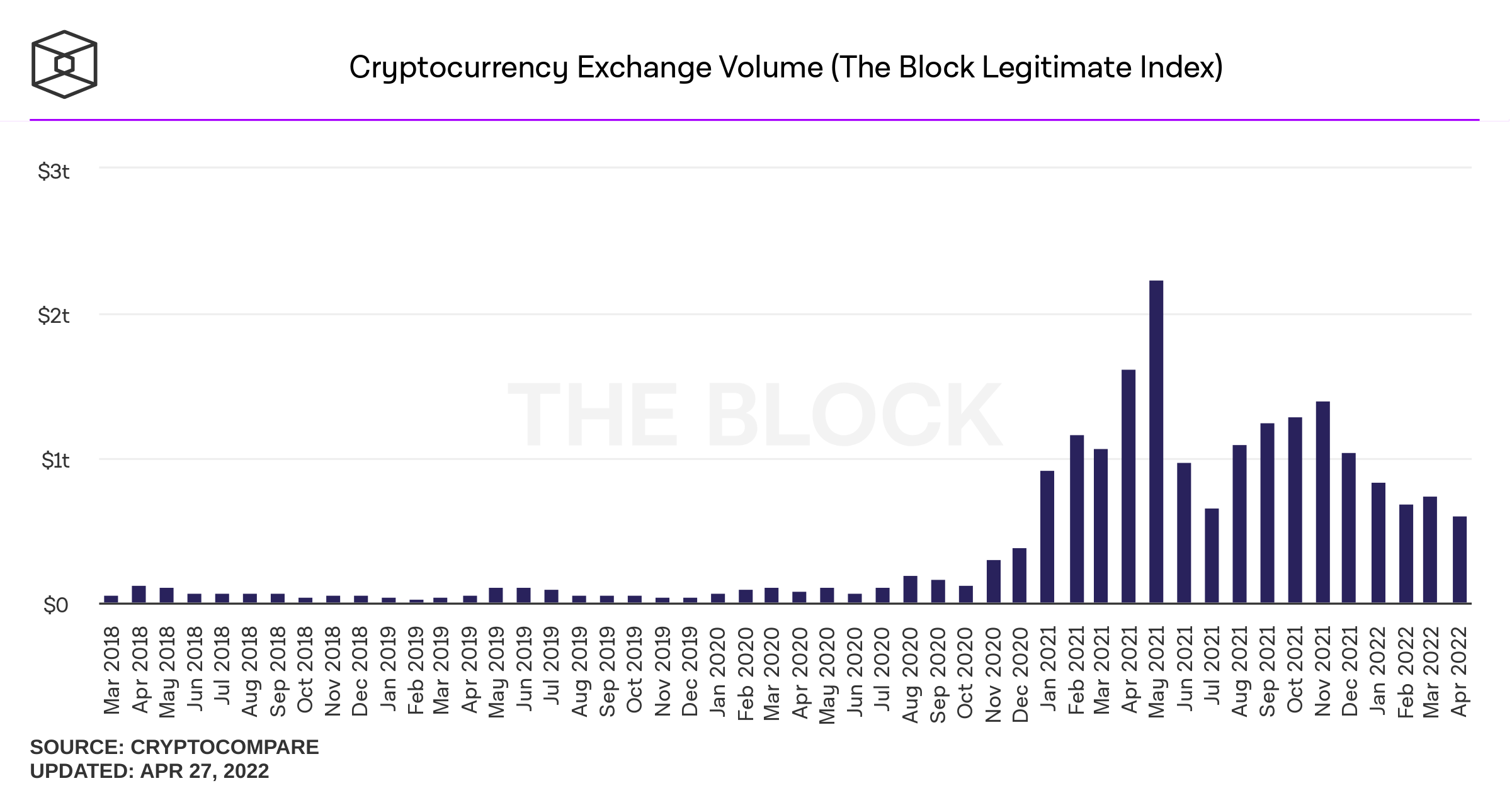

The crypto economy ended the month of April within the pink, as maximum virtual belongings suffered losses all the way through the previous couple of weeks. On the time of writing, all ten of the tip crypto belongings are down considerably as they misplaced between 10.39% to 31.43% all the way through the trailing 30 days. Metrics additional point out that April’s cryptocurrency trade volumes dropped 18.95% less than in March.

As of Might 1, 2022, bitcoin misplaced 15.43%, ethereum dropped 17.49%, BNB slipped through 10.39%, solana slid 31.43%, and XRP misplaced 25.27% over the past 30 days. Trailing 30 day knowledge signifies that terra is beneath 27.66%, cardano dropped 31.39%, however dogecoin best shed 3.46% this previous month.

Statistics display that all the way through the month of March, $739.four billion in business quantity was once recorded, in the case of general crypto spot marketplace quantity. April’s spot volume, in step with the Block’s Official Index and Crypto Examine metrics, got here in at $599.22 billion.

30 Day Crypto Derivatives Quantity Slide, Dex Volumes Slip, NFT Gross sales Larger through 64%

The similar will also be stated for crypto derivatives markets as knowledge signifies April noticed $1.06 trillion in bitcoin futures quantity, whilst $1.32 trillion was once recorded in March. April’s statistics, in the case of bitcoin futures open passion, are decrease all the way through the previous 30 days as neatly.

As of late, there may be $14.58 billion in futures open passion, and a month in the past there was once $16.59 billion in bitcoin futures open passion. Bitcoin options volume from Deribit, CME, Okex, Bit.com, Ledgerx, FTX, and Huobi was once decrease in April than the month prior. In March, there was once $20.77 billion in bitcoin choices quantity, whilst April’s bitcoin choices quantity noticed $15.81 billion.

Moreover, the new defi report lined through Bitcoin.com Information signifies that April’s decentralized trade (dex) business volumes had been 21% lower than in March. In March dex business quantity was once $117 billion, whilst April’s dex business quantity recorded $92.18 billion.

Non-fungible token (NFT) gross sales, alternatively, noticed a 39.25% building up all the way through the final seven days, which bumped NFT gross sales over the past month up 64.44%. Moonbirds was once the top-selling NFT assortment this previous month with $492 million in international gross sales.

What do you take into consideration the crypto marketplace motion all the way through the final 30 days? Tell us what you take into consideration this topic within the feedback segment beneath.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)