Information displays Ethereum staking has handed any other milestone as greater than 10% of the entire ETH provide is now locked inside the contract.

Round 12 Million ETH Is Now In The Ethereum 2.zero Deposit Contract

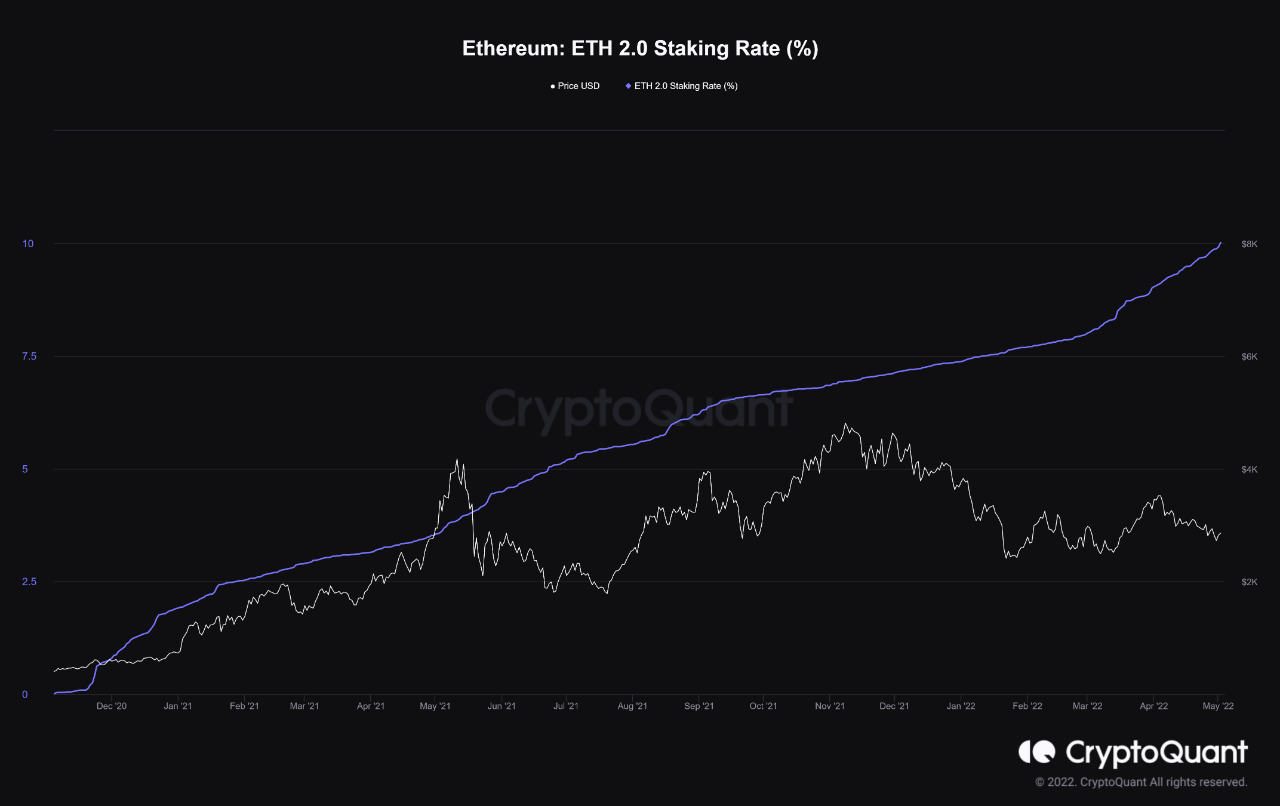

As identified via an analyst in a CryptoQuant post, the ETH staking fee has seen additional surge not too long ago, taking the metric’s price to 10% of the entire provide.

In case any person’s now not acutely aware of what “staking” is, it’s very best to try the “proof of stake” (PoS) consensus machine first.

In cryptocurrencies the usage of the PoS framework, community validators (referred to as the stakers) want to lock in a minimal quantity of the crypto into a freelance (32 ETH in case of Ethereum) to take part within the consensus machine.

The community then randomly chooses one of the crucial stakers to signal the following transaction (stakers with the upper staked quantity have a greater likelihood of being selected).

Similar Studying | Bitcoin, Ethereum, Other Coins Now Supported By Argentina’s Biggest Private Bank

That is not like evidence of labor (PoW), the place miners require a top quantity of computing energy to compete with each and every different to signal the transactions.

Since mining machines could have a unfavourable have an effect on at the atmosphere, PoW cryptos have increasingly more come below scrutiny not too long ago.

Alternatively, as PoS networks don’t require validators to have any top energy {hardware}, they’re via design extra environmentally pleasant.

The Ethereum “staking fee” is a measure of the proportion of the entire ETH provide lately locked into its staking contract.

The beneath chart displays the fad within the indicator over the last couple of years:

Seems like the metric has seen sharper uptrend in contemporary months | Supply: CryptoQuant

As you’ll be able to see within the above graph, greater than 10% of the entire Ethereum provide is now locked into the staking contract.

Similar Studying | EPA Vs. Bitcoin: Dorsey, Saylor, Others Oppose Lawmakers’ Call For Action Vs. Crypto Mining

Extra cash being locked into the contract can turn out to be a bullish signal for the crypto as buyers staking are in most cases in it for the lengthy haul, and are thus not likely to promote.

Ethereum Value

On the time of writing, ETH’s price floats round $2.8k, down 5% within the closing seven days. During the last month, the crypto has misplaced 17% in price.

The beneath chart displays the fad in the cost of the crypto over the past 5 days.

The cost of the crypto turns out to have most commonly moved sideways over the previous few days | Supply: ETHUSD on TradingView

Ethereum has been suffering for slightly some time now, as has been the remainder of the crypto and fiscal marketplace. In this day and age, it’s unclear when the coin might see any important restoration.

Featured symbol from Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)