ETH follows BTC with robust good points. Conflux leads the altcoin cost. AGIX good points with… USDC recovers peg after Circle funding points.

ETH

Ethereum rallied over 20% and Bitcoin was over 30% increased buyers turned to crypto after the fallout from the Silicon Valley Financial institution collapse.

Nexo’s Co-Founder Antoni Trenchev advised Yahoo Finance:

We’re seeing a flight into Bitcoin and Ethereum as a result of folks wish to escape among the smaller caps and among the stablecoins which might be on the market.

Nevertheless, he additionally anxious that the shutdown of Signature Financial institution might have an hostile impact on the business.

“I have no idea what precisely was flawed at Signature Financial institution. And I am no fan of conspiracy theories, but it surely’s apparent proper now that the blockchain area has very restricted entry to fiat and that the banks that had been servicing the area are all however gone,” he added.

“… new cash, if it desires to return into the area from US {dollars} to crypto-native belongings, can have a very onerous time. So the second-order results of the shutoffs of the fiat ramps might be felt within the months to return”.

Nevertheless, the 2 largest cryptocurrencies surrendered a few of their good points on Monday and one ETH whale had moved over $33 million price of ether to Binance.

The worth of ETH has hit resistance at $1,800 and should pull again to check the current breakout degree round $1,660.

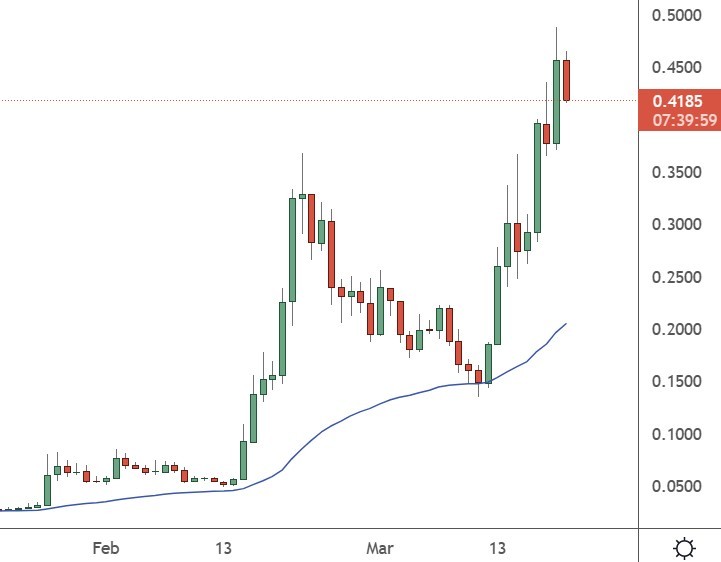

CFX

Conflux Community led the marketplace for the most important altcoins with a 74% rally for the week. The transfer has introduced CFX to a $1 billion market cap and into the highest 50 cash.

Conflux has been receiving quite a lot of investor consideration in 2023 as it’s a Chinese language crypto undertaking. Though the nation’s authorities took a hard-line strategy to crypto prior to now, there’s hope that they’ve cooled their regulatory efforts, which was evident within the expertise area.

The federal government is now mentioned to be taking an curiosity in Hong Kong’s strategy to digital belongings, whereas Chinese language companies, comparable to China Telecom are additionally transferring ahead. The corporate is claimed to be collaborating on sim playing cards which might be based mostly on blockchain expertise.

Conflux is a layer 1 blockchain within the model of Ethereum that makes use of a novel Tree-Graph consensus algorithm. This enables for the parallel processing of blocks for elevated velocity and scalability.

At current, Ethereum depends on third-party scalers to attain this purpose, with gasoline charges nonetheless costly on the ETH community.

The worth of CFX now trades at $0.41 after a surge from $0.05 in February.

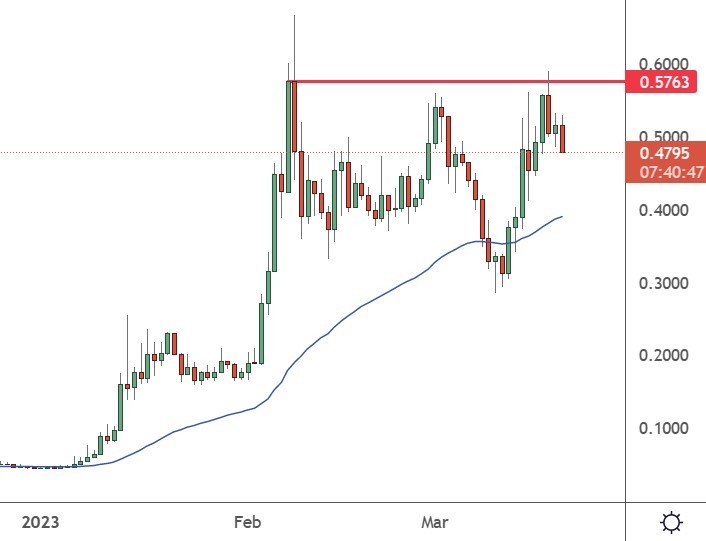

AGIX

SingularityNet (AGIX) was up over 20% this week and that is one other undertaking to see robust good points this 12 months.

The undertaking rose together with different synthetic intelligence (AI) cryptos and hit resistance across the $0.580 value degree.

AGIX is now the second-largest token by market worth within the AI area, behind The Graph. The latter has $1 billion in market cap versus the $580 million.

The newest good points for SingularityNet (AGIX) have come from the launch of a utility token by the undertaking. Rejuve (RJV) was launched with the purpose to hurry developments in human well being and lifespans. SingularityNET’s thrust, when it comes to the social impression it goals to attain, is kind of The brand new coin can add worth to SingularityNet and its purpose to “create, share, and monetize” AI providers by its international AI market. Customers of {the marketplace} should buy developer providers or supply them and the undertaking may even profit from the information database that these choices present.

The worth of AGIX could have topped for now, with a possible pullback to $0.400 within the works. The potential to develop additional with AI developments will proceed to assist the coin.

USDC

The worth of the USDC stablecoin was capable of regain its peg to the U.S. greenback after a rocky interval introduced on by the collapse of Silicon Valley Financial institution.

Circle, the founding father of the second-largest crypto stablecoin had mentioned that $3.3bn of its deposits had been held within the failed lender. That led to merchants promoting the coin for concern of it shedding its safe standing. As soon as the Federal Reserve and different regulators introduced that each one depositors would see the return of their funds, the USDC coin rallied again to its $1.00 peg.

Issues at Circle might’ve been unhealthy for the general market with Coinbase and Binance among the many exchanges suspending buying and selling within the coin till the problems had been resolved. USDC has returned to its $1.00 peg however has been unable to see deposits return. The undertaking has $36 billion in deposits after dropping from $43 billion. The undertaking at the moment has round half the market worth of the tether stablecoin.

On March 13, Circle introduced that Cross River Financial institution could be the corporate’s new business banking associate assigned to creating and redeeming USDC. Cross River Financial institution additionally supplies providers to Coinbase, whereas Circle will additional its ties to Financial institution of New York Mellon. The agency’s remaining SVB funds might be transferred to BNY, which already supplies custody for Circle reserves.

Disclaimer: data contained herein is supplied with out contemplating your private circumstances, subsequently shouldn’t be construed as monetary recommendation, funding suggestion or a proposal of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)