Ethereum provides 3% as promoting slows down, Binance Coin the largest winner in most sensible ten, FTM up 43%, Tether loses flooring in stablecoin rout.

ETH

Ethereum noticed a leap of over 3% within the final week because the cryptocurrency marketplace stabilized from fresh promoting.

Alternatively, the transfer upper has been vulnerable as buyers nonetheless concern additional problem available in the market.

Ethereum’s founder Vitalik Buterin has mentioned there is usually a extend within the rollout of its long-awaited Merge improve and that has weighed on worth. Buterin used to be speaking on the ETH Shanghai Internet 3.Zero convention and mentioned:

This shall be a significant take a look at, higher than any of the exams that we have got completed ahead of, Taking a big current take a look at community with many programs with proof-of-work, transferring into proof-of-stake…If there aren’t any issues then the merge will occur in August. However in fact, there’s at all times a possibility of issues. There’s additionally a possibility of delays. And so September is imaginable and October is imaginable as smartly.

In the most recent feedback from Ethereum builders, some have mentioned August may well be the date.

Preston Van Loon mentioned:

“So far as we all know, if the whole lot is going to devise, August — it simply is smart. If we don’t have to transport (the trouble bomb), let’s do it once we will be able to.”

The Merge is scheduled to be introduced in this testnet on June 8, 2022. ETH trades at $2057 which is some distance from its November highs of $4,800.

USDT

The USDT stablecoin is shedding flooring with a drop in its marketplace capitalization because the UST Terra crash.

Tether now has a marketplace cap of $72bn and has USD Coin respiring down its neck at $53bn. Tether has dropped as little as $0.9704 within the fresh marketplace tumble with the marketplace cap falling from round $83bn to the present degree, $10bn decrease.

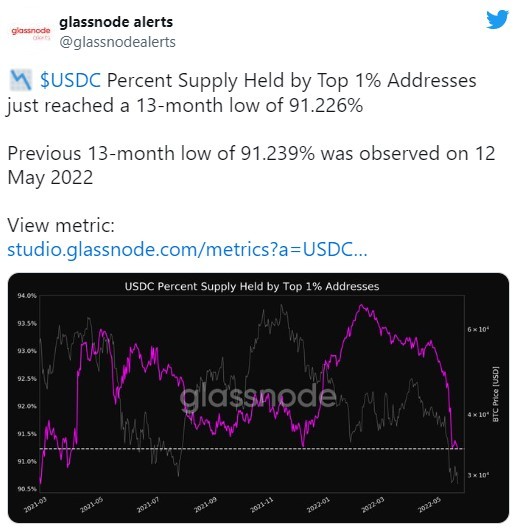

Alternatively, USDC may be seeing some outflows with a 13-month low in whale holdings as buyers flip clear of stablecoins after the new turmoil, in step with Glassnode.

However the analysts had been assured in a contemporary file that USDC used to be rising in significance.

“USDC reversed the craze of provide contraction that has been in position since past due Feb, increasing by means of $2.639B.”

Given the dominant expansion of USDC over the past two years, this can be a trademark of adjusting marketplace choice clear of USDT and against USDC as the most popular stablecoin.

It is going to be attention-grabbing to observe how USDC plays within the coming weeks, or if buyers chop extra price from USDT, which has lengthy been essentially the most precious stablecoin.

BNB

The cost of Binance Coin rallied essentially the most of any coin within the most sensible ten with a 14% achieve.

It used to be combined fortunes for the corporate’s founder who remarked that he’s ‘deficient’ once more after the LUNA coin worth crash.

In 2018, Binance gained 15 million tokens of LUNA for a $Three million funding into the Terra community. At its April top, the funding in stablecoins reached $1.6 billion. After the new crash, the tokens at the moment are worth round $2,000.

However in spite of the large loss for Binance, Changpeng Zhao mentioned he nonetheless desires to peer retail buyers who misplaced cash all over Luna’s crash be reimbursed ahead of Binance.

“To steer by means of instance on PROTECTING USERS, Binance will let this cross and ask the Terra mission staff to compensate the retail customers first, Binance final, if ever,” Zhao wrote.

The cost of Binance Coin has rallied to $334 however has noticed a stoop from the November crypto highs. Binance used to be answerable for $7.7 trillion crypto trade quantity in 2021 and noticed 24hr quantity of virtually $14 billion.

FTM

The cost of Fantom rallied over 40% at the week over hypothesis that probably the most mission’s key builders used to be returning.

Andre Cronje led to some commotion within the Fantom group within the final week after he submitted an fUSD optimization proposal that may glance to resolve the stablecoin’s de-pegging drawback. Cronje used to be credited with developing the yield optimization instrument Yearn Finance and a few different DeFi protocols. FTM suffered when he introduced he can be leaving crypto to go back to the normal finance sector in March. That announcement took place days after the release of the long-awaited Solidly mission at the protocol.

Prior to now two weeks, a Fantom blockchain deal with which is regarded as owned by means of Cronje has added over 100 million FTM up to now two weeks.

The fUSD proposal comes after difficult occasions for the stablecoin sector of cryptocurrency. Terra’s cave in got here after a lack of self assurance in its UST stablecoin, which misplaced its peg to the greenback. Alternatively, the Fantom Basis commented on a Twitter submit that “fUSD isn’t UST”.

Customers create fUSD by means of borrowing towards their staked FTM. If the worth of the FTM is going underneath the minimal collateral ratio, then the FTM is regularly auctioned off to customers who bid the usage of fUSD (to stay peg).

The cost of FTM rallied to the $0.500 degree however the 40% go back doesn’t glance so spectacular in comparison to its fresh worth motion as DeFi initiatives had been hit laborious by means of the new stoop and Fantom will want to proper its stablecoin problems.

Disclaimer: data contained herein is equipped with out bearing in mind your own instances, due to this fact will have to now not be construed as monetary recommendation, funding advice or an be offering of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)