With a sleepy begin to 2022, bitcoin has been outpaced by means of the vintage commodity — however this is able to exchange speedy.

With a sleepy begin to 2022, bitcoin has been outpaced by means of the vintage commodity — however this is able to exchange speedy.

For the reason that introduction of Bitcoin, bodily gold and virtual gold were offered as foils to traders. However views of every asset’s underlying mining business are too steadily missing from the comparability conversations.

Specifically, the previous 12 months of marketplace task have highlighted some essential idiosyncrasies and similarities between the yellow steel and its blockchain-based counterpart. Whilst bitcoin mining corporations considerably outperformed gold miners a number of months in the past, the marketplace pattern has shifted to choose gold. However will this dynamic closing?

Overviewing probably the most newest marketplace knowledge for bitcoin and gold miners is the purpose for this text. Alongside the way in which, the information will level to essential similarities and variations between the 2 industries appearing that, in many ways and in spite of relentless banter on Twitter, miners of gold and bitcoin have extra in not unusual than is normally assumed.

Mining Knowledge Replace

All of the charts on this segment visualize other knowledge units for the general public bitcoin and gold mining industries. The charts is also pointless although, for the reason that die-hard gold recommend Peter Schiff has been awfully vocal about his favourite yellow steel not too long ago.

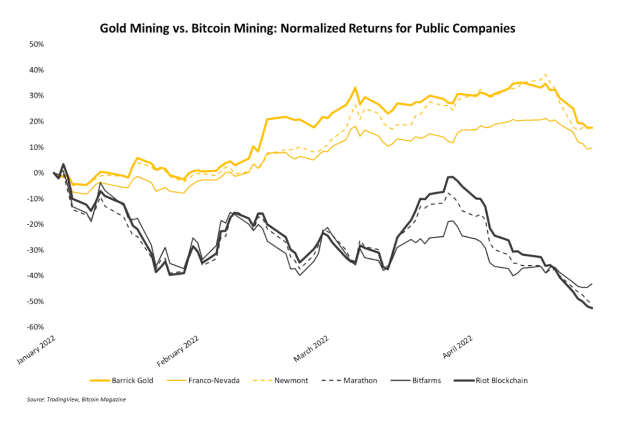

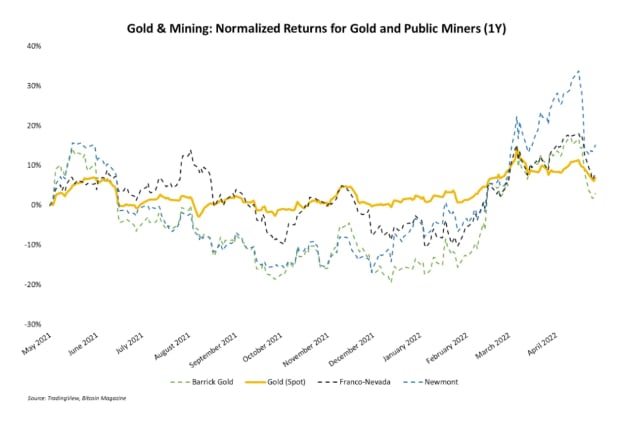

The normalized year-to-date efficiency of a few best gold corporations in comparison to a couple of best bitcoin mining corporations are nearly replicate photographs of one another. The road chart beneath presentations those two teams – gold and bitcoin corporations – and their developments in 2022. Features for public gold mining corporations are within the double-digit percentages whilst worth actions for bitcoin miners are kind of the similar however in the other way.

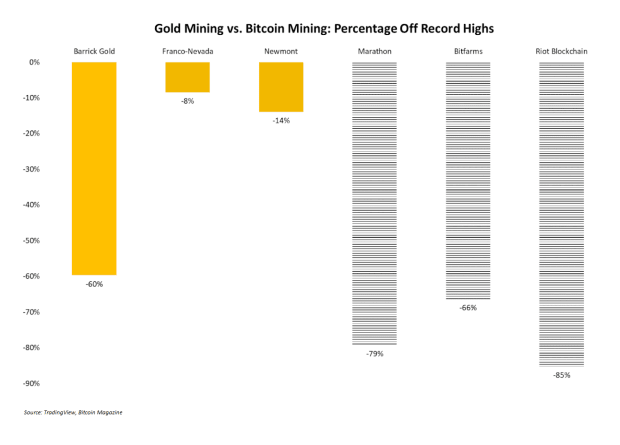

Evaluating those corporations in line with how a ways beneath their all-time worth highs additionally demonstrates the new relative power of bodily gold in comparison to virtual gold. The bar chart beneath presentations this information. Readers will understand Barrick Gold continues to be smartly beneath its prime set a number of years in the past in spite of the new total power of the gold marketplace. Bitcoin mining corporations, by means of comparability, are sitting between 60-80% less than their highs.

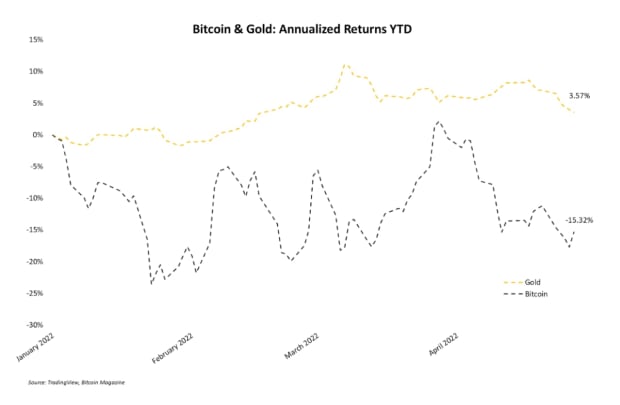

All this information tracks carefully with the returns for gold and bitcoin themselves, as one would be expecting.

For Bitcoin, the begin to 2022 has no longer been in particular energetic. The main cryptocurrency has most commonly traded in a spread between $36,000 and $46,000, from time to time deviating from this space for short sessions. No longer strangely, this worth motion has brought about bitcoin’s market volatility to continuously decline.

In the meantime, gold has loved a quite robust begin to the 12 months, continuously buying and selling upper since January. The chart beneath presentations year-to-date returns for bitcoin and the yellow steel.

Measured in proportion drops from all-time highs, gold wins once more. (Cross forward and snicker, Schiff.) On the time of writing, gold is kind of 6% off its report prime whilst virtual gold is buying and selling over 40% less than its prime level, reached in overdue 2021.

Honey Badger Behavior

Bitcoin being outperformed by means of a yellow steel isn’t the norm for the connection between those two markets, then again. All over 2021, for instance, bitcoin and its mining corporations loved a robust and extended uptrend in worth whilst gold and gold miners lagged considerably. Some charts proven later on this article reveal this era.

However for now, as bitcoin sits in a quite small worth vary and volatility drops, gold is taking heart degree. So, will it closing?

In fact, that is an open query for which predictive solutions are demanding to offer. In comparison to gold mining corporations, bitcoin miners are a a ways more recent and not more established or environment friendly business, which could have robust results on their worth efficiency. With time, it’s affordable to be expecting those nascent traits to be outgrown. Additionally, hedge finances which might be lively within the gold marketplace are reportedly expanding their bearish bets at the steel, which might sign gold’s near-term long run.

Miners Can Be Buddies

Hanging apart the marketplace knowledge and worth comparisons for now, those two mining industries have extra in not unusual than is in most cases said. Point out gold and bitcoin in combination in the similar tweet, and a kind of innovation-versus-antiquity animosity is nearly instinctively implemented as an undertone to no matter is written. However each belongings constitute asset categories liked by means of other colleges of political libertarians and financial freethinkers, even supposing generational divides steadily overshadow the 2 investor teams.

Gold and bitcoin miners each proceed experiencing the entire weight of environmental ire from non-profit organizations, reporters, and politicians whose platforms and private manufacturers require lambasting purportedly heinous crimes towards the local weather. Even supposing some bitcoin traders (together with this creator) love to from time to time poke fun at footage of gold mining websites in comparison to bitcoin mining farms on social media, fact is that each kinds of miners are and most likely at all times can be closely disfavored by means of environmental teams.

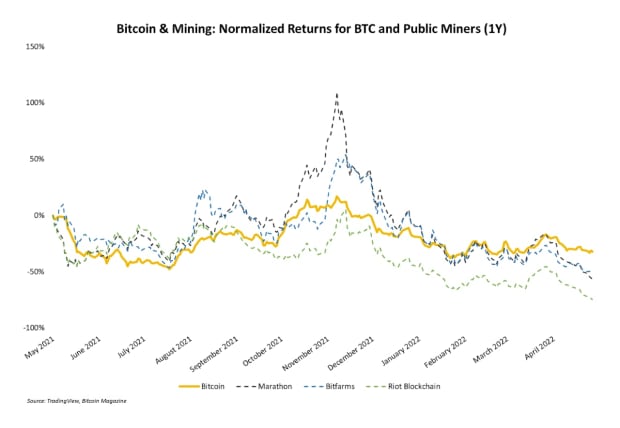

One different noteworthy similarity is how either one of those teams of businesses business in comparison to their underlying asset. Gold and bitcoin mining corporations business in public markets as successfully leveraged bets on no matter commodity the corporate mines. When both bitcoin or gold strikes in a route, publicly-traded mining corporations for both asset practice swimsuit however with extra exaggerated strikes up and down.

The chart beneath visualizes 12 months of normalized worth motion for bitcoin and a couple of mining corporations incorporated in charts proven previous on this article. It’s simple to note when bitcoin strikes up or down how mining inventory costs practice with higher proportion strikes.

This dating is much more pronounced in the similar chart constructure for gold and gold miners. Over the similar length (previous 12 months), sessions the place gold traded decrease had been adopted by means of even higher downward strikes by means of gold corporations. The other is right for gold’s newest few months of bullish worth motion.

Conclusion

Bitcoin and bitcoin mining corporations underperforming gold as they’ve to start out 2022 is anomalous however no longer unexplainable. Gold insects could have their laughs for now, however the honey badger is handiest dozing. And although social media banter normally pits those two belongings and their traders towards every different, gold and bitcoin miners have extra in not unusual than is normally known. Each kinds of miners are, in many ways, extra so brothers-in-arms than enemy warring parties. Particularly on environmental problems, even supposing virtual gold replaces a good portion of the yellow steel’s marketplace, each sorts of mining percentage a not unusual bond in being brutalized by means of woke environmentalists. In spite of everything, for now gold can revel in its second to outshine bitcoin as a result of ultimately virtual gold can be again within the motive force’s seat.

This can be a visitor put up by means of Zack Voell. Reviews expressed are totally their very own and don’t essentially replicate the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)