We’re going to continue our dialog of Bitcoin’s function in humanitarianism, this time within the realm of personal assets rights. However sooner than we speak about that, we want to perceive why non-public assets is so vital.

One of the crucial largest drivers of financial expansion and better requirements of dwelling is non-public assets rights.

That is the concept you personal the culmination of your exertions in addition to the rest you buy with the culmination of your exertions. Let’s say this, let’s say you might be operating at an organization and also you save sufficient cash to shop for a automobile. The cash you earn (which is the fruit of your exertions) and the auto are each your own home. The federal government has to give protection to your own home from robbery by means of different non-public folks, and the federal government itself can not take your own home with out due purpose and/or simply repayment.

Personal assets rights are vital as a result of they incentivize productiveness. Individuals are disincentivized to paintings if the cash they earn or the stuff they purchase will also be confiscated with out caution or repayment.

And in a society the place individuals are disincentivized to paintings, there are fewer services and products to be had and not more innovation going on. Those 3 components are the important thing drivers in making improvements to a area’s way of life. Personal assets rights are the explanation why there are higher vehicles yearly, higher telephones, computer systems and sooner web.

However, assets rights don’t exist naturally. They should be enforced by means of a central authority that punishes other folks for stealing folks’s assets in addition to no longer encroaching by itself citizen’s assets. And, sadly, many nations world wide shouldn’t have a central authority that does this.

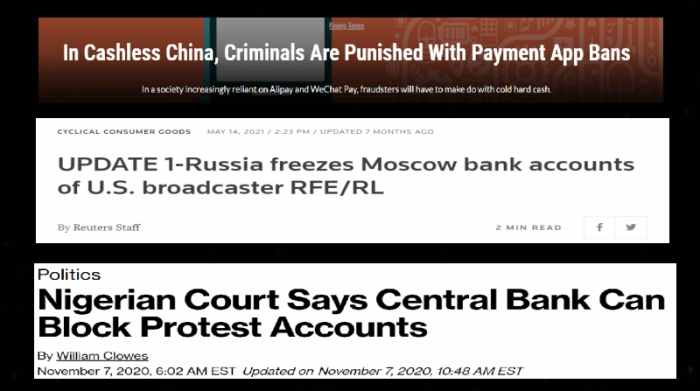

For instance, the Chinese language govt will bring to an end other folks from Alipay and WeChat Pay, in style Chinese language fee programs, in the event that they make statements that cross towards the present authoritarian regime. Russia will freeze other folks’s financial institution accounts in the event that they unfold information that works towards the Kremlin and its pursuits. And in 2021, Nigeria iced over the financial institution accounts of voters protesting towards the federal government.

The loss of appreciate for personal assets harms those nations’ voters and helps to keep them in a worse state of dwelling relative to different freer nations. It’s no longer a twist of fate that democratic nations are a lot wealthier than authoritarian nations.

How Does Bitcoin Offer protection to Belongings Rights?

Bitcoin’s blockchain, by means of design, makes it unattainable for personal and public actors to take keep an eye on of any individual else’s cash. The blockchain is proof against robbery and unitary keep an eye on as a result of this is a decentralized gadget. The blockchain is unfold throughout a community of computer systems, known as nodes, and to keep an eye on the blockchain, you would need to keep an eye on a minimum of 50% of the nodes within the community. It is a digital impossibility for the reason that quantity of power and assets had to keep an eye on 51% of the community can be insurmountable by means of any sensible measure these days. The blockchain has stood the take a look at of time, in that 51% of it has but to remain under the control of a unmarried actor, and because the choice of nodes grows, this turns into much less and not more prone to occur.

Voters below an authoritarian govt shouldn’t have to fret in regards to the govt stealing their bitcoin, nor do they’ve to depend on inept failing governments to give protection to their assets.

For hundreds of thousands of other folks world wide, bitcoin is their first probability to follow self-sovereignty over their very own cash. Their cash is below their keep an eye on and they do not have to fret about any individual stealing it. Bitcoin helps them keep the human proper to non-public assets.

It is a visitor publish by means of Siby Suriyan. Critiques expressed are totally their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)