Marketplace sentiment is the general public hobby within the underlying property and the conduct of investors on derivatives markets. Due to sentiment research, one can determine the angle of long-term traders, as they at all times promote all the way through the uptrend to momentary speculators and purchase the dips with a statistically certain expectation. To the contrary, the group psyche is irrational, as they continuously purchase with spiking candlesticks in worry of lacking out and dumping within the downtrend.

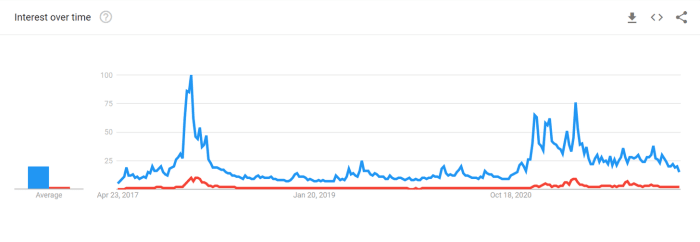

The general public hobby has cooled off as proven in google pattern information (Source).

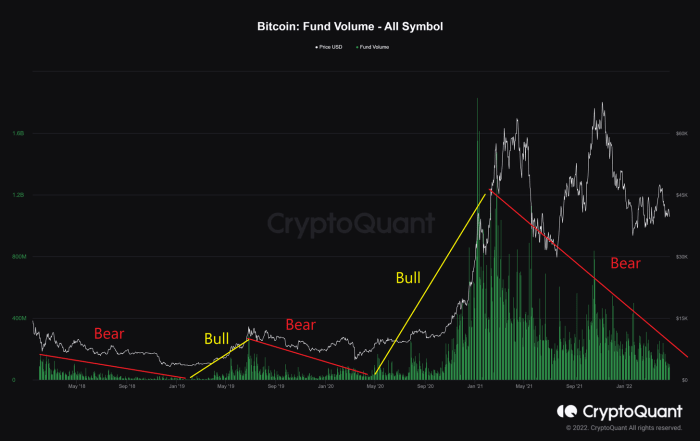

The very first thing to be taken under consideration when inspecting marketplace sentiment is the fund quantity which performs a pivotal function in whether or not the marketplace is trending or consolidating because it depicts the buying and selling quantity. In a bull marketplace, fund quantity will increase at the side of the associated fee and vice versa, nevertheless it has step by step lowered because the Might 2021 top.

The fund buying and selling quantity greater in bull and lowered in endure (Source).

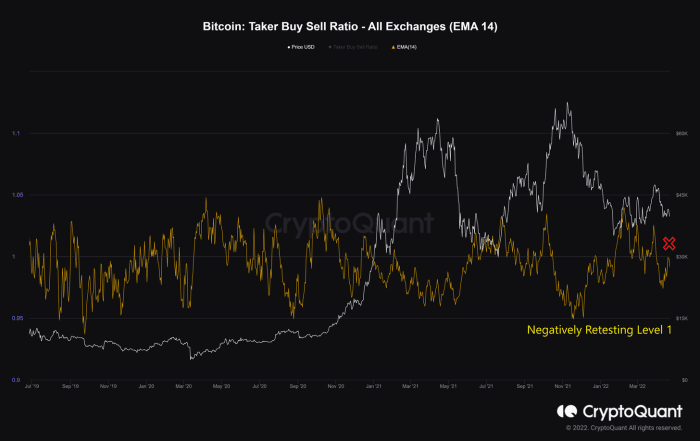

At the same time as, having seemed on the ratio of purchase quantity divided by means of promote quantity of takers in perpetual change trades, values over one — extra purchase orders taken by the use of marketplace order — point out bullish sentiment is dominant. In a similar fashion, values below one point out the dominance of bearish sentiment as extra promote orders are actively achieved thru marketplace orders. Additionally, the 14-day exponential shifting moderate (EMA-14) of the taker purchase/promote ratio has been adverse and not too long ago retested the extent of 1, suggesting that extra dealers are prepared to promote cash at a cheaper price and that promoting drive is more potent than the purchasing drive.

Taker purchase/promote ratio EMA-14 in adverse zone and retesting the extent one (Source).

In a bull marketplace, there may be an expanding liquidation in correlation to the upward thrust in value. The present general quantity of liquidated lengthy and quick positions within the derivatives marketplace is rather low when put next with the former bull runs.

Small liquidation signaling bearish sentiment (Source).

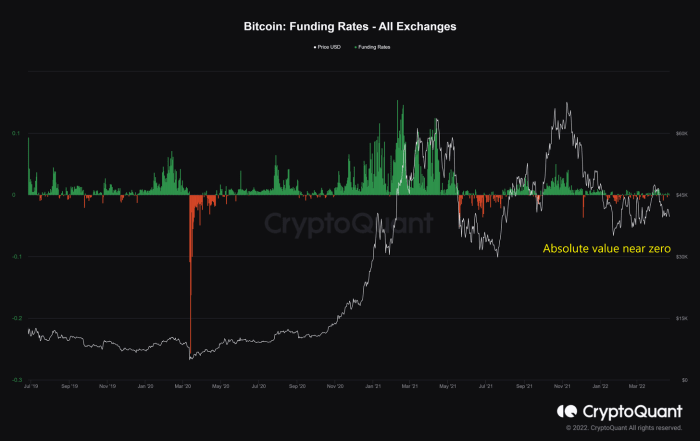

“Investment charges constitute investors’ sentiment within the perpetual swaps marketplace and the quantity is proportional to the choice of contracts. Sure investment charges point out that lengthy place investors are dominant and are prepared to pay investment to quick investors. Adverse investment charges point out that quick place investors are dominant and are prepared to pay lengthy investors” (Source).

The upper absolutely the worth of the investment price is, the extra competitive the investors are. Then again, the present absolute worth of the investment price has been soaring close to 0, this means that investors don’t seem to be competitive below the present financial stipulations.

Investment’s absolute worth close to 0 asserting no aggressiveness amongst investors (Source).

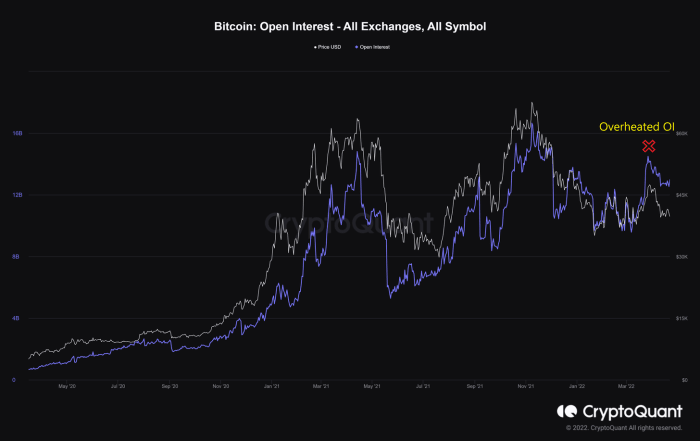

Probably the most vital elements of the derivatives marketplace is open hobby (OI) outlined because the choice of open positions recently on a by-product change’s buying and selling pairs. The expanding OI from March eight to March 28, 2022, is overheated and intentionally pushed by means of the momentary investors as there was once an open-ended capitulation that initiated on the top of $48,000 on March 28. Therefore, it isn’t able to supporting a conceivable uptrend.

Overheated OI pushed by means of momentary investors plummeting as a capitulation (Source).

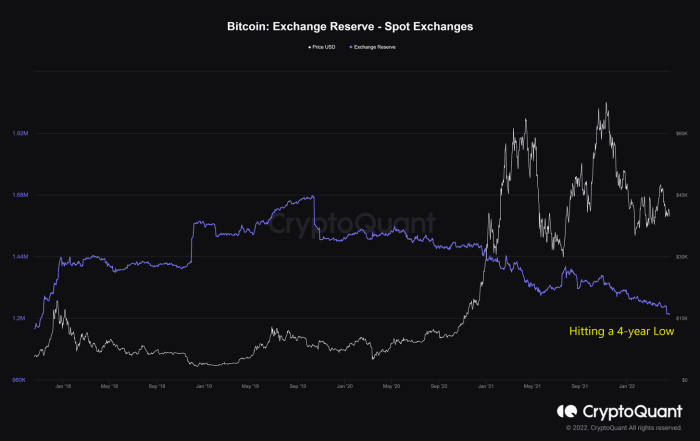

In the meantime, the overall choice of bitcoin held within the spot change has hit a four-year low, and that is continuously thought to be a just right signal within the elementary on-chain process.

The spot change reserve hit a four-year low as a just right signal (Source).

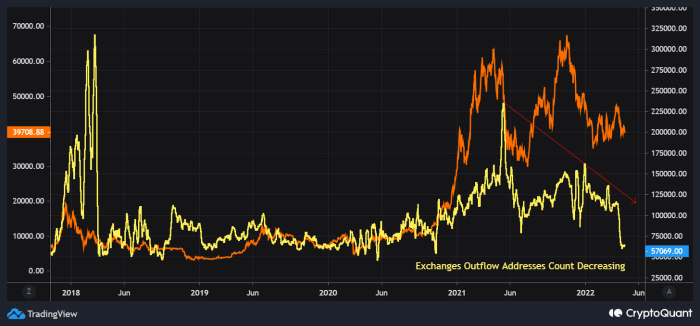

However extra importantly, it might not be the retail’s process because the change outflow addresses depend has plummeted since Might 10, 2021. It means that no longer many retail traders transfer the ones cash off of exchanges however may well be whale accumulation as an alternative.

The change outflow deal with plummeting as retail traders are much less energetic (Source).

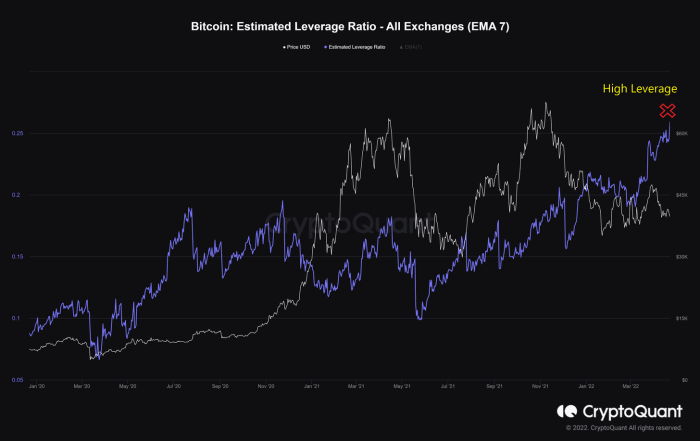

As well as, the downtrend in exchanges’ reserve and overheated OI make the estimated leverage ratio upper, calculated by means of the change’s open hobby divided by means of their bitcoin reserve. It finds that upper leverage is utilized by customers on moderate, this is, extra traders are taking high-leverage possibility within the derivatives industry.

Heated Leverage makes the marketplace riskier (Source).

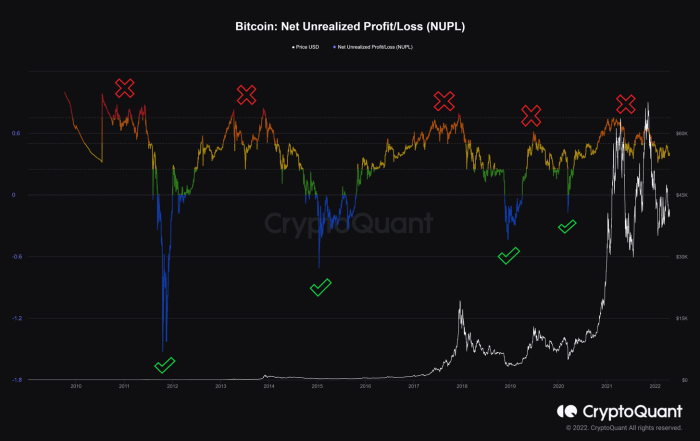

Closing however no longer least, internet unrealized benefit and loss (NUPL), the adaptation between marketplace cap and discovered cap divided by means of marketplace cap, signifies the capitulation segment has begun since Might 2021. The maximal worth of the ratio of traders who’re in benefit was once that day, and a sell-off has ensued. Nowadays, bitcoin is also in the midst of this segment with the believable explanation why to take benefit till not more promoting drive.

NUPL supposing the marketplace being within the semi-capitulation segment (Source).

On stability, marketplace sentiment isn’t as robust as on-chain process. There may be the chance that we’re in a semi-bear marketplace by which the continued capitulation has taken impact since Might 2021, and the ongoing accumulation segment has perceived to wipe out the momentary speculators.

This can be a visitor submit by means of Dang Quan Vuong. Evaluations expressed are fully their very own and don’t essentially mirror the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)