The underneath is an excerpt from a contemporary version of Bitcoin Mag Professional, Bitcoin Mag’s top rate markets e-newsletter. To be a few of the first to obtain those insights and different on-chain bitcoin marketplace research directly in your inbox, subscribe now.

Retail Holds 14% Of Provide

One of the commonplace Bitcoin worry, uncertainty and doubt (FUD) reviews is that almost all of provide is closely concentrated within the arms of the few. Like each monetary machine or asset elegance that exists these days, there may be some reality to that form of distribution nevertheless it’s virtually all the time exaggerated in Bitcoin’s case.

Bitcoin’s percentage of provide held through estimated retail people has been taking extra percentage of the community yearly. It’s probably the most handiest property on the earth the place somebody with an web connection and a smartphone can download, having extremely low adoption friction for the typical particular person.

Many critics cite an deal with chart like this one and contact it reality. In reality that monitoring provide distributions throughout addresses is extremely nuanced and it’s a key explanation why Glassnode has used a suite of heuristics and clustering algorithms to estimate entities, reasonably than addresses, at the community.

What Glassnode discovered of their research a yr in the past, is that:

“We will derive that round 2% of community entities keep watch over 71.5% of all Bitcoin. Notice that this determine is considerably other from the frequently propagated ‘2% keep watch over 95% of the availability.’”

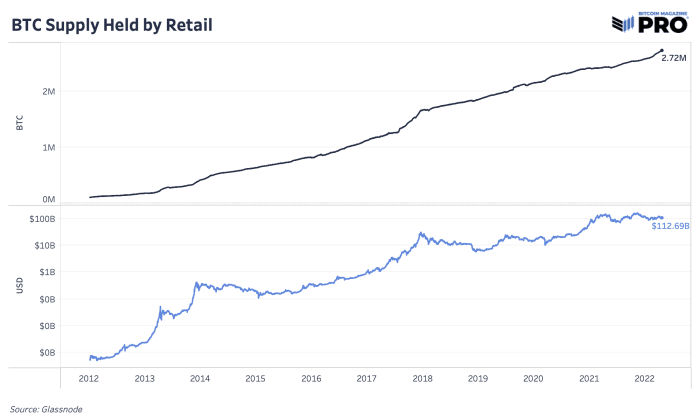

And that 71.5% used to be an higher certain, i.e., a prime estimate of the availability distribution focus. There are lots of the reason why the retail percentage is most probably greater as a result of bitcoin with custodians, provide on exchanges, misplaced cash, and a conservative method to spot entities.

When digging into the entities provide distribution information these days, we discover a transparent development of retail (entities conserving lower than 10 BTC) expanding their percentage of circulating provide from 1.51% in 2012 to 13.90% in 2022 on moderate. The most important percentage expansion of provide comes from entities conserving 1-10 BTC and zero.1 – 1 BTC.

Ultimate Notice

The knowledge contributes to the case that Bitcoin is a cash designed for and obtainable to the typical international particular person. Even if establishments and institutional capital flowing into the community is most probably the following primary worth catalyst and can have an effect on provide percentage, we proceed to peer the community percentage of retail upward push as somebody on the earth can gain and retailer bitcoin themselves.

It’s been a first-of-its-kind case learn about the place for as soon as, retail and persons are in a position to get right of entry to property and financial wealth sooner than establishments.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)