The corporate mentioned its general publicity to FTX was once a small portion of its complete portfolio.

Primary mission capital company Sequoia Capital has written down the price of its funding within the beleaguered crypto trade FTX, to 0.

Significantly, the corporate was once a part of the traders who participated in FTX’s $900 million investment spherical in July 2021, which introduced the trade’s valuation to $18 billion on the time.

Sequoia Marks Down FTX Funding to $0

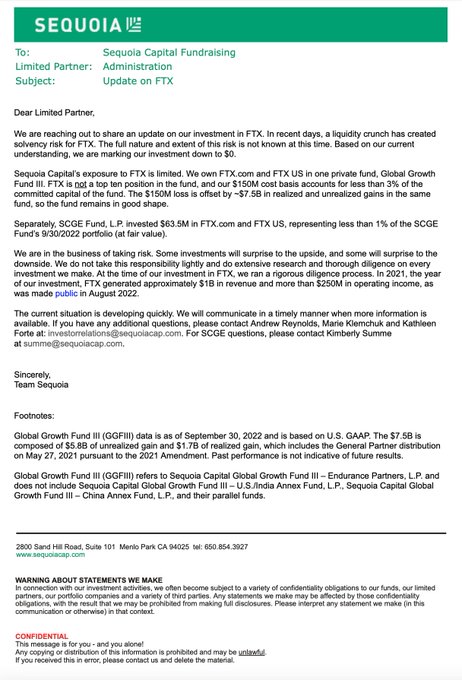

In a note to restricted companions (LPs), which was once published by means of Sequoia’s Twitter maintain on Thursday (November 10, 2022), the mission capital company said that its funding in FTX and FTX.US – the American-based unit of the trade – totaling $213.five million, is marked right down to $0.

Sequoia invested $150 million in FTX and FTX.US by means of its International Believe Fund III, noting that the funding accounted for simplest 3% of the whole capital within the fund. The mission capital company reassured LPs that the fund was once in excellent monetary situation because it has learned and unrealized beneficial properties of $7.five billion.

There was once additionally a separate funding of $63.five million in each entities throughout the SCGE Fund. However the publicity was once 1% of its portfolio.

Sequoia additional mentioned it at all times performed a radical diligence procedure earlier than making an investment and did the similar for FTX. The corporate was once a part of 60 traders who raised $900 million in FTX’s Sequence B investment in July 2021, which valued the trade at an estimated $18 billion.

“On the time of our funding in FTX, we ran a rigorous diligence procedure. In 2021, the yr of our funding, FTX generated roughly $1B in income and greater than $250 million in running source of revenue.”

Whilst Sequoia mentioned the character and extent of the chance are recently unknown, the company advised LPs that it will supply additional information at the FTX state of affairs, which the corporate is “growing temporarily.”

In the meantime, it is still noticed what motion different FTX backers, like Softbank, and Pantera Capital Temasek, will take.

Responses Proceed to Path FTX Cave in

U.S. Senator Elizabeth Warren weighed in at the FTX saga, mentioning that the trade’s cave in was once a sign that the trade was once all “smokes and mirrors.” Sen. Warren, some of the fiercest crypto critics on Capitol Hill, mentioned she would proceed to push for competitive enforcement for the SEC to “put into effect the legislation to give protection to shoppers and monetary balance.”

Former Kraken CEO Jesse Powell, in a long tweet thread, slammed FTX CEO Sam Bankman-Fried for his recklessness and sociopathic conduct. Powell additionally mentioned:

“The wear and tear right here is massive. An trade implosion of this magnitude is a present to bitcoin haters in every single place the sector. It’s the excuse they have been looking forward to to justify no matter assault they’ve been preserving of their again pocket. We’re going to be operating to undo this for years.”

The ex-Kraken leader additionally blamed U.S. regulators and lawmakers for no longer offering an enabling setting and appropriate regulatory insurance policies for crypto corporations to function.

The put up Sequoia Says Investment in FTX Does Not Negatively Impact its Fund gave the impression first on CryptoPotato.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)