“Fed Watch” is a macro podcast, true to bitcoin’s insurrection nature. In each and every episode, we query mainstream and Bitcoin narratives through analyzing present occasions in macro from around the globe, with an emphasis on central banks and currencies.

Watch This Episode On YouTube Or Rumble

Pay attention To The Episode Right here:

On this episode, CK and I quilt a big bite of the continuing macro information. First, we coated New York Federal Reserve President John William’s speech on inflation, then the U.N. record difficult central banks exchange route and in any case the OPEC choice to chop quotas through 2 million barrels in keeping with day (mbd).

Charts And Bitcoin Sentiment

Each and every week, CK and I lead off with a bitcoin chart to heart our macro dialog from this standpoint.

The day-to-day chart from this week displays a slight bullish curl because it approaches the diagonal pattern line. A number of signs are bullish, together with extra important weekly and per 30 days indicators.

At the weekly chart, the primary ever weekly bullish divergence has locked in. This doesn’t imply we will’t have additional drawback. If you happen to take a look at the crimson columns at the chart underneath that symbolize weekly bearish divergences, you’ll see they steadily are available multiples. Then again, on the first signal of a weekly divergence, it does sign that we’re very with reference to without equal reversal.

The sentiment within the Bitcoin ecosystem has began to shift from worry to being quite extra sure. If the fee can capitalize right here and get away, shall we revel in a large shift into bullish momentum.

On this segment, CK and I additionally talk about a conceivable bitcoin decoupling from shares. The correlation has been rather prime not too long ago, however bitcoin does be offering some basically other homes. As CK issues out, bitcoin isn’t weakened through being uncovered to a selected corporate’s revenues in a credit score disaster. The place corporations may face harsh credit score stipulations, bitcoin doesn’t. Bitcoin in reality advantages from a flight clear of credit score possibility.

How The Fed Defines Inflation

On this phase, I learn a number of quotes from a recent speech through John Williams, president of the New York Federal Reserve. Maximum of it revolved round a humorous definition of inflation, which Williams calls the “Inflation Onion.”

The primary layer of this onion is commodity costs, the second one layer is costs of goods like home equipment and cars. The innermost layer of the inflation onion is — stay up for it — underlying inflation.

There we’ve got it: Inflation is an onion of various layers of costs. On the root is provide and insist and underlying inflation. No point out in any respect of cash printing or debasement. I believe what he intends to painting is that inflation works its manner in the course of the financial system. Costs of commodities trickle inward to merchandise, on this case, which in flip trickle inward to such things as rents and exertions.

U.N. Tells Central Banks To Halt Price Hikes

This week noticed the discharge of the United Countries’ annual Trade and Development Report, by which they described the present standing of the worldwide financial system and equipped coverage suggestions. Total, I used to be stunned through the cogent nature of the record, getting many stuff proper. They even used phrases like “super-hysteresis” and shadow banking, concepts we’ve been speaking about on “Fed Watch” for years.

We undergo a number of quotes proper out of the record and in finding ourselves agreeing with them a couple of instances. It is just when the U.N. involves make suggestions that they lose us.

The coverage possible choices are directly out of the International Financial Discussion board or communist playbook. They’re stuffed with words like “equitable distribution of source of revenue” and “redistributive insurance policies.” What they would like the Fed to do is to forestall charge hikes which might be disproportionately hurting rising markets and as an alternative use value controls and regressive taxation.

OPEC+ Reduces Quota Via 2 Million Barrels In keeping with Day

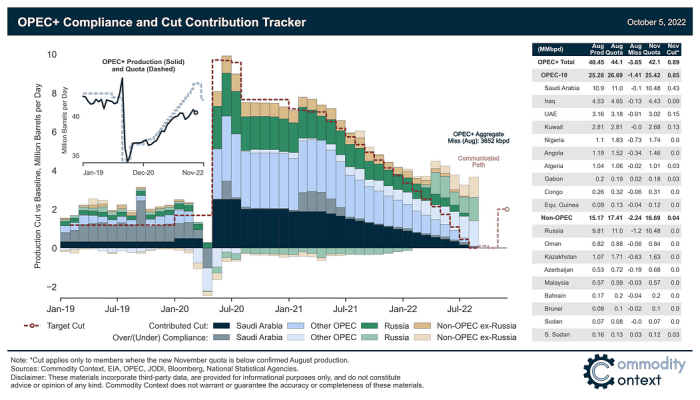

A large number of this tale doesn’t make sense to me. OPEC+ had an in-person assembly on October 5, 2022 and decided to scale back their oil manufacturing quota through 2 mbd. Then again, this comes as they’re lately generating 3.6 mbd underneath their present quota.

Supply: Commodity Context

Below the voluntary manufacturing quota lower, OPEC’s overall voluntary quota in November is 42.1 mbd, however their August manufacturing used to be 40.45 mbd. Because it stands now, the aid within the quota of two mbd, with present manufacturing ranges, simplest shrinks OPEC’s shortfall. They’ll nonetheless have 1.6 mbd of room to extend manufacturing!

Some persons are figuring the brand new voluntary quotas through nation, which ends up in a nil.86 mbd aid, most commonly from Saudi Arabia, however the overall is as mentioned above. I’ve been calling it voluntary as a result of OPEC officers stressed out that those quotas have been voluntary.

Wait, what? How is that this some kind of emergency? It’s now not. CK and I speculate on precisely why we see all of the fear-mongering headlines we do from this tale and it boils right down to election season timing and narratives.

It is a visitor submit through Ansel Lindner. Evaluations expressed are solely their very own and don’t essentially mirror the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)