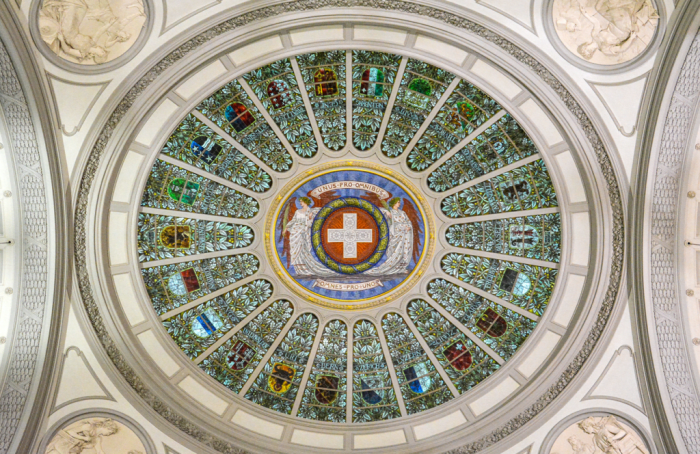

(Source) The dome of the Swiss Federal Palace with the coats of fingers of the cantons.

Fynn Kreuz is the CEO of the Swiss Bitcoin corporate, Numbrs.

Independence

In 1291, 3 areas of the Holy Roman Empire seceded and swore an oath that based the Swiss Confederacy. This motion, born out of a eager for freedom and independence, started when the legendary nationwide hero, William Inform, challenged a tyrannical bailiff known as Albrecht Gessler.

Over 700 years later, Bitcoin was once created to secede from the prevailing monetary and financial order. In its combat for freedom and independence, Bitcoin fights conventional finance, cheating narratives and the regulatory overreach of businesses such because the SEC, run by way of Gary Gensler. It’s stated that historical past does no longer repeat itself, however frequently rhymes. On this case, paradoxically, Gessler and Gensler actually rhyme.

Bitcoin and Switzerland proportion a elementary philosophy with regards to freedom and independence. We at Numbrs, imagine Bitcoin is the arena’s very best safe-haven retailer of worth and Switzerland will transform the logical vacation spot to retailer one’s valuable inner most keys. Rooted in its lengthy custom of protection, balance and privateness, Switzerland will turn out to be its monetary panorama, because of Bitcoin, and we can be at the vanguard of this inevitable construction.

Custom

Ever since its advent, Switzerland has molded its machine at the founding rules of freedom and independence. A deeply ingrained mistrust of centralized energy has given it a novel political machine in accordance with a free union of states, or cantons, which all retain their very own parliaments, governments and courts. This free union is sure in combination by way of a vulnerable central core, or federal govt, that enacts selections made in a machine of nationwide referenda. The overall inhabitants stays without equal arbiter of political energy and mother or father of the guideline of regulation. This decentralized governance machine has made it one of the vital most secure, maximum solid and wealthiest international locations within the historical past of the arena in addition to the arena’s premier safe-haven vacation spot for the buildup of wealth. A big portion of the arena’s artwork, gold and valuable stones are saved on the planet’s maximum protected vaults in Switzerland.

Switzerland additionally has an extended custom of economic privateness. Within the early 18th century, European Catholic monarchs gave their money to Swiss Protestant bankers to regulate and neither facet sought after it to be identified they had been coping with each and every different. The Great Council of Geneva thereby started a practice of banking secrecy, which might be enshrined in Swiss regulation in 1934. Next makes an attempt by way of governments around the globe to confiscate belongings and impose exorbitant taxes led an expanding quantity of capital to Switzerland. The status of the Swiss monetary machine has outlived political crises, global wars and financial catastrophes.

Revolution

Lately, banking secrecy in conventional finance is all however useless, however Bitcoin has established a brand new and awesome pseudonymous transaction machine. Thru cryptography, Bitcoin has allowed for the advent, switch and garage of monetary worth at the virtual sphere. It’s run on a decentralized, without boundaries protocol maintained by way of a world community of computer systems owned by way of no unmarried particular person, govt or criminal entity. Its provide is unalterable and is on a identified issuance time table, maxing out at 21 million bitcoin.

It’s massively awesome to money, as no govt has the facility to debase bitcoin by way of generating extra of it. It’s also awesome to gold and different valuable metals, as its provide is predictable, the time table of provide issuance is mounted and unalterable. Past its mounted provide, Bitcoin’s technical attributes make it a ways more secure, more effective and discreet than conventional retail outlets of worth. Monumental financial worth can also be simply divided and transferred around the planet affordably, securely and instantaneously in Bitcoin. The one infrastructure required for the machine to run is the web.

Past practicality, Bitcoin is breaking the standard monetary order by way of giving its customers unadulterated possession over their financial belongings. There is not any financial institution or monetary middleman which individuals must consider to regulate their livelihood. With a non-custodial pockets and personal keys, each and every consumer acts as their very own financial institution. This selection of Bitcoin, amongst others, is modern. You now not must consider banks and also you now not have to fret about governments implementing monetary censorship, confiscation or different draconian insurance policies via banks.

Bitcoin’s laborious cap, technical attributes and private-key possession make it the arena’s very best safe-haven retailer of worth. This monetary revolution allowed the Bitcoin community to settle over $13 trillion of transactions in 2021 and taken its marketplace cap to over $1 trillion. We imagine that is only the start and lengthening world instability and financial mismanagement will result in rising grassroots adoption and higher momentum for Bitcoin. Society will ultimately succeed in a tipping level and fiat can be fully discredited as a way of trade. Bitcoin will transform the one logical and viable selection. More and more international locations will settle for it as criminal gentle and make it the root of a brand new financial order.

Long run

With a view to totally take pleasure in this monetary revolution, customers should retailer their bitcoin in non-custodial wallets that give them complete keep an eye on over their inner most keys. Contemporary occasions around the globe have proven how governments can simply use banks and centralized exchanges to expropriate customers in their wealth. Bitcoin, via using inner most keys, places other folks’s wealth outdoor of this overreach. The possession and garage of personal keys is thus of primordial significance to keep one’s livelihood.

It is for that reason that Switzerland is the logical position to expand the most secure strategy to retailer bitcoin. With an extended custom of protection and monetary discretion, a Swiss non-custodial pockets, subsidized up by way of army encryption within the center of the Swiss Alps, is the one manner that one’s bitcoin can be totally secure and very easily available.

To ensure that Switzerland to stay at the vanguard of finance, it’ll have to conform and proceed its lengthy custom of economic safety and excellence. We’re extremely joyful to look that the criminal framework is on the chopping fringe of the desires of a brand new virtual financial machine and we can proceed to try to take a number one function within the business.

It is a visitor publish by way of Fynn Kreuz. Reviews expressed are fully their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)