A “paradigm,” as defined by Ray Dalio, is a time period all the way through which “Markets and marketplace relationships function in a definite means that the general public adapt to and in the end extrapolate.” A “paradigm shift” happens when the ones relationships are overdone, leading to “markets that function extra reverse than very similar to how they operated all the way through the prior paradigm.”

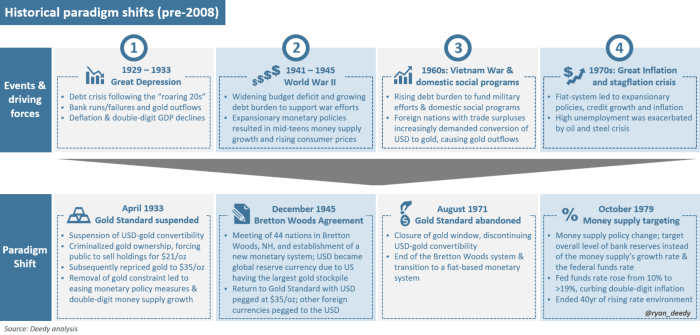

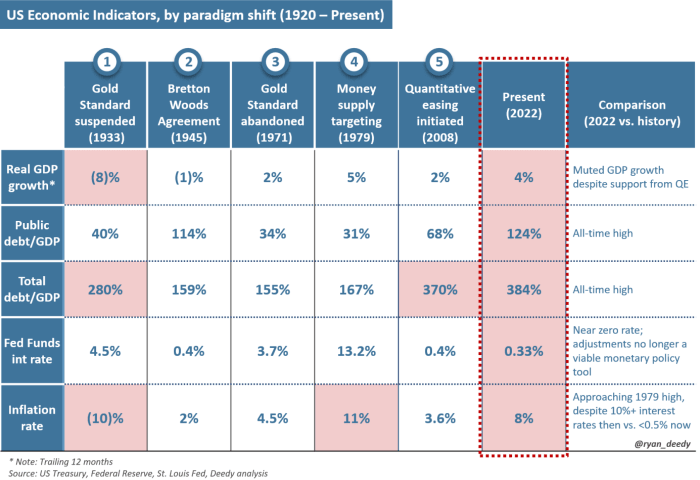

Previous to 2008, there have been 4 such paradigm shifts, every recognized by means of a subject matter exchange within the Federal Reserve Board’s financial coverage framework based on unsustainable debt enlargement. In 2008, we noticed the 5th and most up-to-date paradigm shift, when former Fed Chair Ben Bernanke presented quantitative easing (QE) based on the Nice Recession. Since then, the Fed has been running in uncharted territory, launching a couple of rounds of an already unconventional financial coverage with destructive results.

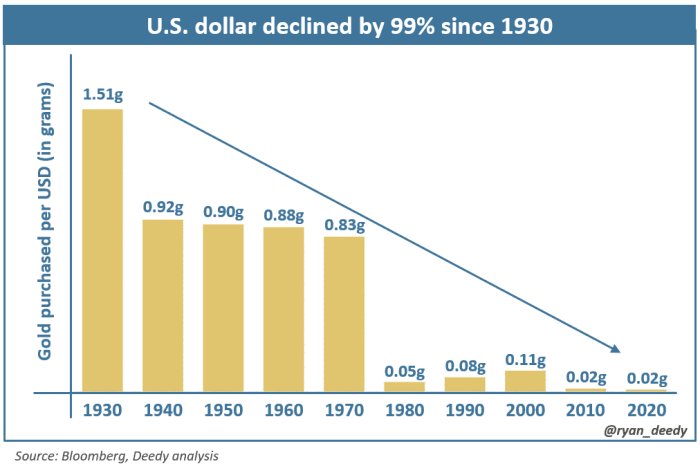

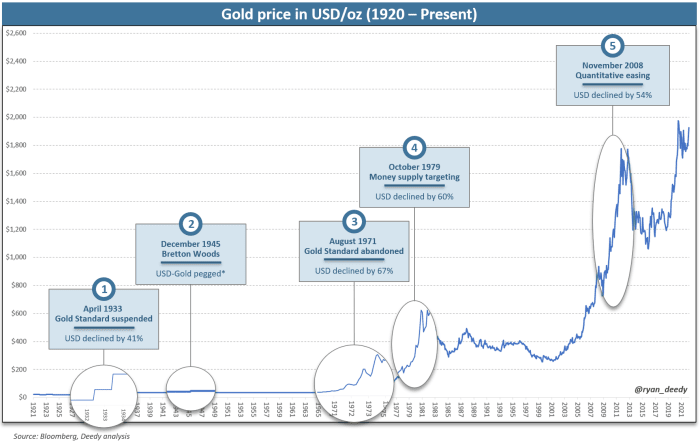

An important and painful result of the previous 5 paradigm shifts has been the devaluation of the U.S. buck. Because the first shift in 1933, the buck has misplaced 99% of its cost towards gold.

We’re lately residing thru a length with exceptional ranges of nationwide debt, expanding inflationary pressures and escalating geopolitical conflicts. This could also be coming at a time when the worldwide affect of the US is waning and the buck’s reserve foreign money standing is being referred to as into query. All of this means that the tip of the present paradigm is rapid drawing near.

Inspecting previous paradigm shifts will lead some to wait for a go back to the gold same old, however we now are living in a global with an alternate and awesome financial asset – bitcoin – which is readily gaining adoption amongst folks and countries. Not like in previous paradigms, the discovery of bitcoin introduces the opportunity of a brand new financial framework – a Bitcoin same old.

To raised assess the prospective affect from a transformation to the present financial gadget, it is very important know the way we arrived at this level. Armed with this data, we will be able to be higher situated to navigate the impending paradigm shift, the related financial volatility, and perceive the prospective affect at the buck’s cost. Bitcoin will most probably play a central position on this transition, no longer handiest as a financial savings instrument, but in addition in shaping long run financial coverage.

Debt’s Position In The Trade Cycle

A trade cycle refers back to the recurrent collection of will increase and reduces in financial task through the years. The 4 phases of a trade cycle come with enlargement, height, contraction and trough. The expansionary segment is characterised by means of bettering financial prerequisites, emerging client self belief and declining rates of interest. As enlargement hurries up and the provision of credit score expands, debtors are incentivized to tackle leverage to fund asset purchases. Alternatively, because the financial system reaches the later years of the cycle, inflation has a tendency to extend and asset bubbles are shaped. Height financial prerequisites can also be sustained for years, however in the end, enlargement turns unfavorable, resulting in the contraction segment of the cycle. The severity and duration of those downturns can range from a light recession lasting six months to a melancholy that lasts for years.

The volume of debt accrued all the way through the expansionary segment of the trade cycle performs a very important position in how policymakers react to financial crises. Traditionally, the Fed navigated maximum recessions by means of depending on its 3 financial coverage gear: open marketplace operations, the cut price price and reserve necessities. Alternatively, there have been 4 cases previous to 2008 the place the Fed pivoted from ancient norms and presented a brand new financial coverage framework, marking the tip of 1 paradigm and the start of every other — a paradigm shift.

Ancient Paradigm Shifts

The primary paradigm shift came about in 1933 all the way through the Nice Melancholy when President Franklin D. Roosevelt suspended the convertibility of greenbacks to gold, successfully leaving behind the gold same old. Severing the buck’s hyperlink to gold allowed the Fed to extend the cash provide with out constraint to stimulate the financial system.

Following years of world central banks investment their nation’s army efforts in WWII, the financial gadget skilled every other paradigm shift in 1945 with the signing of the Bretton Woods Settlement, which reintroduced the buck’s peg to gold. Reverting to the gold same old led to just about 15 years of most commonly wealthy occasions for the U.S. financial system. Nominal gross home product (GDP) averaged 6% enlargement, whilst inflation remained muted round 3.5%, regardless of very accommodative rate of interest insurance policies.

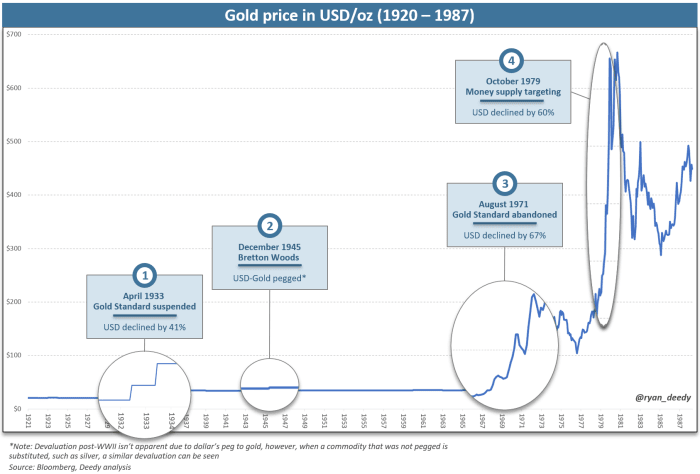

Alternatively, govt spending picked up within the 1960s to make stronger social spending techniques and to fund the Vietnam Battle. Ahead of lengthy, the federal government discovered itself saddled once more with an excessive amount of debt, emerging inflation and a rising fiscal deficit. At the night time of August 15, 1971, Richard Nixon announced that he would shut the gold window, finishing buck convertibility to gold — an particular default on its debt tasks — in an effort to curb inflation and save you overseas countries from retrieving any gold that was once nonetheless owed to them. Nixon’s announcement formally marked the tip of the gold same old, and the transition to a purely fiat-based financial gadget.

Like within the 1930s, leaving behind the gold same old allowed the Fed to extend the cash provide at will. The expansionary insurance policies that adopted fueled one of the most most powerful inflationary sessions in historical past. With inflation exceeding 10% by 1979, then-Fed Chair Paul Volcker made a wonder announcement that the Fed would start managing the amount of financial institution reserves within the monetary gadget, versus particularly focused on the cash provide’s enlargement price and day by day federal price range price. He warned that the exchange in coverage would permit rates of interest to have “substantial freedom in the market,” subjecting it to extra “fluctuations.” The federal price range price therefore started to extend and eventually exceeded 19%, sending the financial system right into a recession. Volcker’s coverage exchange and the reset of rates of interest to all-time highs marked the tip of 40 years of a emerging price atmosphere.

Ancient Paradigm Shifts

The primary paradigm shift came about in 1933 all the way through the Nice Melancholy when President Franklin D. Roosevelt suspended the convertibility of greenbacks to gold, successfully leaving behind the gold same old. Severing the buck’s hyperlink to gold allowed the Fed to extend the cash provide with out constraint to stimulate the financial system.

Following years of world central banks investment their nation’s army efforts in WWII, the financial gadget skilled every other paradigm shift in 1945 with the signing of the Bretton Woods Settlement, which reintroduced the buck’s peg to gold. Reverting to the gold same old led to just about 15 years of most commonly wealthy occasions for the U.S. financial system. Nominal gross home product (GDP) averaged 6% enlargement, whilst inflation remained muted round 3.5%, regardless of very accommodative rate of interest insurance policies.

Alternatively, govt spending picked up within the 1960s to make stronger social spending techniques and to fund the Vietnam Battle. Ahead of lengthy, the federal government discovered itself saddled once more with an excessive amount of debt, emerging inflation and a rising fiscal deficit. At the night time of August 15, 1971, Richard Nixon announced that he would shut the gold window, finishing buck convertibility to gold — an particular default on its debt tasks — in an effort to curb inflation and save you overseas countries from retrieving any gold that was once nonetheless owed to them. Nixon’s announcement formally marked the tip of the gold same old, and the transition to a purely fiat-based financial gadget.

Like within the 1930s, leaving behind the gold same old allowed the Fed to extend the cash provide at will. The expansionary insurance policies that adopted fueled one of the most most powerful inflationary sessions in historical past. With inflation exceeding 10% by 1979, then-Fed Chair Paul Volcker made a wonder announcement that the Fed would start managing the amount of financial institution reserves within the monetary gadget, versus particularly focused on the cash provide’s enlargement price and day by day federal price range price. He warned that the exchange in coverage would permit rates of interest to have “substantial freedom in the market,” subjecting it to extra “fluctuations.” The federal price range price therefore started to extend and eventually exceeded 19%, sending the financial system right into a recession. Volcker’s coverage exchange and the reset of rates of interest to all-time highs marked the tip of 40 years of a emerging price atmosphere.

Affect of Paradigm Shifts On The U.S. Greenback

Gold is without doubt one of the few commodities that has been used all over historical past as each a store-of-value asset and as a foreign money, evidenced by means of its position in financial techniques world wide, i.e., “the gold same old.” Irrespective of its bodily shape, gold is measured by means of its weight and purity. Inside the US, a troy ounce is the usual measure for gold’s weight and karats for its purity. As soon as measured, its cost can also be quoted in quite a lot of trade charges, together with person who references the U.S. buck.

With gold having a typical unit of measure, any fluctuation in its trade price displays an building up or lower within the respective foreign money’s buying energy. As an example, when the buying energy of the buck will increase, house owners of greenbacks can purchase extra devices of gold. When the buck’s cost declines, it may be exchanged for fewer devices of gold.

On the time of writing, the U.S. buck value for one troy ounce of gold with 99.9% purity is kind of $2,000. At this trade price, $10,000 can also be exchanged for 5 oz. of gold. If the buying energy of the buck strengthens by means of 20%, the fee for gold would decline to $1,667, permitting the consumer to buy six oz. for $10,000 in comparison to 5 oz. from the primary instance. On the other hand, if the buck weakens by means of 20%, gold’s value would building up to $2,500, permitting the consumer to buy handiest 4 oz..

With this courting in thoughts when looking at gold’s ancient value chart, the decline within the buck’s buying energy all the way through ancient paradigm shifts turns into obtrusive.

Quantitative Easing In The Present Paradigm

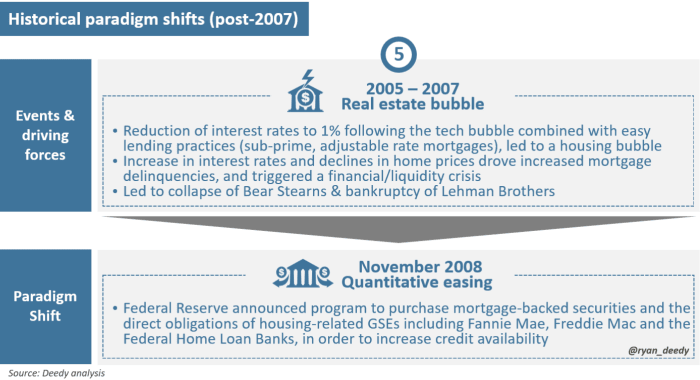

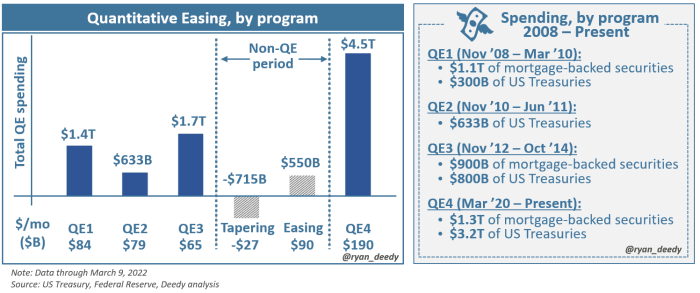

The latest paradigm shift came about on the finish of 2008 when the Fed presented the primary spherical of quantitative easing based on the Nice Recession.

Whilst emerging rates of interest and weak point in house costs have been the important thing catalysts for the recession, the seeds have been sown lengthy earlier than, relationship again to 2000 when the Fed first started decreasing rates of interest. Over the next seven years, the federal price range price was once lowered from 6.5% to a meager 1.0%, which similtaneously drove a $6 trillion building up in house loan loans to over $11 trillion. By means of 2007, family debt had larger from 70% to 100% of GDP, a debt burden that proved to be unsustainable as rates of interest rose and the financial system softened.

Like previous shifts, the unsustainable debt burden was once the important thing issue that in the end led the Fed to regulate its coverage framework. Now not strangely, the result from imposing its new coverage was once in keeping with historical past — a big building up within the cash provide and a 50% devaluation within the cost of the buck towards gold.

Alternatively, this paradigm has been in contrast to every other in historical past. In spite of taking exceptional movements — 4 rounds of QE totaling $8 trillion of stimulus over the last 14 years — the Fed has no longer been in a position to toughen its keep an eye on of the wider financial system. Relatively, its grip has handiest weakened, whilst the country’s debt has ballooned.

With nationwide debt now exceeding $30 trillion, or 120% of GDP, a federal finances deficit nearing $Three trillion, an efficient federal price range price of simply 0.33% and eight% inflation, the financial system is in its maximum prone place in comparison to every other time in historical past.

Govt Investment Wishes Will Build up In Financial Instability

Whilst the Fed discusses additional tapering of its monetary make stronger, any tightening measures usually are short-lived, given the financial system’s persisted weak point and reliance on debt to force financial enlargement.

Lower than 4 months in the past, Congress increased the debt ceiling for the 78th time for the reason that 1960s. Given the country’s traditionally top debt degree and its present fiscal state of affairs, its want for long run borrowing is not likely to modify.

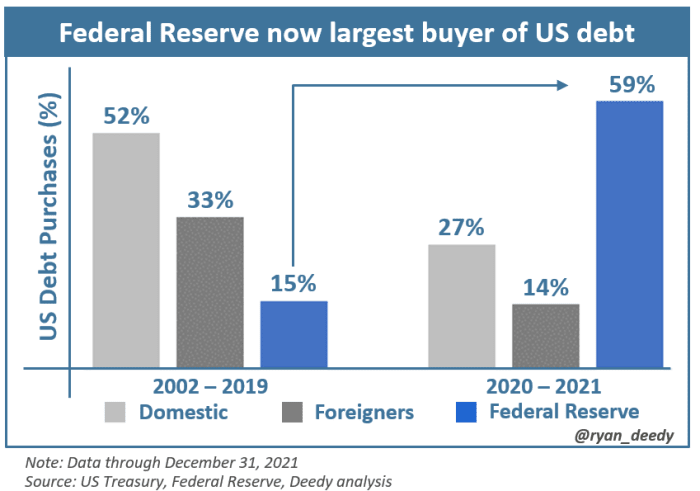

Alternatively, the investment marketplace for the federal government’s debt has modified. Because the pandemic-related lockdowns and the related monetary reduction techniques that have been introduced in 2020, call for for U.S. debt has dried up. The federal government has since relied at the Fed to fund nearly all of its spending wishes.

As call for for U.S. debt from home and overseas traders continues to wane, it’s most probably that the Fed will stay the most important financier of the U.S. govt. This may occasionally force additional will increase within the cash provide, inflation, and a decline within the cost of the buck.

Bitcoin Is The Easiest Shape Of Cash

Because the country’s debt burden grows and the buying energy of the buck continues to say no over the approaching months and years, call for for a greater type of cash and/or store-of-value asset will building up.

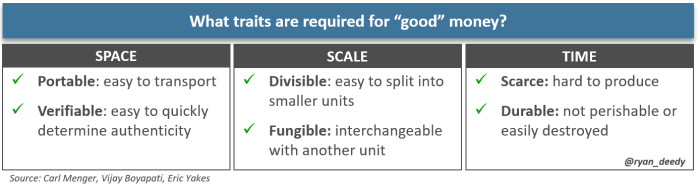

This ends up in the questions, what’s cash and what makes one shape higher than every other? Cash is a device this is used to facilitate financial trade. Consistent with Austrian economist Carl Menger, the best form of money is that which is maximum saleable, being able to simply be bought in any amount, at any cut-off date and for a value this is desired. That which has “virtually limitless saleableness” will probably be deemed the most productive cash, for which different lesser varieties of cash are measured.

Saleability of a excellent can also be assessed throughout 3 dimensions: area, scale and time. House refers back to the stage to which a excellent can also be simply transported over distances. Scale approach a excellent plays neatly as a medium of trade. Finally, and most significantly, time refers to a excellent’s shortage and its skill to keep cost over lengthy sessions.

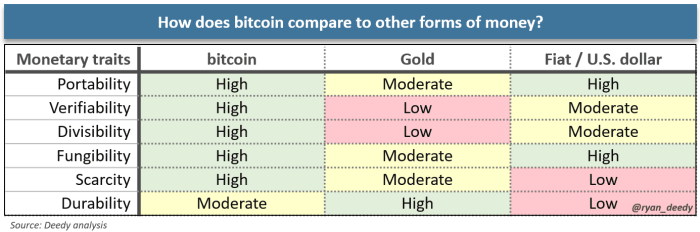

As observed repeatedly all over historical past, gold has continuously been hunted for its saleability. The buck has additionally been considered in a similar way, however its financial characteristics have degraded meaningfully since dropping its gold backing. Alternatively, with the arrival of the web and Satoshi Nakamoto’s invention of Bitcoin in 2009, there may be now a awesome financial selection.

Bitcoin stocks many similarities with gold however improves upon its weaknesses. Bitcoin has the very best saleability — it’s extra moveable, verifiable, divisible, fungible, and scarce. The only space the place it stays inferior is its sturdiness, for the reason that gold has been round for 1000’s of years in comparison to handiest 13 years for bitcoin. It’s only an issue of time earlier than bitcoin demonstrates its sturdiness.

The Subsequent Paradigm Shift

The buck’s lack of its reserve foreign money standing will urged the 6th paradigm shift in U.S. financial coverage. With it’s going to come but every other important decline within the cost of the buck.

Ancient precedents will lead some to consider {that a} transition again to the gold same old is in all probability. Whilst that is solely imaginable, every other possible and practical financial selection within the virtual age is the adoption of a Bitcoin same old. Basically, bitcoin is a awesome financial excellent in comparison to all of its predecessors. As historical past has proven relating to gold, the asset this is maximum saleable, with the most powerful financial characteristics, is the one who everybody will converge to.

Bitcoin is the toughest type of cash the arena has ever observed. Some have already discovered this, however with time, everybody from folks to realms will come to the similar conclusion.

This can be a visitor submit by means of Ryan Deedy. Evaluations expressed are solely their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)