Ethereum is in the end coming again to existence after a protracted duration of consolidation and main the present bullish momentum within the crypto most sensible 10 by means of marketplace cap. The gradual value motion may well be dull for many marketplace contributors, however a professional believes ETH underwent a important level to create an enduring backside.

On the time of writing, Ethereum (ETH) trades at $1,550 with sideways motion over nowadays’s buying and selling consultation and a 20% benefit within the remaining seven days. The meme coin data a 30% benefit over the similar duration. Within the crypto most sensible 10, ETH’s value efficiency is most effective surpassed by means of Dogecoin (DOGE).

Ethereum Shut To Some other Multi-Yr Backside?

Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone believes Ethereum’s migration to a Evidence-of-Stake (PoS) consensus will probably be the most important in its long-term appreciation. Within the present macroeconomic panorama, top power costs and top inflation have taken a toll on world markets.

The U.S. Federal Reserve (Fed) has tightened its financial coverage according to this case. In consequence, Ethereum and different possibility belongings returned to their pre-pandemic ranges.

Nonetheless, the second one crypto by means of marketplace cap has been not able to carry the road with reference to its 2017 all-time top at round $1,400 to $1,500. As McGlone emphasised, ETH’s value has averted additional drawback at those ranges regardless of the Fed enforcing its maximum competitive technique in 40 years.

In that sense, the skilled believes Ethereum is cementing its place “on the epicenter of the digitalization of finance.” McGlone wrote:

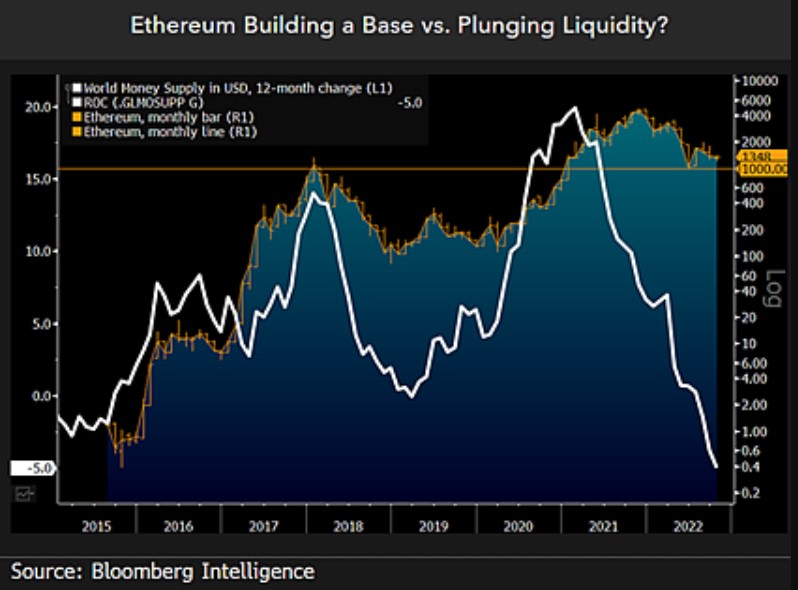

(…) the No. 2 crypto could also be forming a basis round $1,000 (…). Our graphic displays the No.2 crypto probably construction a base across the 2018 height, when world liquidity crowned out round plus 14%. Ethereum seems at a cut price inside a long-lasting bull marketplace (…).

The Final Deflationary Asset

If macroeconomic prerequisites make stronger and the Fed pivots its financial means, Ethereum would possibly in the end reclaim in the past misplaced territory and scouse borrow Bitcoin’s thunder. The skilled hints at a sooner decline within the provide of ETH as opposed to BTC.

Emerging call for for virtual belongings and a decline in provide will turn out certain for the second one crypto by means of marketplace cap. McGlone wrote:

(…) new Ethereum provide shrinking extra temporarily after a protocol exchange that started transferring cash from movement in August 2021 and this yr’s merge. The 52-week rate-of-change within the choice of new Ethereum cash from Conmetrics vs. the entire exceptional has fallen underneath 2% and is on trail to drop underneath that of Bitcoin.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)